-

- Market Research

- |

- CBD Near Me

- |

- Giveaways

- |

- Newsletter

- |

- Contact

- |

- Advertise

- |

We are proud to be publishing The CBD Insider 2019 US CBD Consumer Report, one of the only statistically significant reports available about US CBD consumers.

Note: If you want to see our latest 2021 US CBD Consumer report, click here.

The goal of our report was to better understand what consumers want, like, dislike, and need from the CBD industry.

And that’s exactly what we found out:

In our survey of over 1,000 respondents demographically representing the US population, we study the behaviors and perceptions of current, past, and potential CBD consumers.

We learned which products consumers like the most, how many consumers are replacing medications with CBD, what’s preventing more consumers from trying CBD, and so much more.

We hope you find immense value in the findings and insights within our report.

Click Here to Download The CBD Insider 2019 US CBD Consumer Report

The CBD Insider 2019 US CBD Consumer Report

Executive Summary

Throughout the United States and around the world, awareness, popularity, and usage rates of CBD continue to grow at an extraordinarily rapid rate.

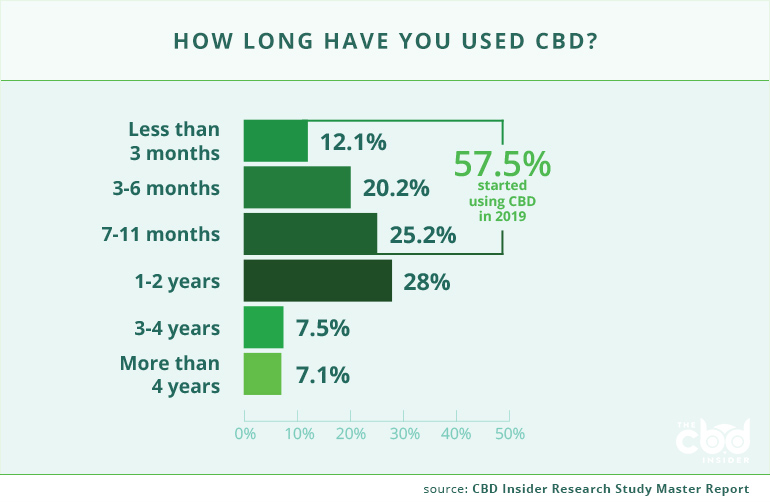

The majority of current CBD consumers have been using the product for less than one year, and mainstream awareness of CBD is increasingly prevalent. At the same time, attitudes and understanding of CBD are shifting across nearly all demographics, including age, region, gender, and others.

With the industry evolving at such a rapid pace, the need for quantitative insight into consumer preferences and behaviors towards CBD are more important than ever.

The CBD Insider 2019 US CBD Consumer Report is an effort by our editorial team to help provide clarity on what consumers want and expect from the CBD industry moving forward.

Key Takeaways

Our key takeaways revolve around consumer behaviors, consumer knowledge about CBD, the state of the marketplace, and the effects of

current public policy.

Some of our key takeaways include:

- Amazon’s current policy prohibits product listings containing CBD, so several sellers sell “hemp oil” that may or may not contain CBD. Despite this, more than one in four consumers (26.7%) say they purchase CBD from Amazon and almost half of all consumers (49.4%) said they would feel comfortable purchasing from Amazon.

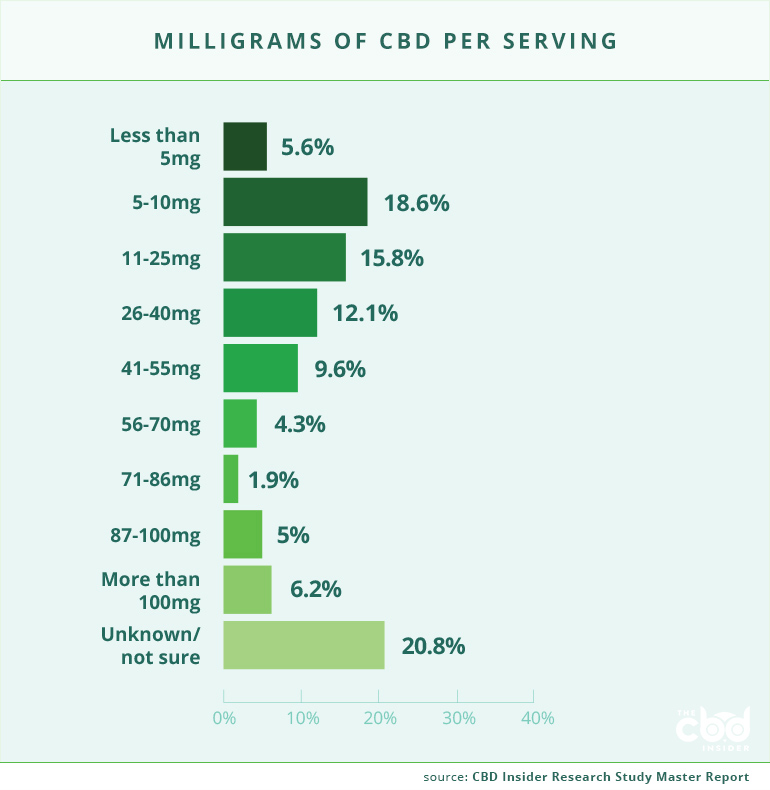

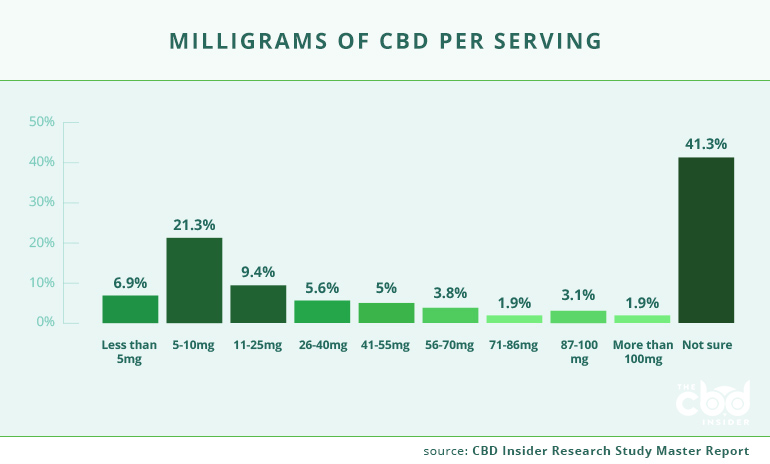

- Consumers do not know how much CBD to take and would benefit from clear guidance. More than two in five past consumers (41.3%) and one in five current consumers (20.8%) are unaware of how much CBD they take.

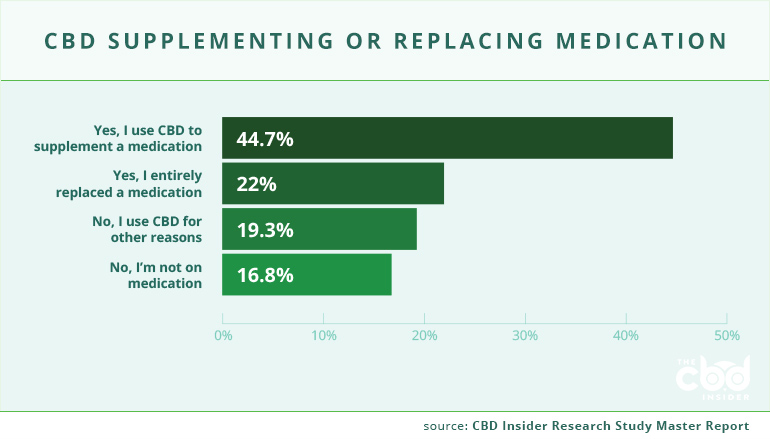

- CBD is beginning to displace some traditional medications. More than one in five current CBD consumers (22%) said they have replaced a medication with CBD.

- The high cost of CBD products is also driving away a significant number of consumers. More than one in five past consumers (21.9%) said they stopped using CBD because it was too expensive.

Methodology

To conduct the study, our team utilized a nationally representative set of online audience panels, with support from Qualtrics. The survey took respondents approximately 15 minutes to complete, and was conducted from December 20th, 2019 through January 20, 2020.

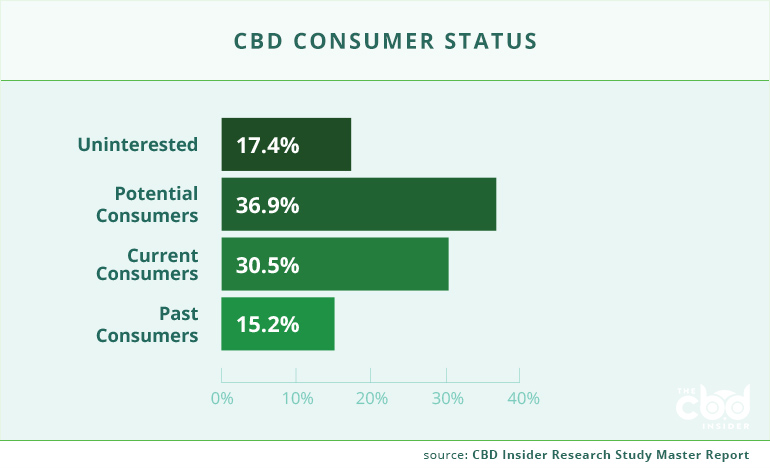

The survey separated respondents into four

segments:

- Current CBD consumers: Individuals who

are familiar with and currently using CBD products. - Potential CBD consumers: Individuals who are at least somewhat familiar with CBD products and were willing to consider using CBD.

- Past CBD consumers: Individuals who had used CBD in the past but no longer do.

- Uninterested: Individuals who were either unaware of or uninterested in CBD.

Respondents were also balanced by age, gender, and region with respondents from 48 states. Crosstabs were identified for the following categories and some are analyzed in Part 2 of this report:

- Age

- Gender

- U.S. region

- Income

- Education

- Disability status

- Military/veteran status

Demographics

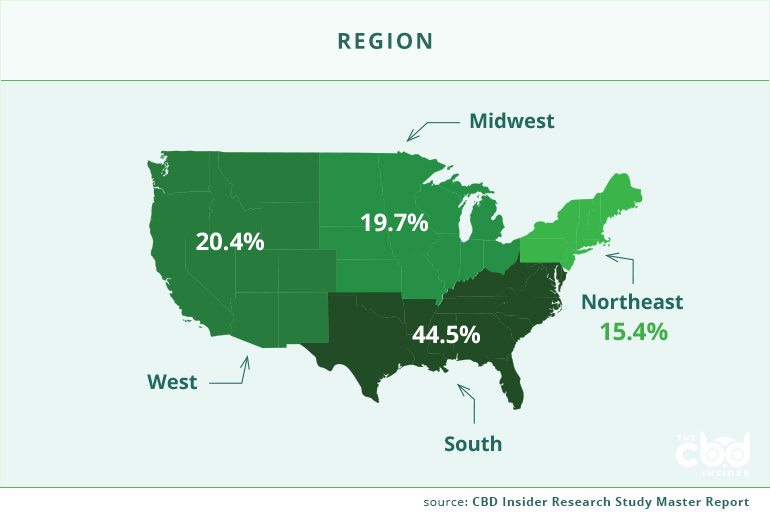

Our study included 1,055 respondents from 48 of the 50 states (only North Dakota and Vermont are not represented in our sample). When analyzing the crosstabs, we separated the United States into four regions: West, South, Northeast, and Midwest, which is in line with how the United States Census Bureau assesses the nation’s regions.

The regional breakdown is as follows: 15.4% of respondents are from the Northeast, 19.7% are from the Midwest, 44.5% of respondents are from the South, and 20.4% are from the West.

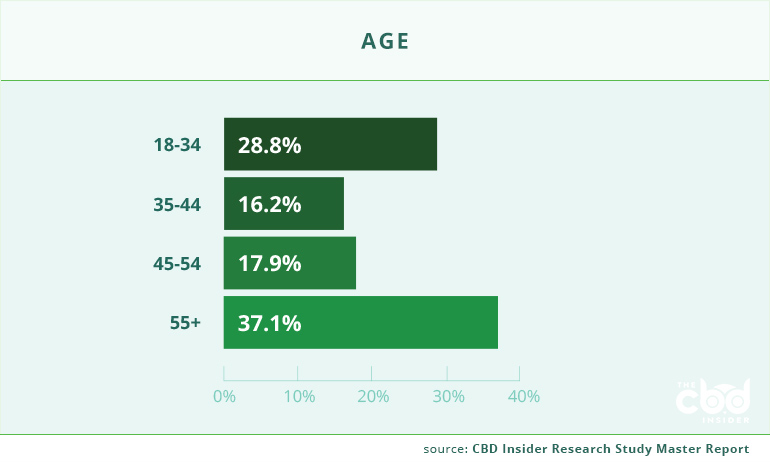

Respondents were also categorized by age, with 28.8% in the 18 to 34 range, 16.2% in the 35 to 44 range, 17.9% in the 45 to 54 range, and 37.1% in the 55 and older range.

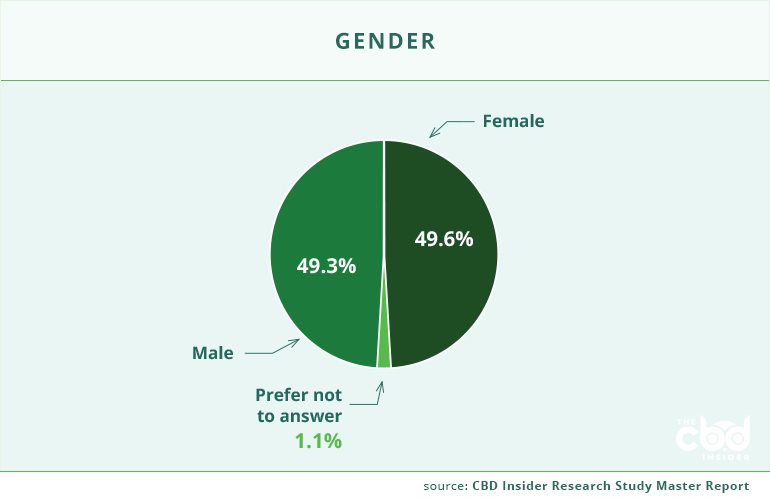

Respondents were roughly split by gender as well, with 49.3% male respondents, 49.6% female respondents, and 1.1% opting not to specify.

Respondents were also categorized by their consumer status relative to CBD. Our study included 184 (17.4%) uninterested consumers, 322 (30.5%) current consumers, 160 (15.2%) past consumers, and 389 (36.9%) potential consumers.

Part One: CBD Consumer Habits and Preferences

Awareness and Exposure to CBD

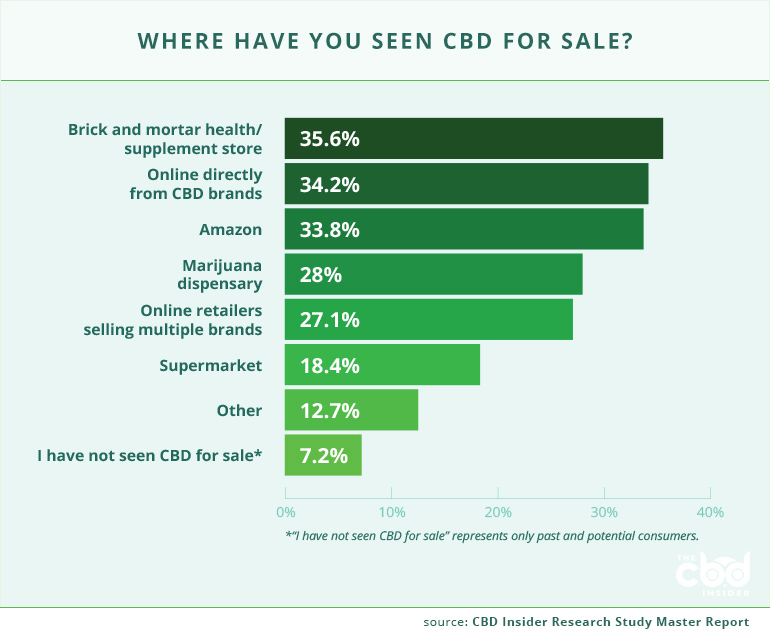

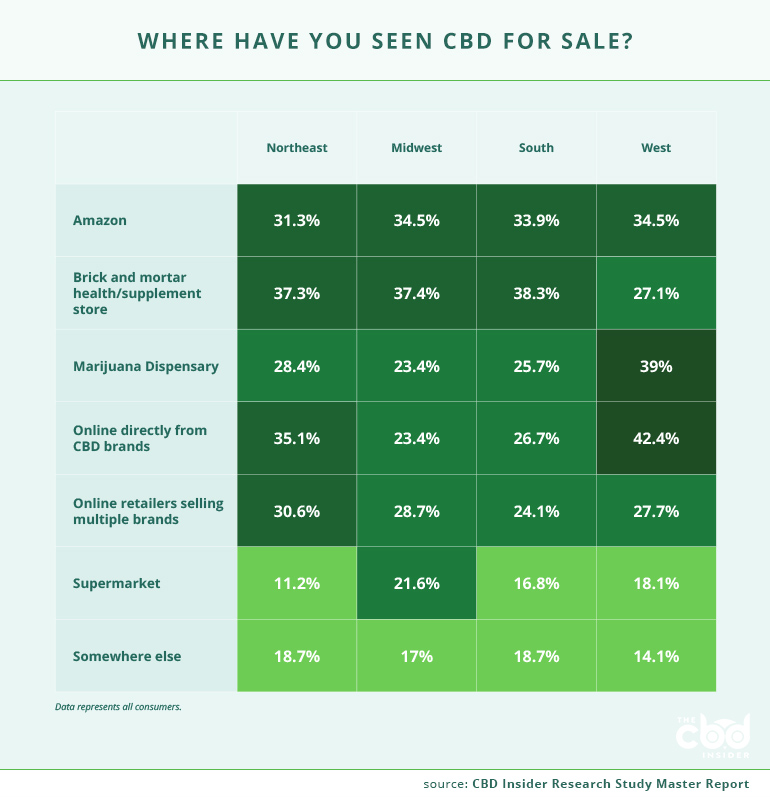

Consumers most often see CBD for sale at brick and mortar health stores (35.6%), followed by the websites of CBD brands (34.2%) and Amazon (33.8%).

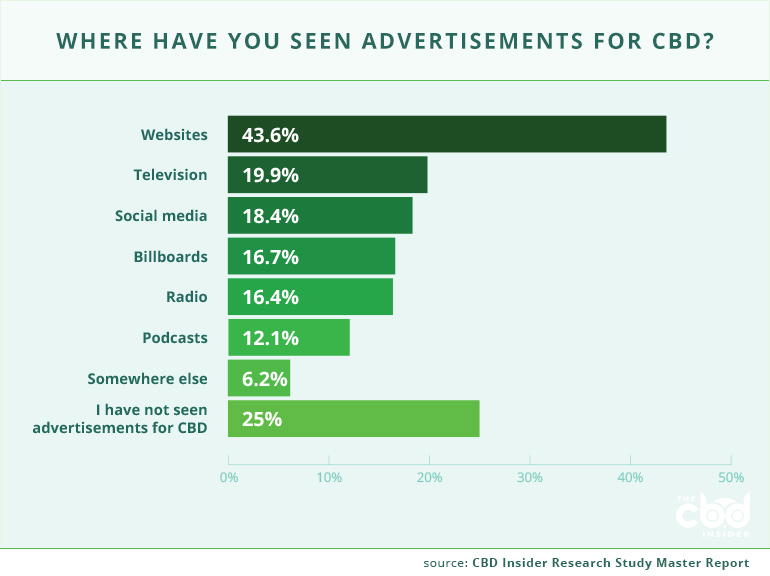

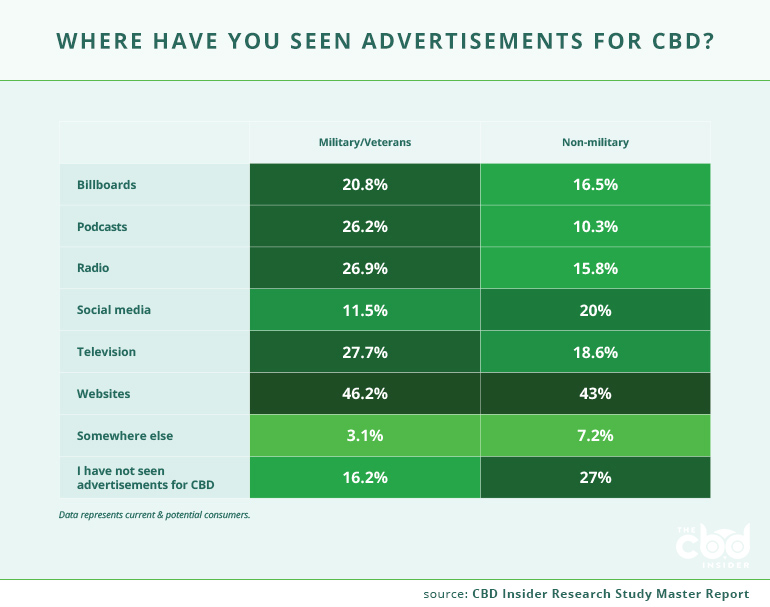

When it comes to advertisements featuring CBD, more than two in five consumers (43.6%) see ads on websites while one in four consumers (25%) have not come across ads for CBD at all.

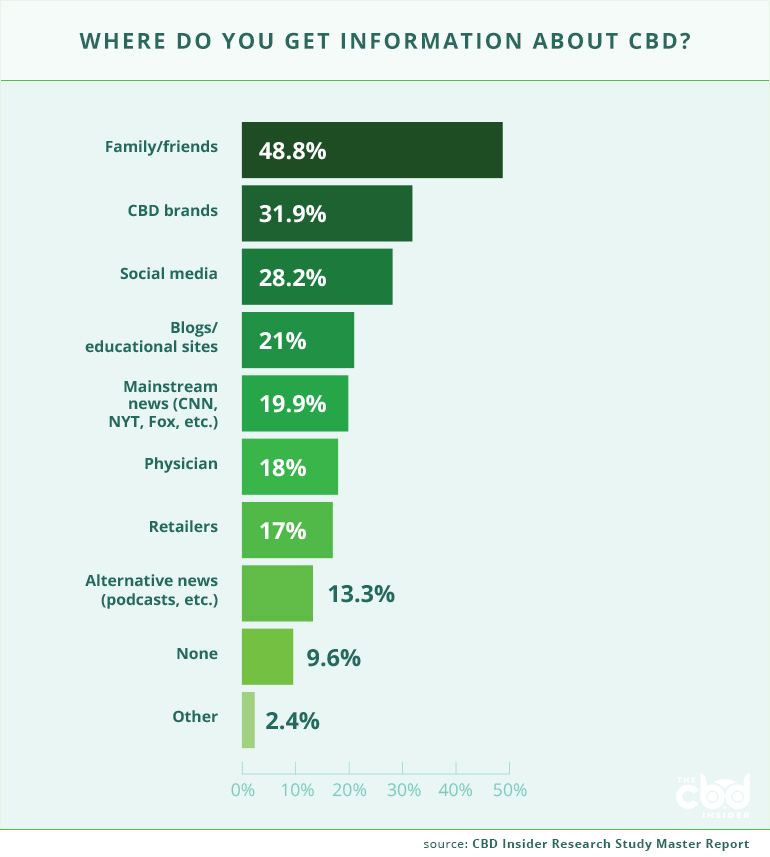

Consumers are most likely to get information about CBD from friends and family (48.8%). CBD brands (31.9%) and social media (28.2%) make up the rest of the top three. Interestingly, almost one in five consumers (18%) are informed by their physician.

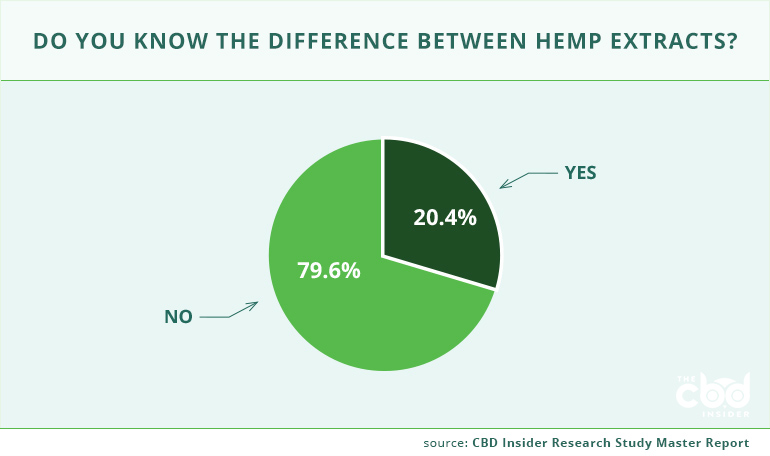

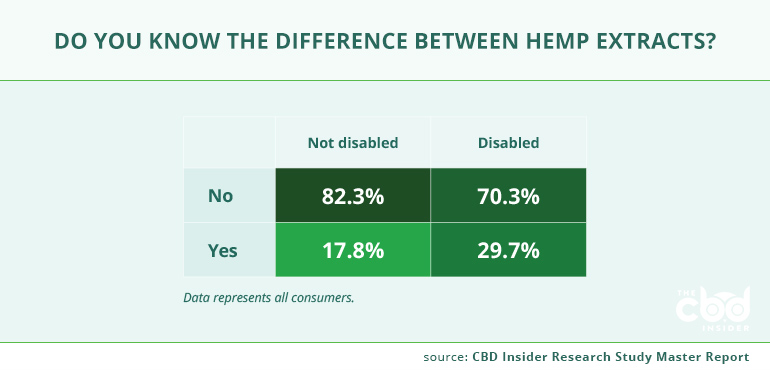

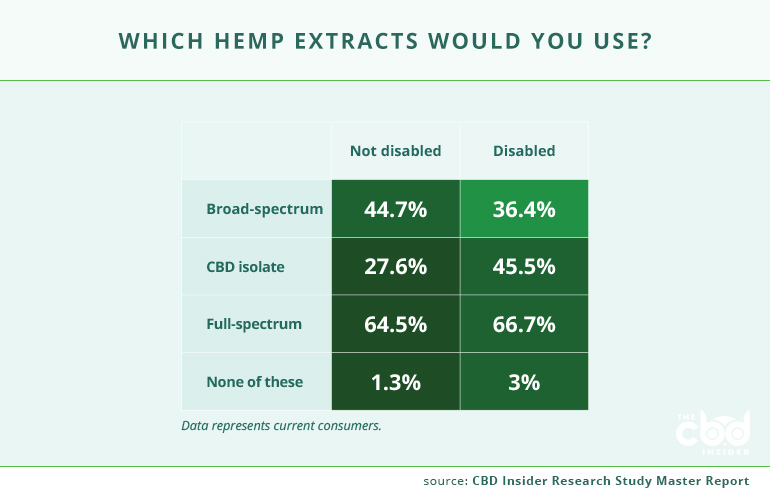

Only one in five consumers (20.4%) knew the difference between full-spectrum, broad-spectrum, and CBD isolate products.

Sentiment Toward CBD

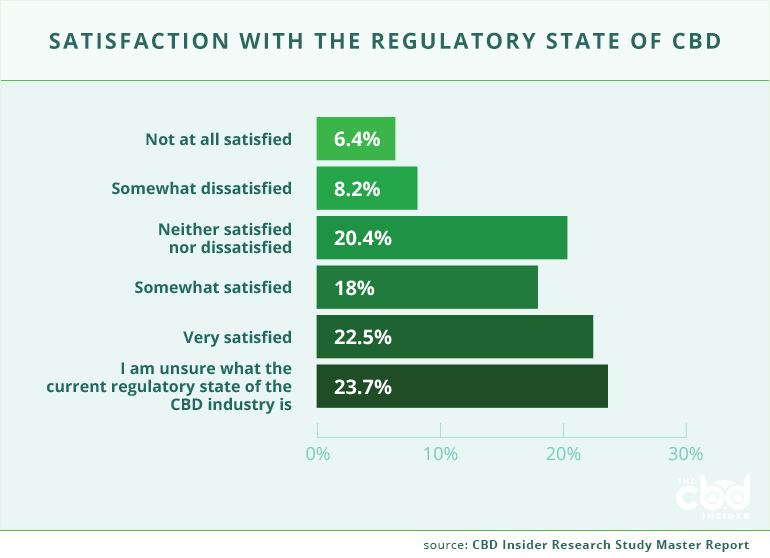

Despite regulatory loose ends left untied by the FDA, it is now fairly easy to purchase CBD in most parts of the United States, both online and in person. As a result, 41.3% of survey respondents were “somewhat satisfied” or “very satisfied” with the current regulatory state of CBD, and only 14.6% were “somewhat dissatisfied” or “not at all satisfied” with the current regulatory environment. Many Americans have yet to take a stance on the regulatory state of CBD with 44.1% of respondents “unsure” of the current regulatory state or having no strong opinion on the issue.

Interestingly, younger consumers are more likely to be satisfied with the current state of CBD regulations than older consumers. For example, more than half of consumers 18-34 years old (55%) were satisfied to some extent compared to just a quarter of consumers 55 and older (25.7%). Younger consumers are likely more satisfied because they are more comfortable purchasing online and at marijuana dispensaries with relatively few restrictions. As a result, the data tells us we need to likewise protect the interests of older consumers.

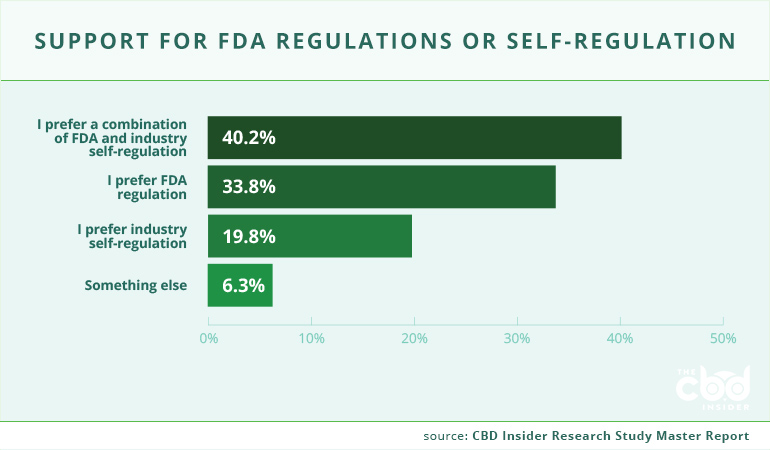

Survey respondents also made it clear that they want the FDA involved in the regulatory process. An overwhelming 73.9% of respondents want

either FDA regulation or a combination of FDA and industry self-regulation, while only 19.8% said they prefer industry self-regulation without the FDA. Brands and consumers alike are waiting on the FDA to fulfill its responsibility to provide clear and reasonable regulations on the CBD industry.

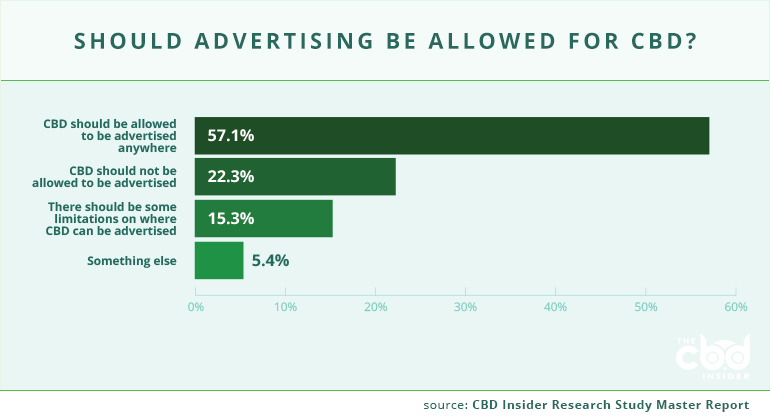

At the same time, most consumers (57.1%) believe that there should be no restrictions on advertising for CBD. About one in five (22.3%) said that CBD should not be allowed to be advertised.

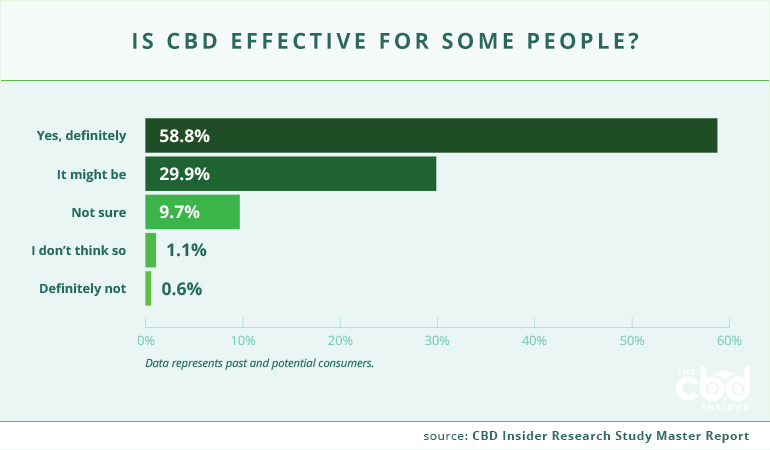

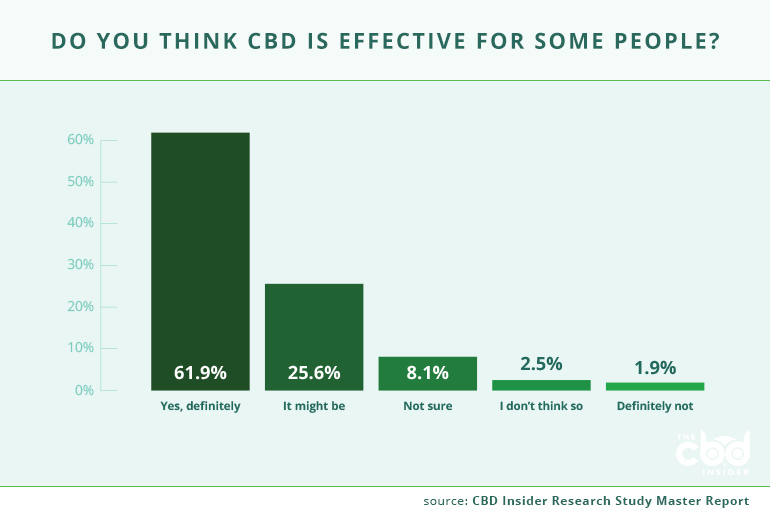

Among consumers who are not currently using CBD, almost three in five (58.8%) believe CBD is definitely effective for some people and another three in ten (29.9%) think it might be effective.

CBD Consumers

Behavior

The majority of CBD consumers (57.5%) started using CBD in 2019. The influx of new consumers is likely attributable to the introduction of CBD products to major retailers like CVS Pharmacy, Walgreens, and Kroger early in the year.

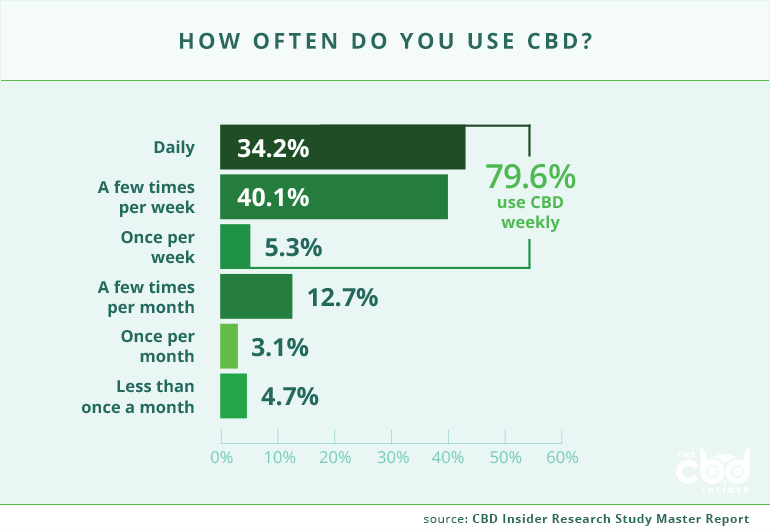

Almost four in five consumers (79.6%) said they use CBD at least weekly, with a plurality of consumers (40.1%) using it a few times per week. More than one in three consumers (34.2%) use CBD daily.

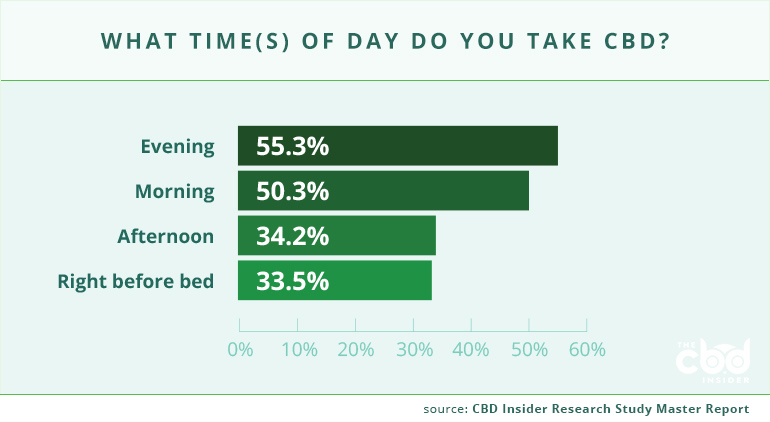

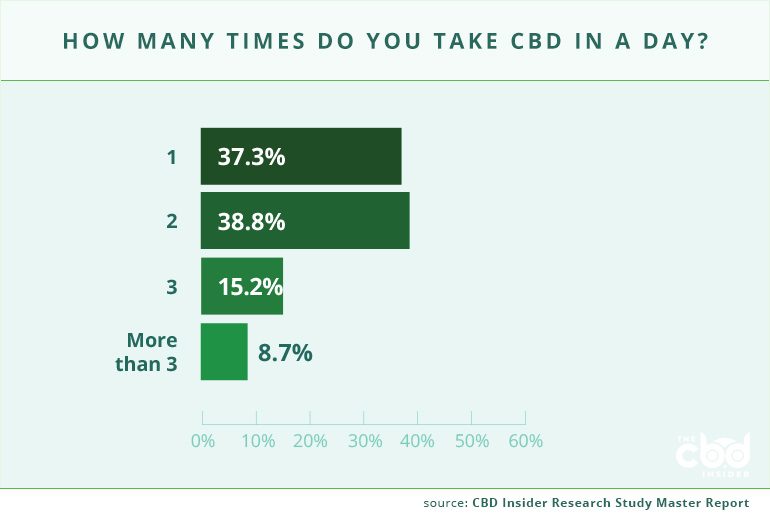

Consumers primarily take CBD in the evening (55.3%) and morning (50.3%). They are also more likely to use it multiple times per day (62.7%) rather than only once (37.3%).

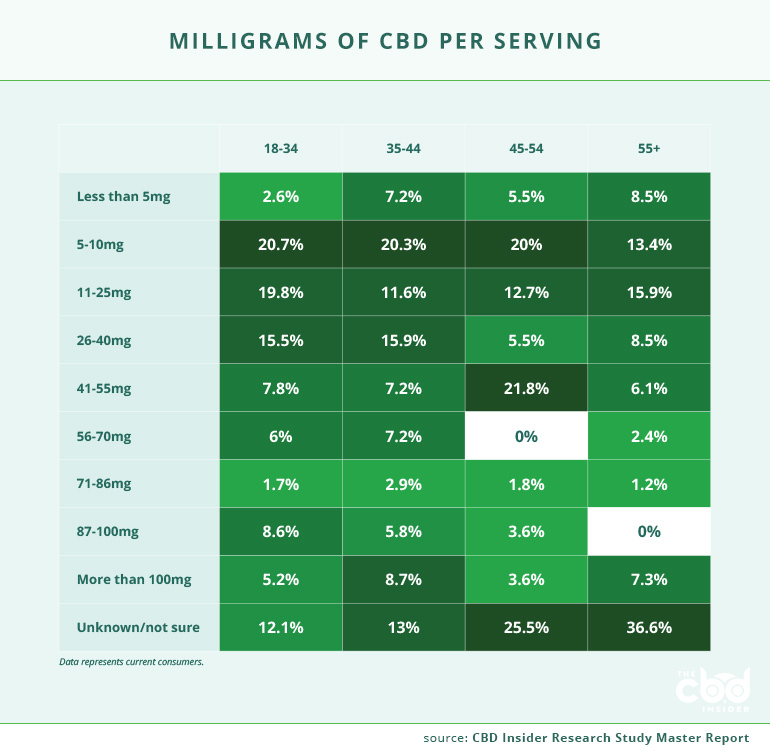

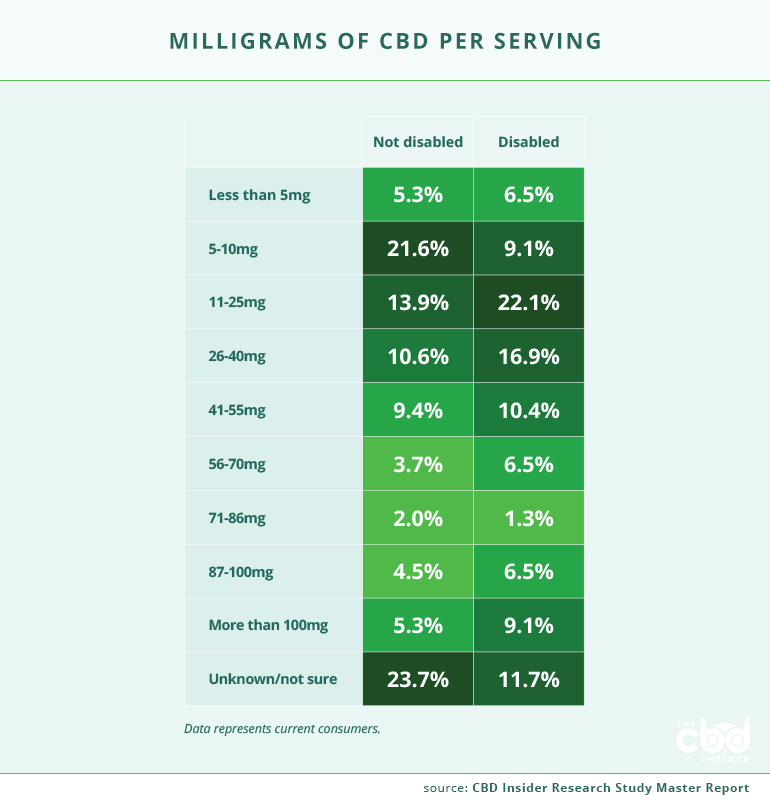

Surprisingly, one in five consumers (20.8%) do not know how much CBD they take per serving, while two in five consumers (40%) use less than 25mg of CBD per serving. We posit that the lack of awareness about how much they take and the small serving sizes may lead to consumers using CBD multiple times per day.

Product Preferences

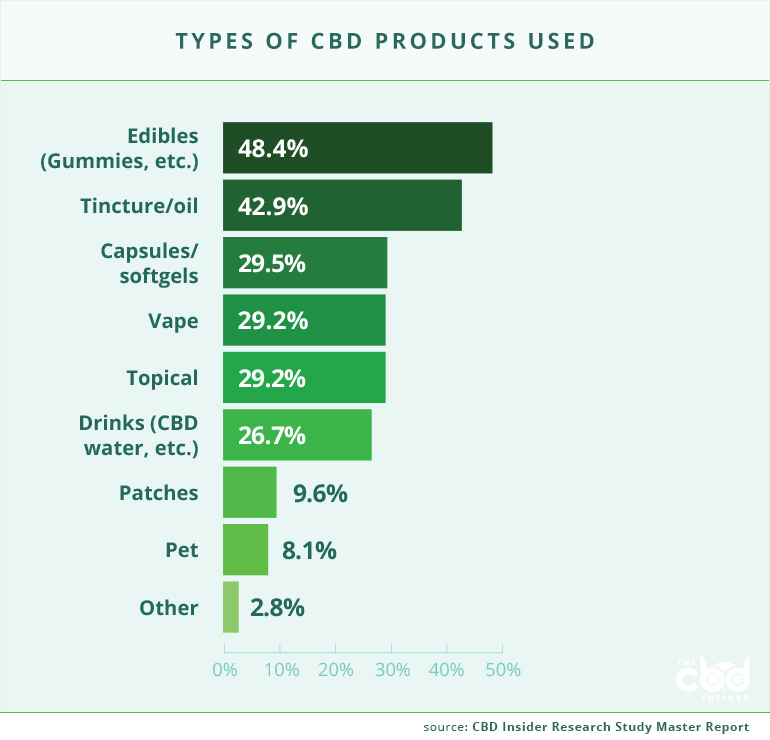

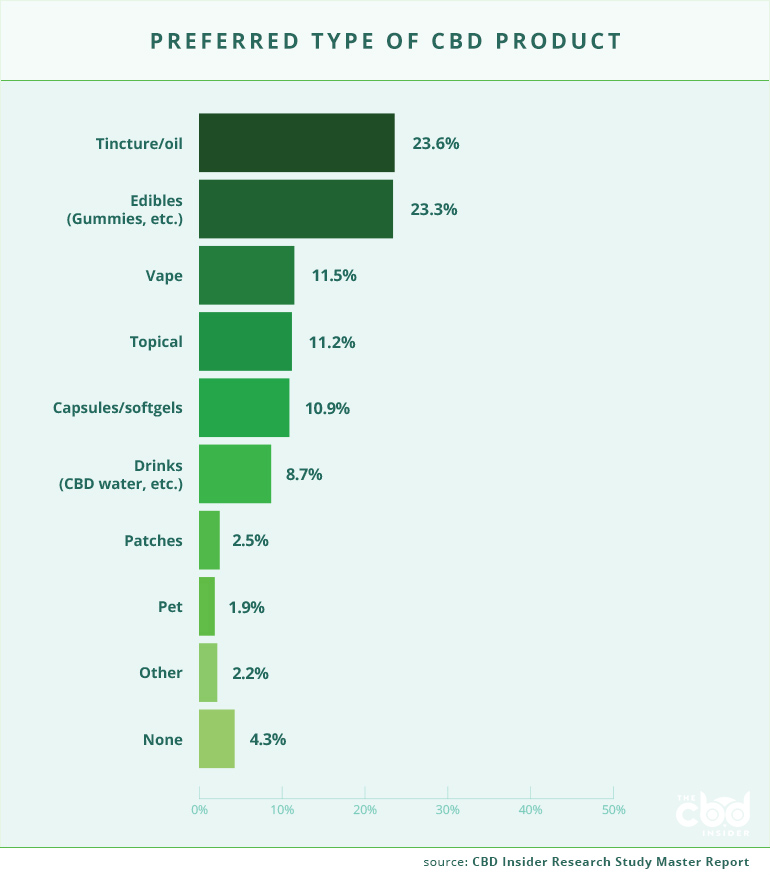

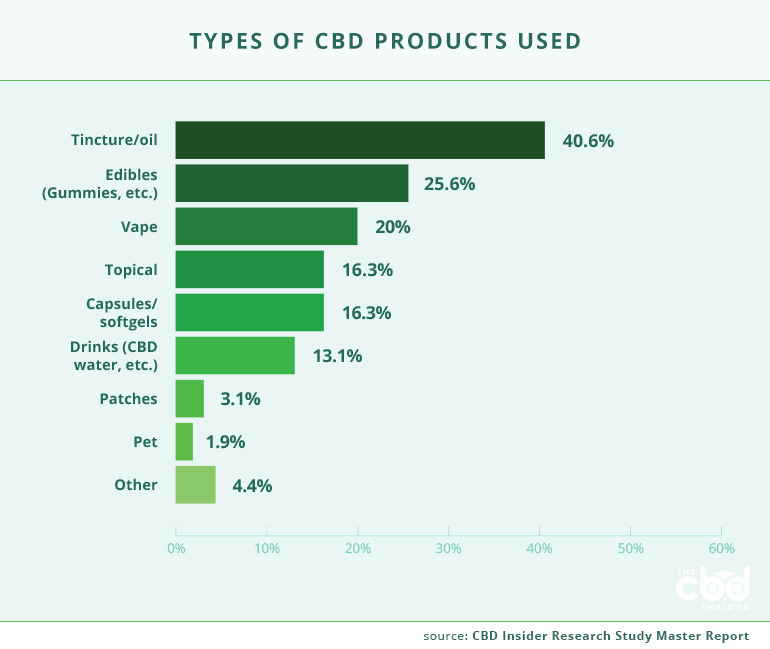

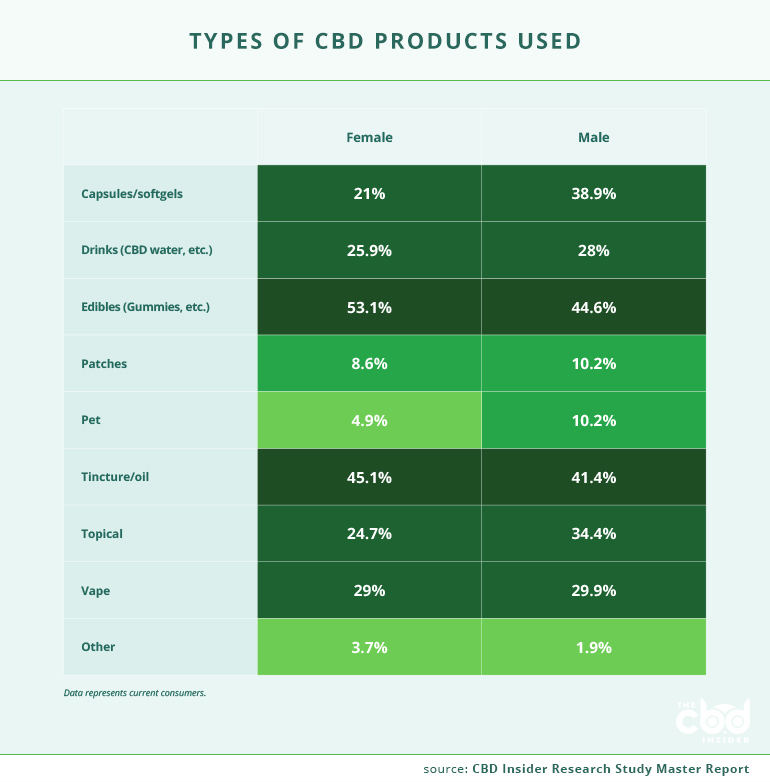

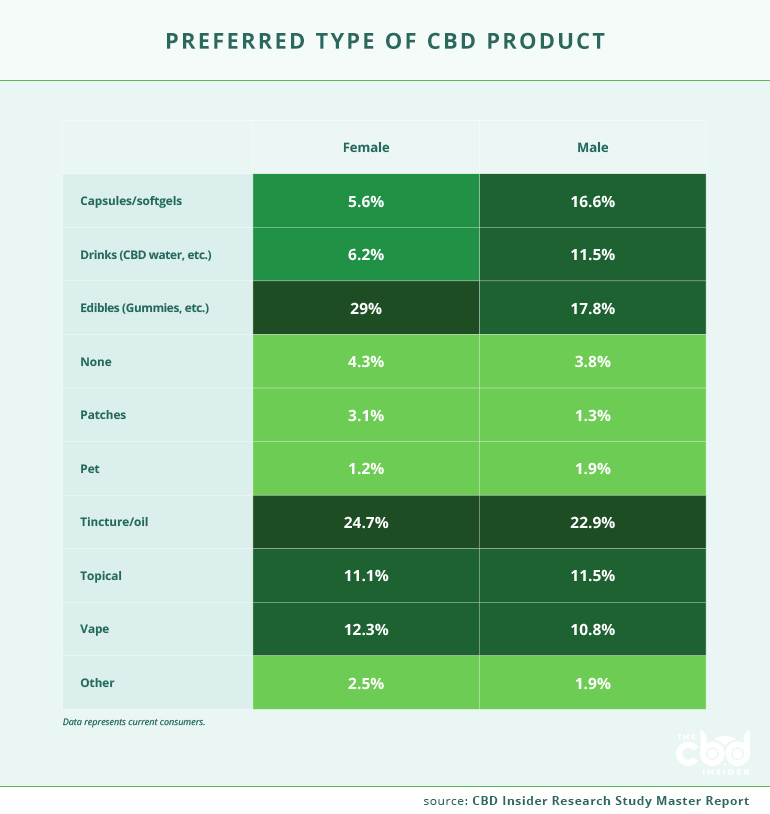

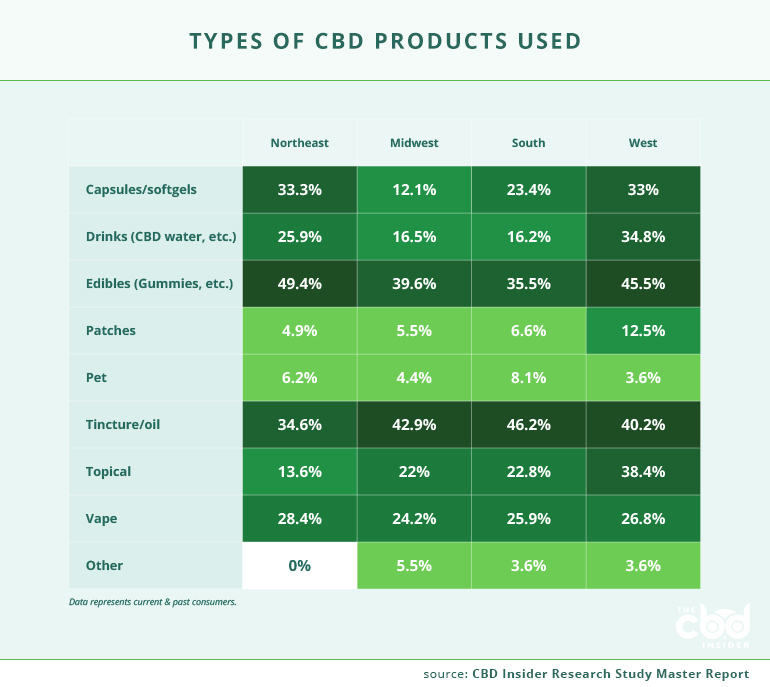

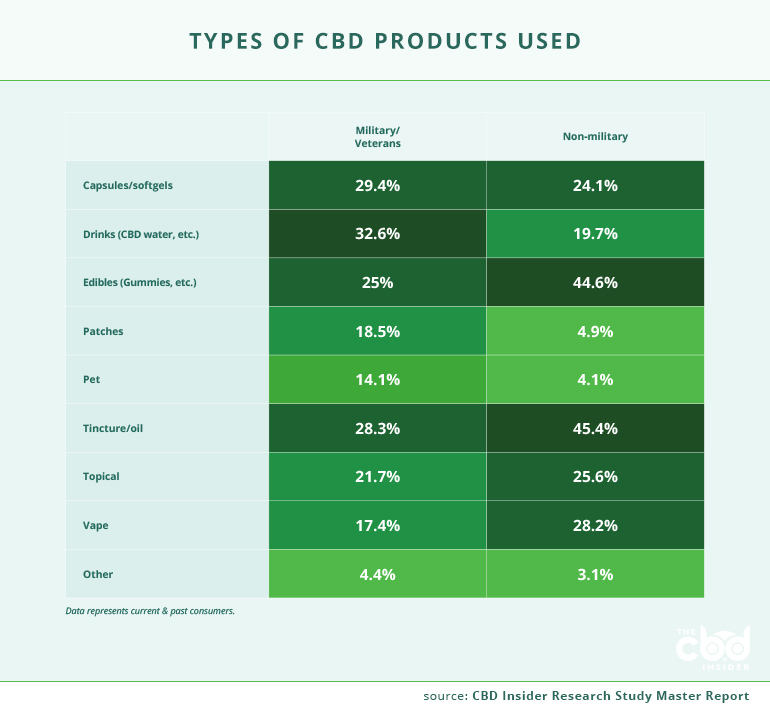

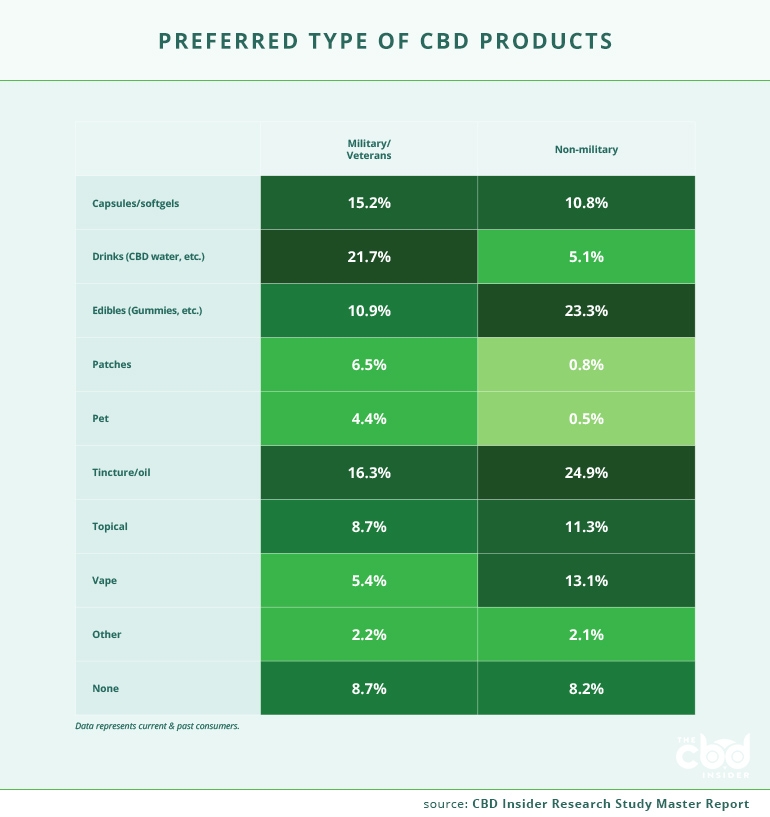

Edibles are the most commonly used product type (48.4%) followed by tinctures (42.9%).

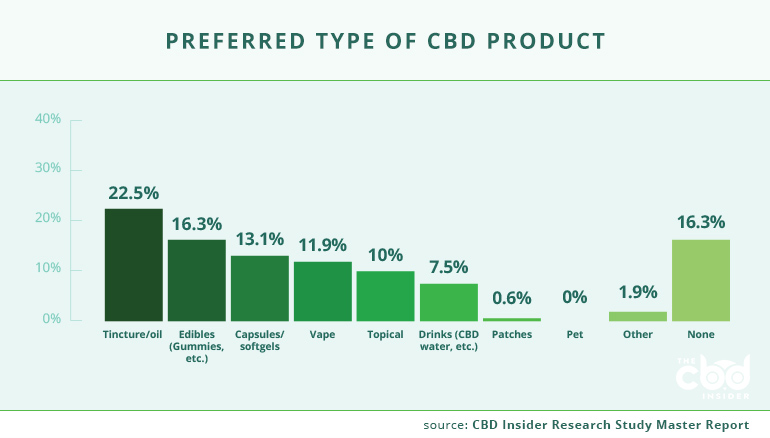

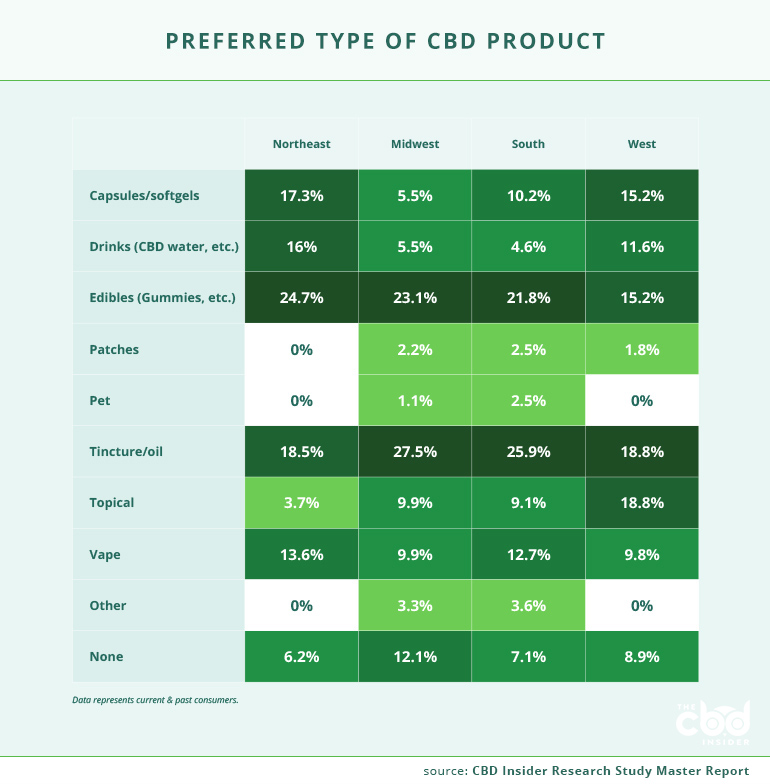

Despite being the second most commonly used product, tinctures are the most preferred (23.6%), narrowly surpassing edibles (23.3%). Interestingly, edibles were the preferred product among those with the lowest and highest annual incomes (37.7% and 23.3%, respectively).

Edibles and tinctures far outrank the rest of the product types in both usage and preference, solidifying their place as the staple products of the CBD industry. However, as the industry grows and new product types are introduced, this is subject to change.

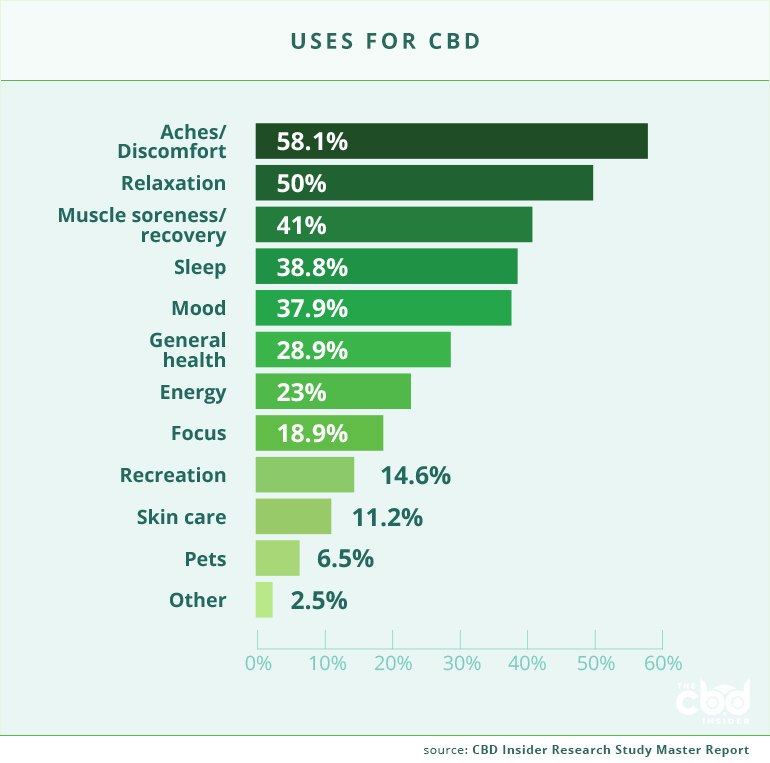

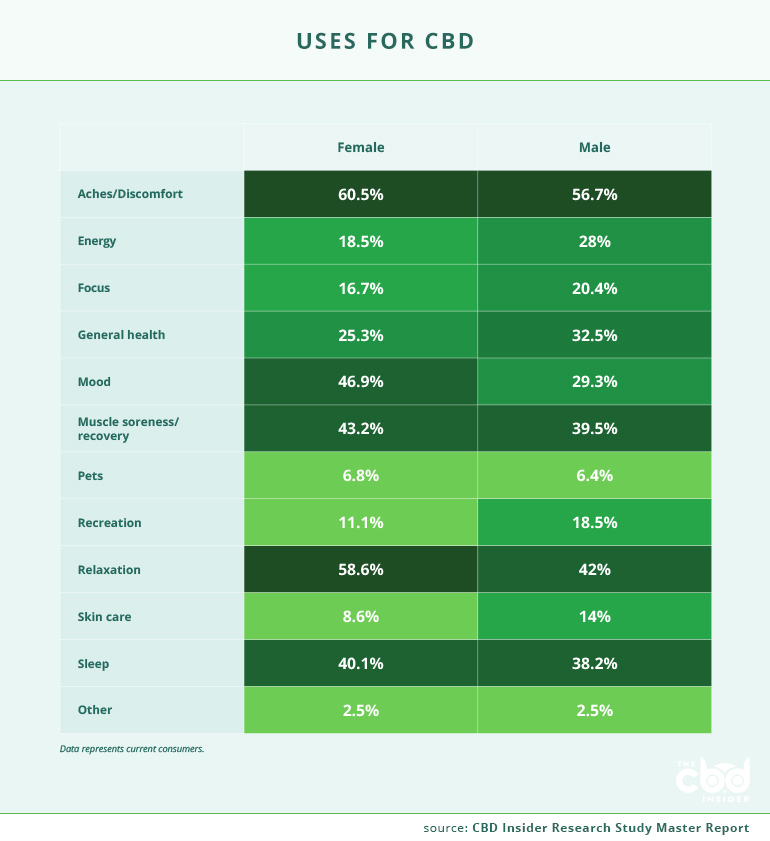

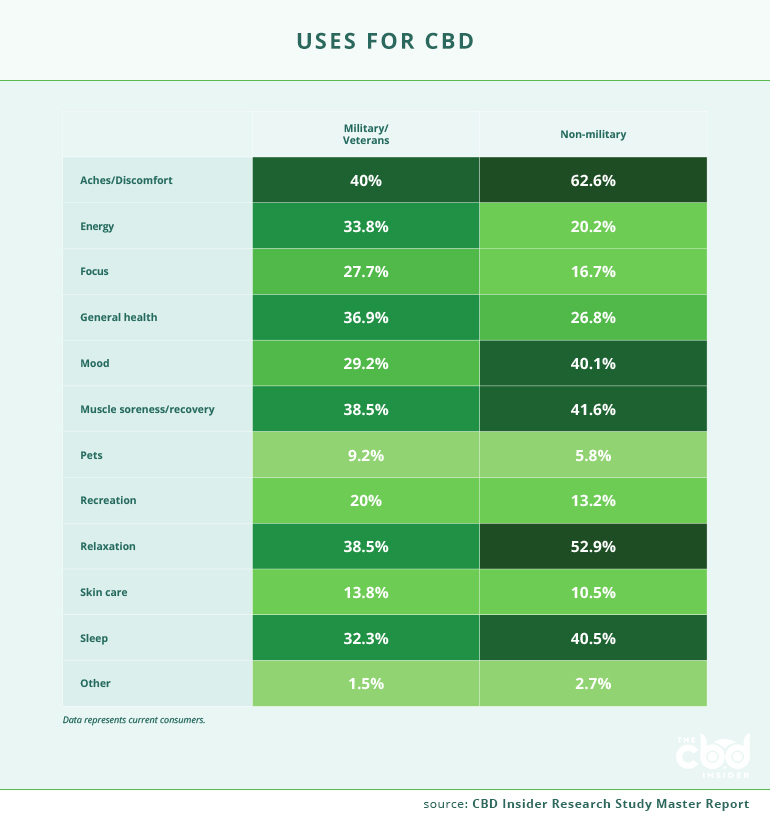

Reasons for Use and Perceived Effectiveness

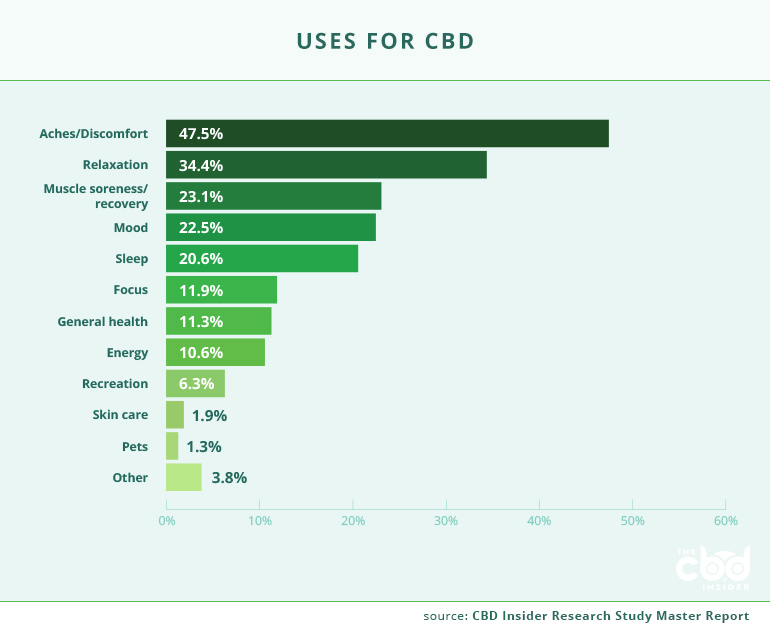

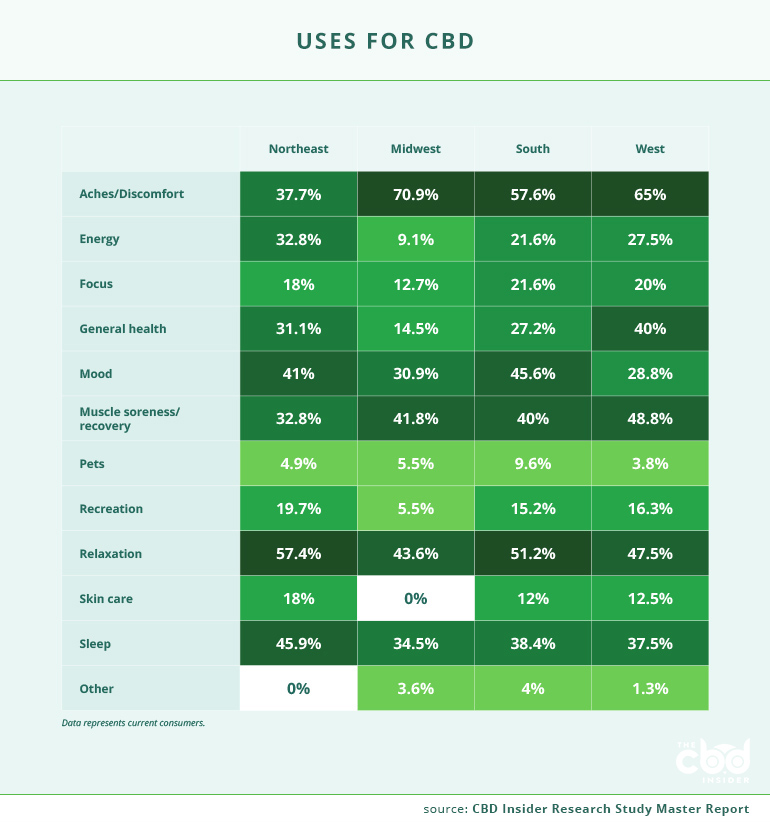

The most commonly reported reason people use CBD is for aches and discomfort (58.1%), followed by relaxation (50%) and muscle soreness and

recovery (41%).

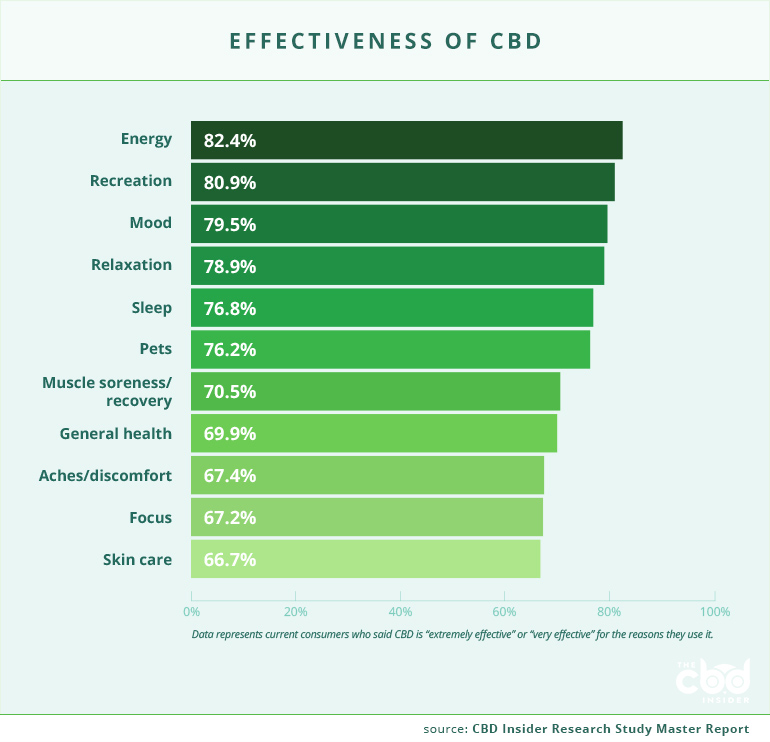

Surprisingly, the use with the highest perceived effectiveness rate was energy. More than four in five consumers (82.4%) using CBD for this purpose said it was “extremely effective” or “very effective.” Recreation (80.9%) and mood (79.5%) round out the top three.

The most popularly reported uses for CBD—aches and discomfort, relaxation, and muscle soreness and recovery—also had high perceived effectiveness rates.

More than two in three consumers (67.4%) said CBD was extremely or very effective for aches and discomfort, seven in ten (70.5%) said the same for muscle soreness and recovery, and nearly four in five (78.9%) said the same for relaxation.

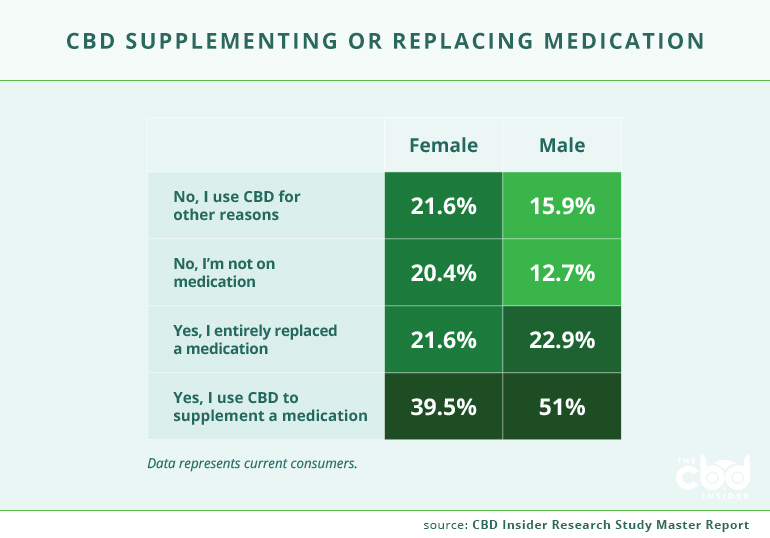

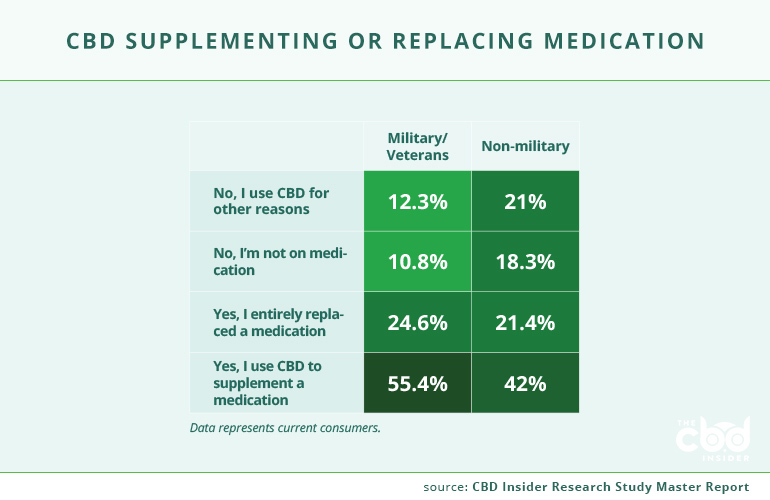

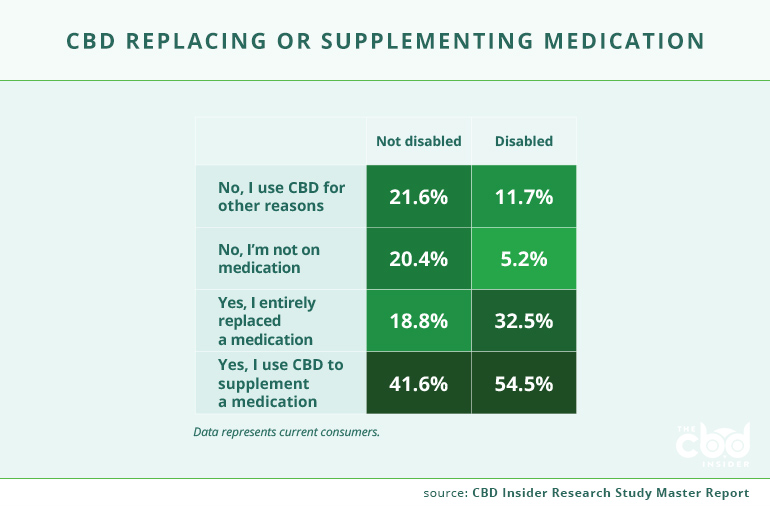

CBD is also beginning to displace some medications. More than one in five consumers (22%) said they replaced a medication with CBD, while more than two in five consumers (44.7%) said they supplement a medication with it.

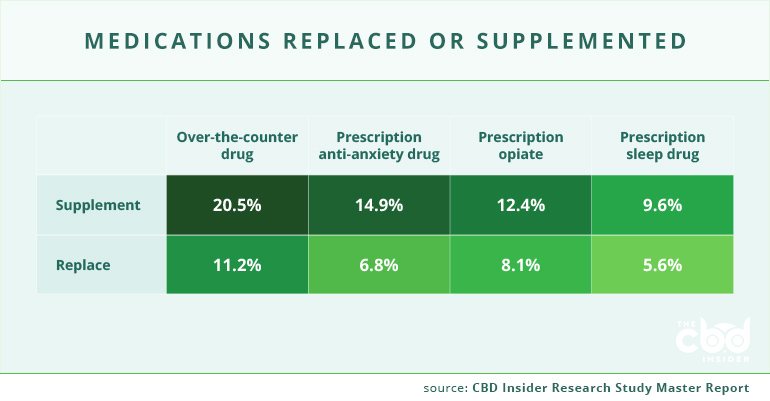

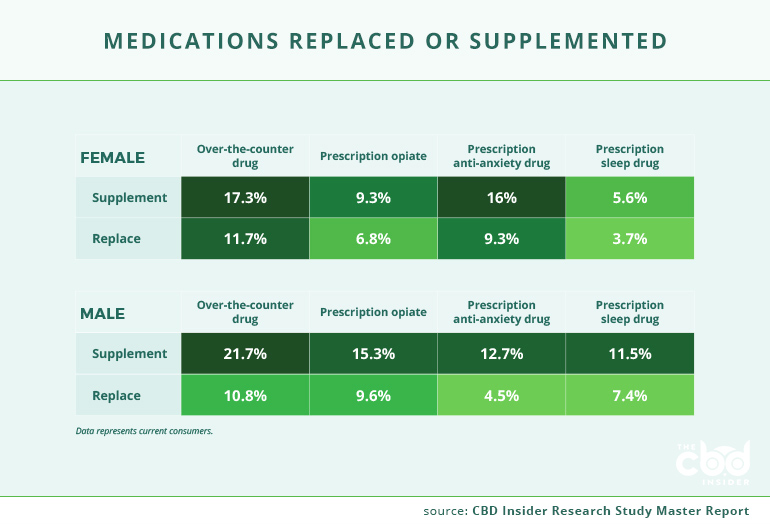

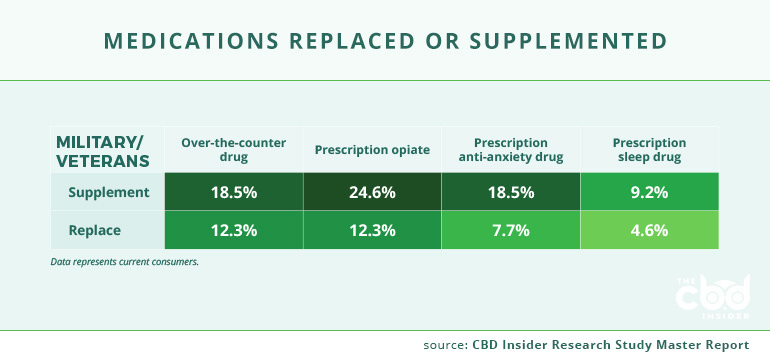

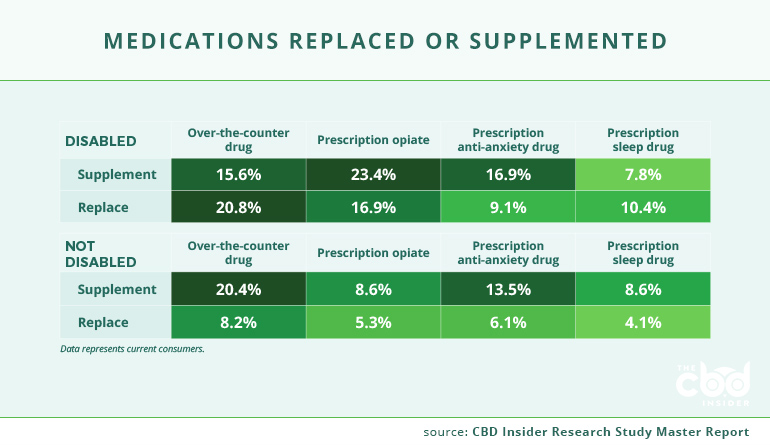

As for the medications consumers replaced, 11.2% of consumers said they replaced an over-the-counter drug, 8.1% replaced a prescription opiate, 6.8% replaced a prescription anxiolytic (anti-anxiety) drug, and 5.6% replaced a prescription sleep drug.

Among those who are supplementing their medication with CBD, 20.5% supplement their over-the-counter medication, 14.9% supplement their prescription anxiolytic (anti-anxiety) drug, 12.4% supplement their prescription opiate, and 9.6% supplement their prescription sleep drug.

In light of the opioid crisis in the US, researchers are looking for alternatives to opiates for pain relief. While more research is needed to verify if CBD is a viable alternative, a significant portion of certain groups of CBD consumers have replaced their prescription opiates.

For example, 12.3% of military and veteran CBD consumers said they replaced a prescription opiate compared to only 7% of non-military consumers. Also, 16.9% of disabled consumers replaced prescription opiates compared to only 5.3% of non-disabled consumers.

Consumer Concerns About CBD

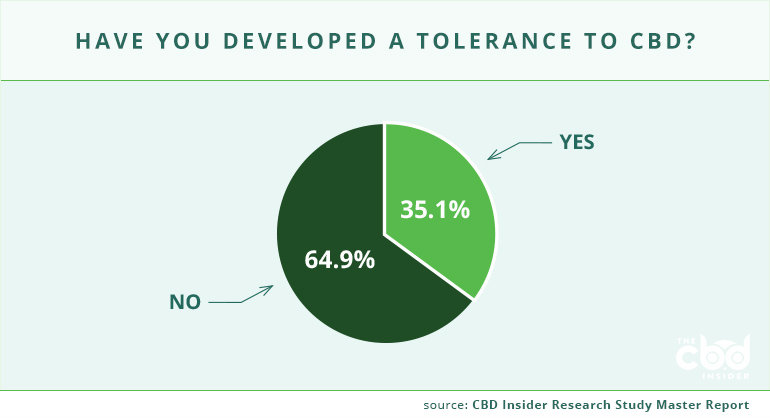

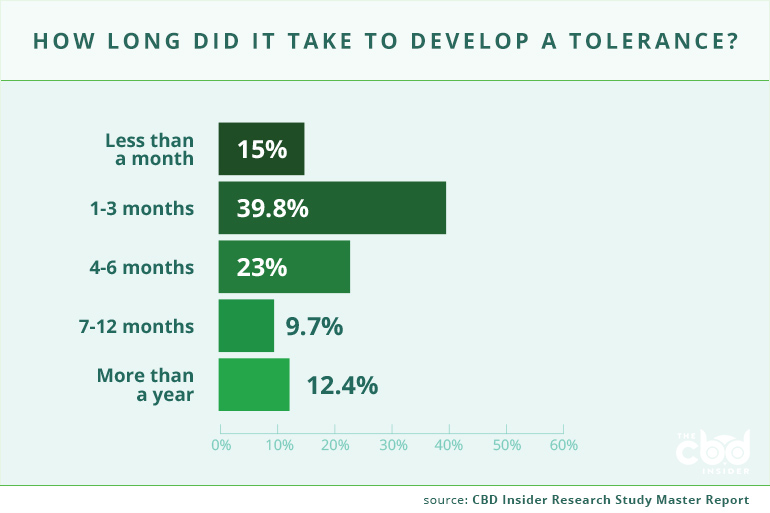

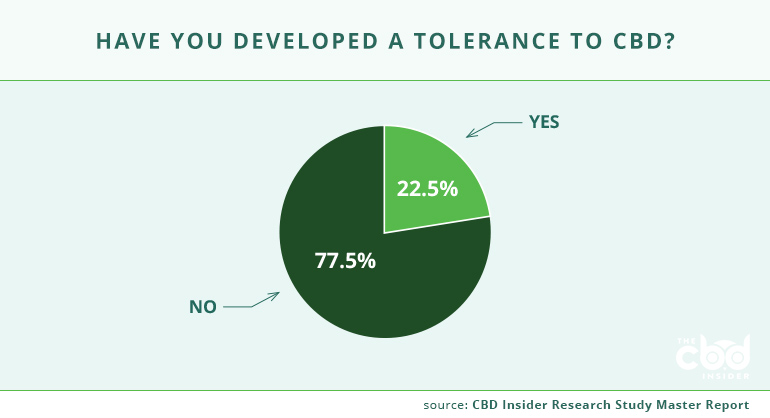

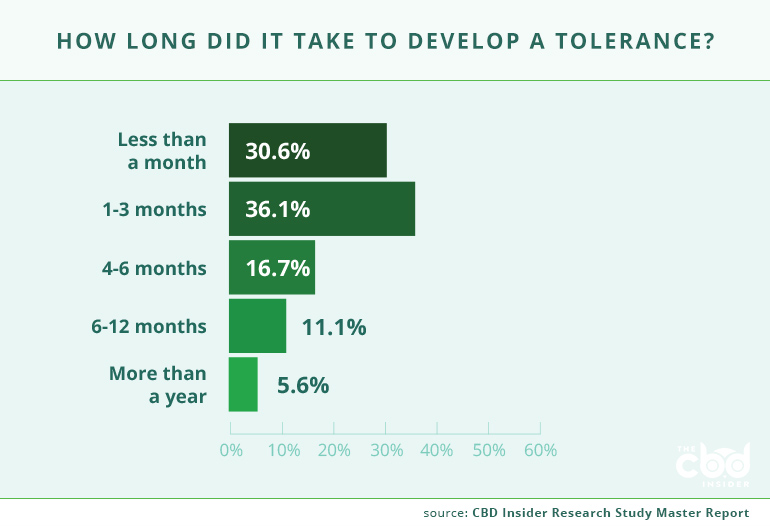

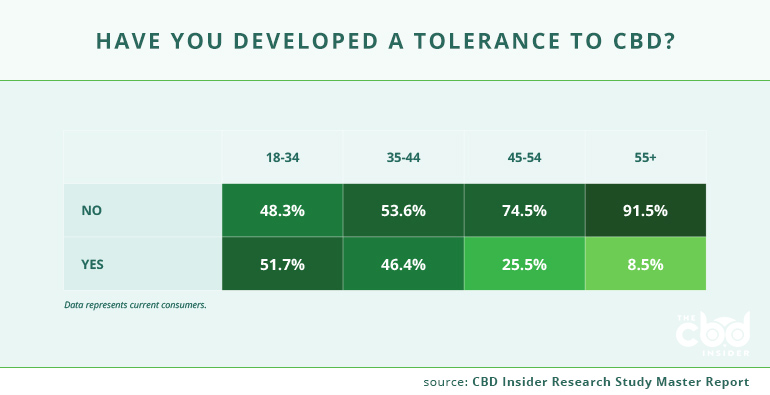

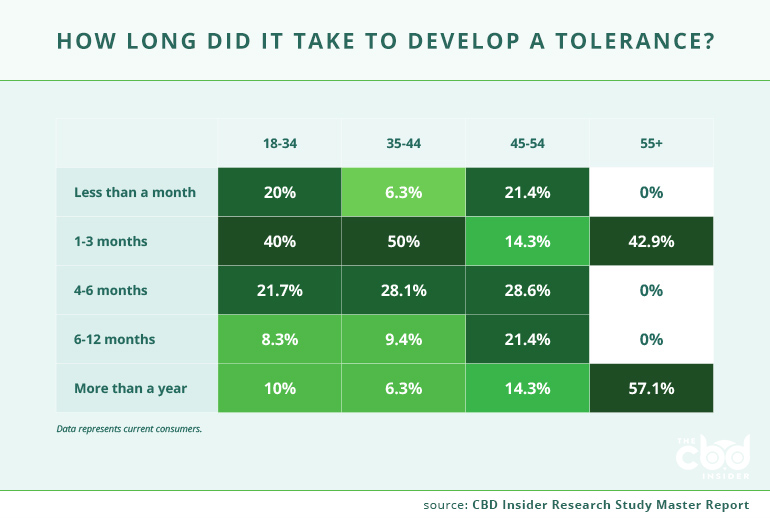

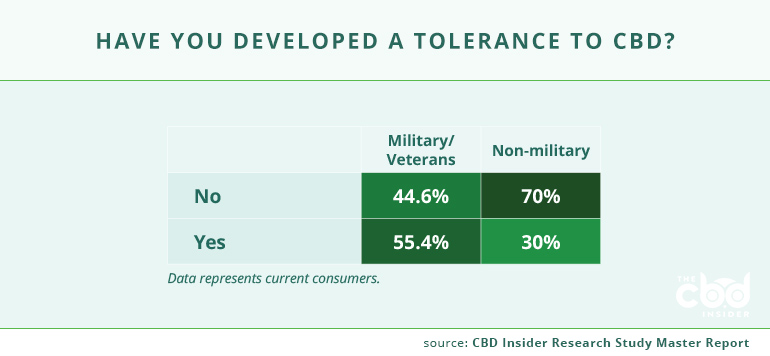

Nearly two-thirds (64.9%) of consumers say they have not developed a tolerance to CBD, defined as consumers requiring an increase in serving size on multiple occasions over time to achieve the same results. Among consumers who said they did develop a tolerance, more than half of them (54.8%) said it took less than three months.

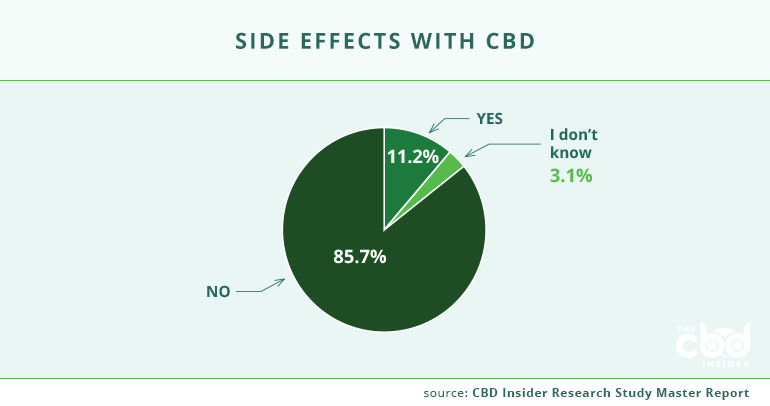

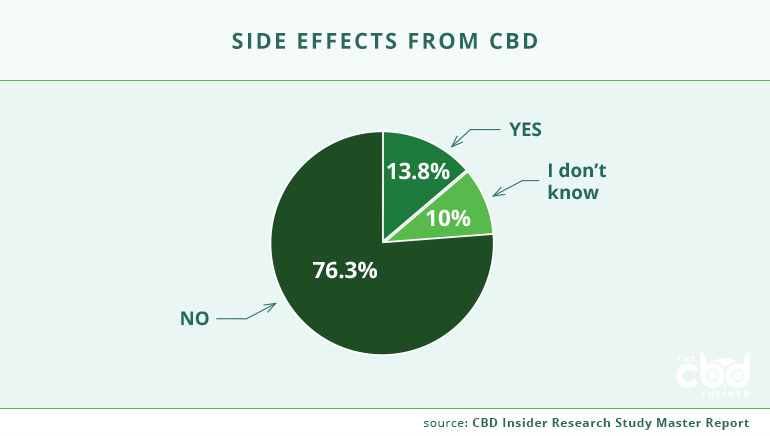

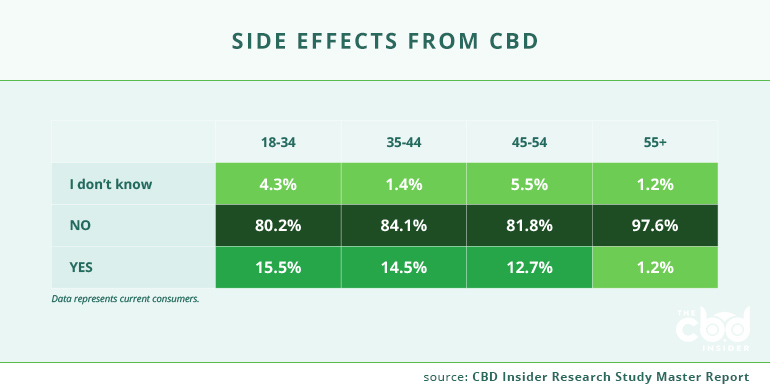

An overwhelming majority of consumers said they did not experience negative side effects (85.7%). Of those who did experience negative side effects, the most common were drowsiness (47.2%) and dry mouth (47.2%).

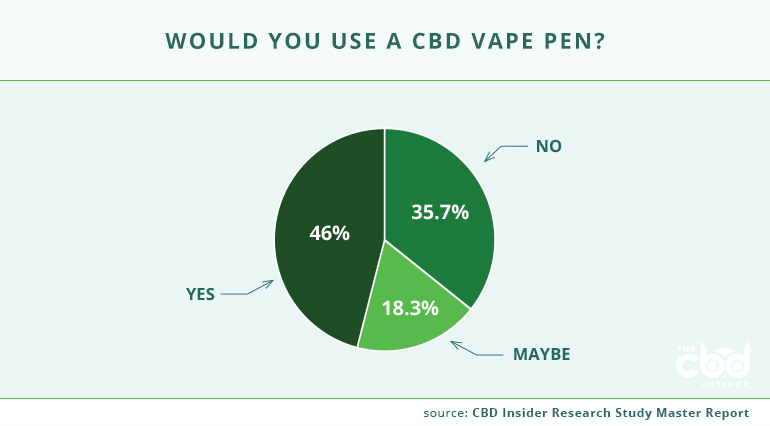

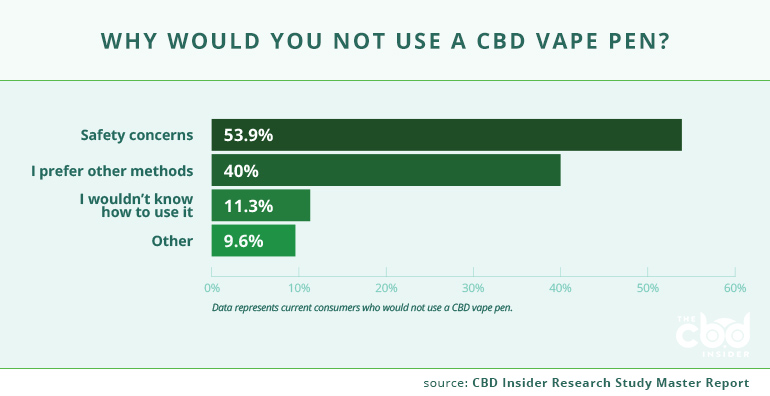

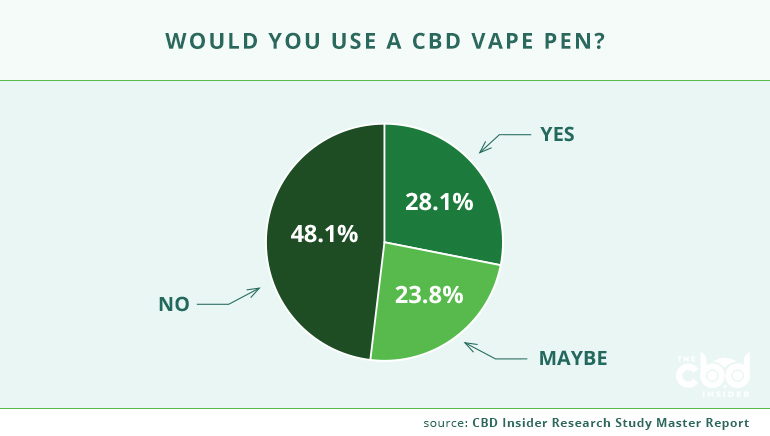

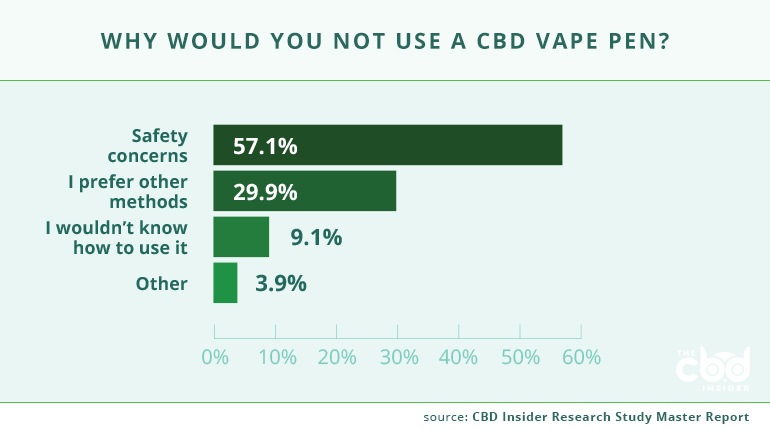

When asked if they would use a CBD vape pen, around one in three consumers (35.7%) said they would not. A majority of those consumers cited safety concerns (53.9%) as one reason they would not use a CBD vape pen.

Purchasing Trends of CBD Consumers

CBD Brands

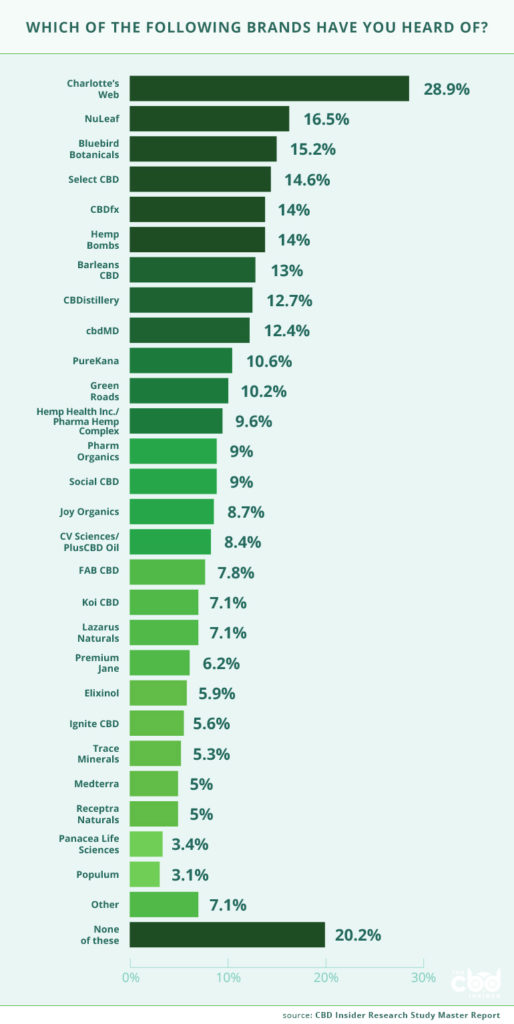

CBD brands are struggling to gain recognition, even among CBD consumers. Using aided awareness, Charlotte’s Web was the most recognized CBD brand (28.9%). The next closest brands were NuLeaf Naturals (16.5%) and Bluebird Botanicals (15.2%). One in five consumers (20.2%) did not recognize any of the 27 brands listed.

Charlotte’s Web was the brand most CBD consumers purchased from (15.8%), while one in three consumers had not purchased from any of these brands (32.9%). CBDfx (9%) and Barleans (8.4%) rounded out the top three.

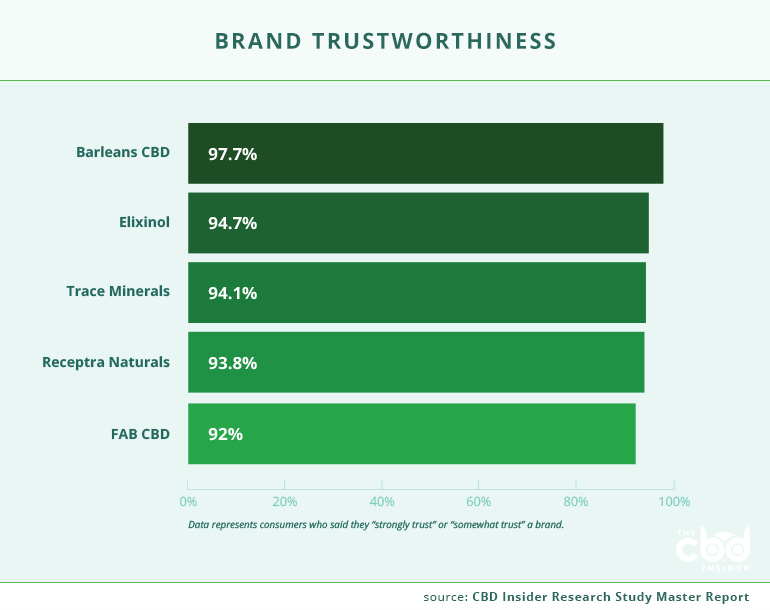

When asked how much consumers trusted the brands they recognized, an overwhelming majority said that they strongly or somewhat trust Barleans (97.7%), Elixinol (94.7%), Trace Minerals (94.1%), Receptra Naturals (93.8%), and FAB CBD (92%). All brands were strongly or somewhat trusted by 70% or more of the consumers who were familiar with them.

Purchase Decision Factors

Consumers want to be confident in both the products they purchase and in the brands those products come from.

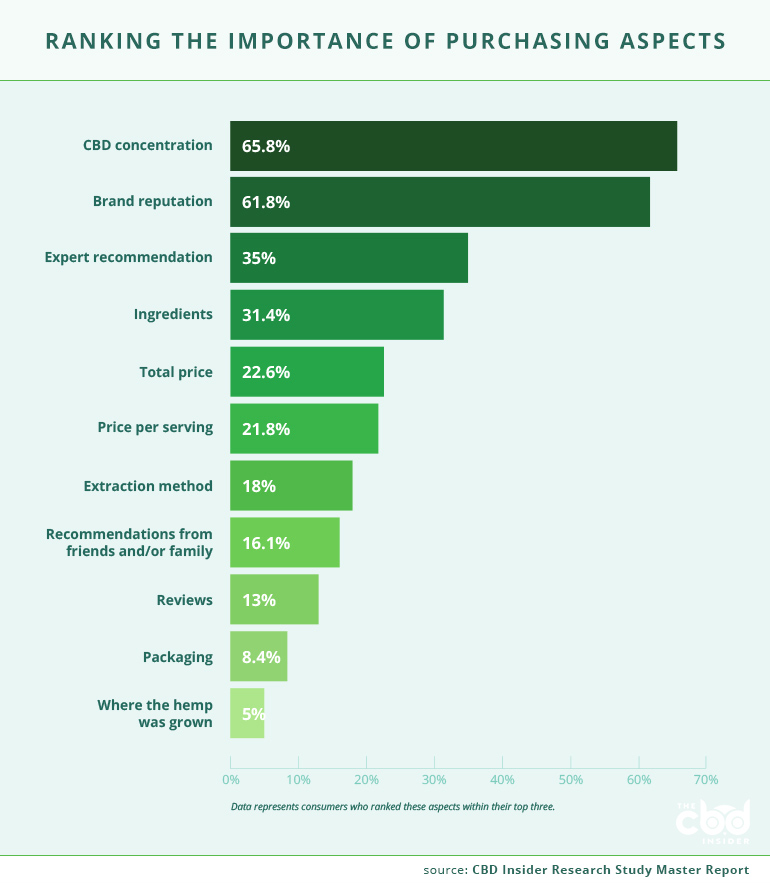

CBD concentration is supremely important as 65.8% of consumers ranked it as one of their top three factors when making a purchase decision.

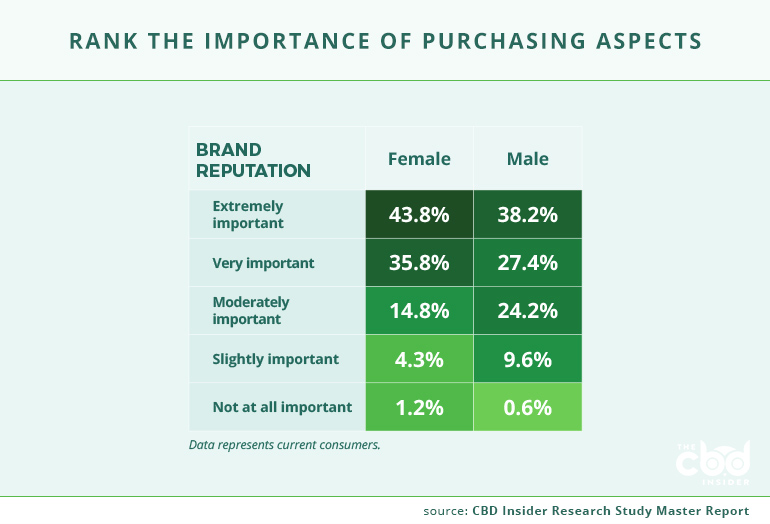

Brand reputation came in second at 61.8%, while expert recommendation was a distant third place at 35%.

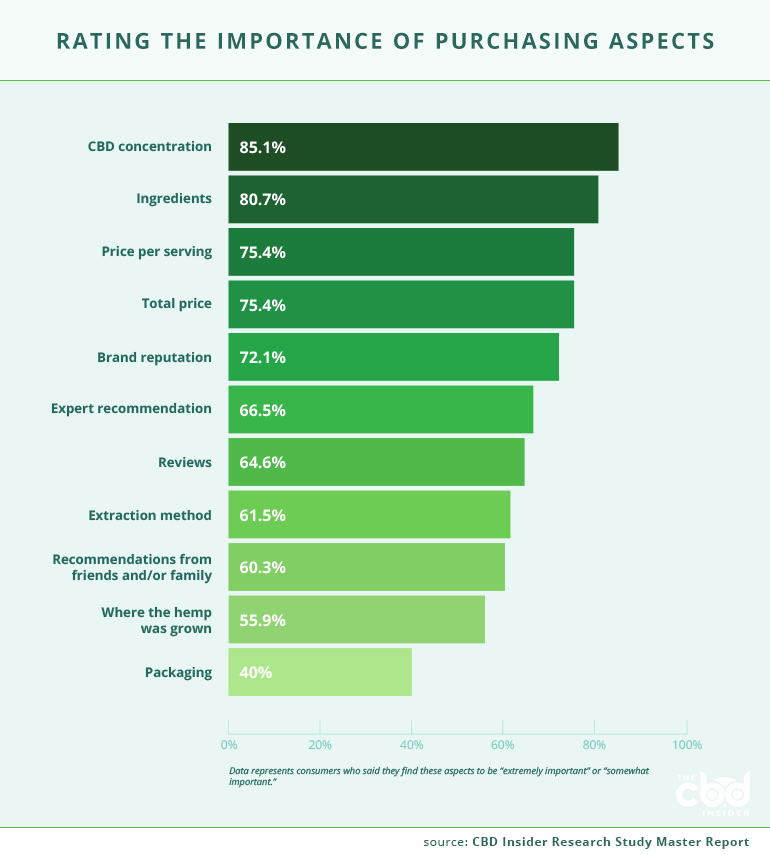

When asked how important an aspect was, 85.1% of consumers said CBD concentration was “extremely important” or “very important,” 80.7% said the same of ingredients, and 75.4% said the same of total price.

Purchasing Behavior

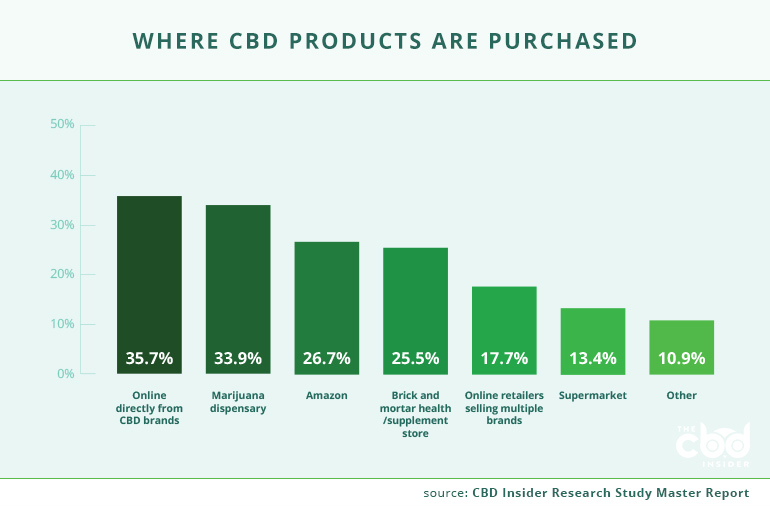

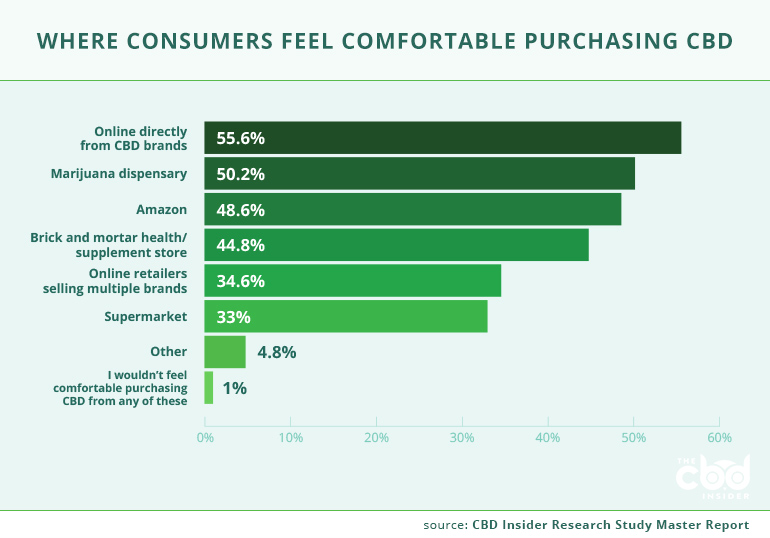

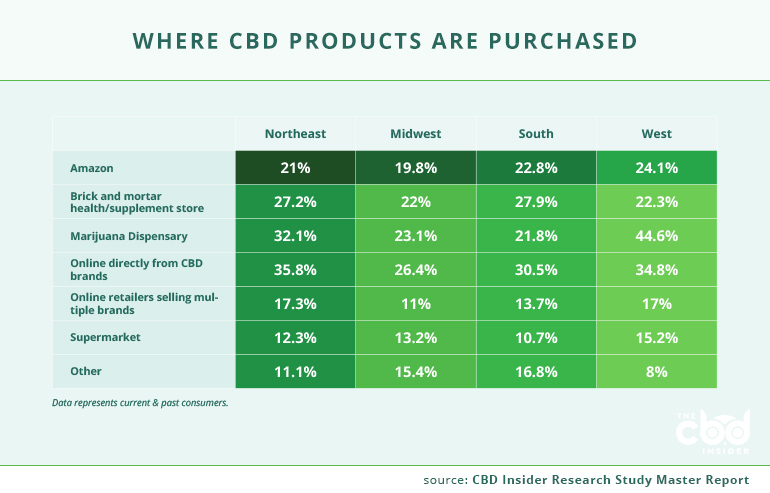

CBD consumers are most likely to buy CBD products directly from brand websites (35.7%), marijuana dispensaries (33.9%), and Amazon (26.7%).

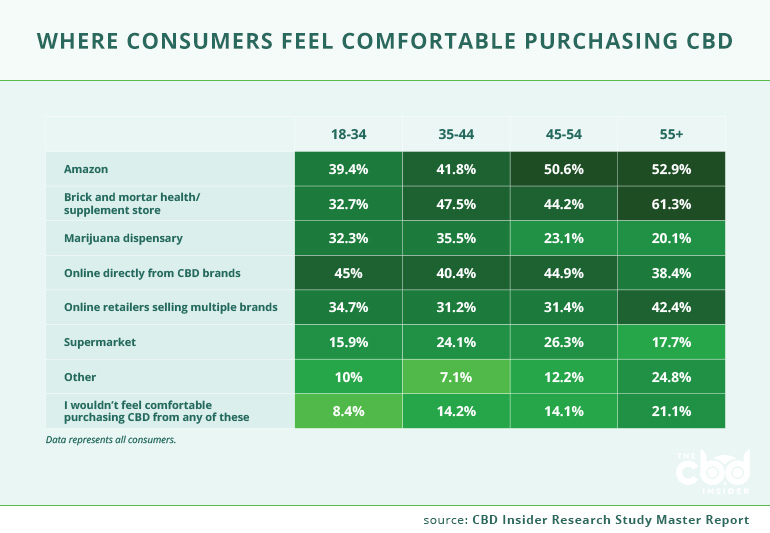

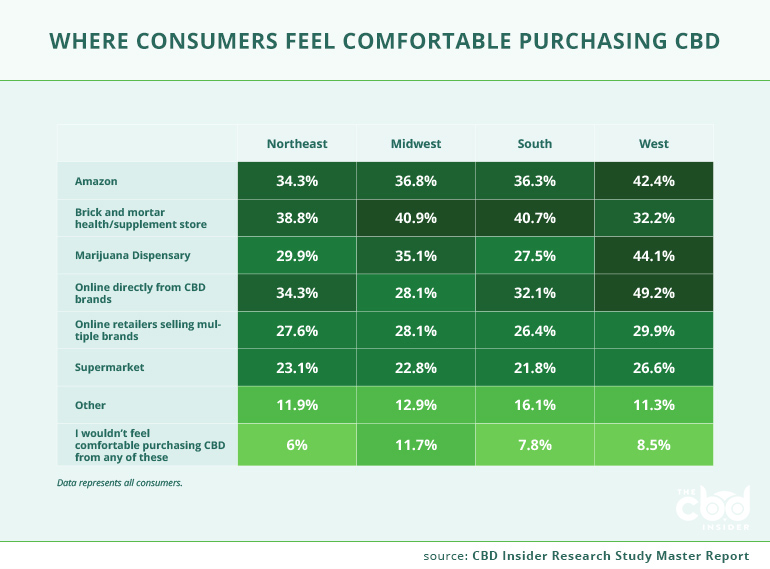

When asked where they would feel comfortable purchasing CBD, more than half of consumers said directly from a brand’s website (55.6%) or a marijuana dispensary (50.2%). Almost half of consumers would feel comfortable purchasing from Amazon (48.6%).

Unfortunately, Amazon’s current policy states: “Listings for products containing cannabidiol (CBD) are prohibited.” Given the clear desire of CBD

consumers to buy from Amazon, we strongly encourage Amazon to reconsider their policy so that their customers can purchase CBD safely.

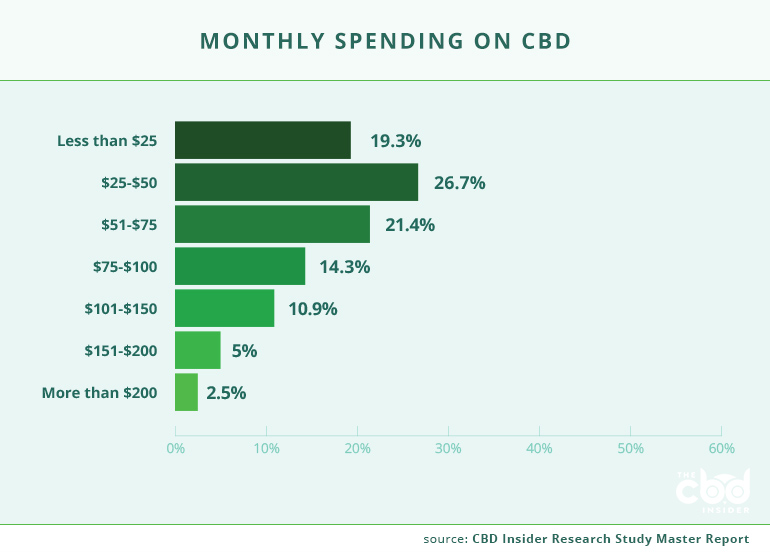

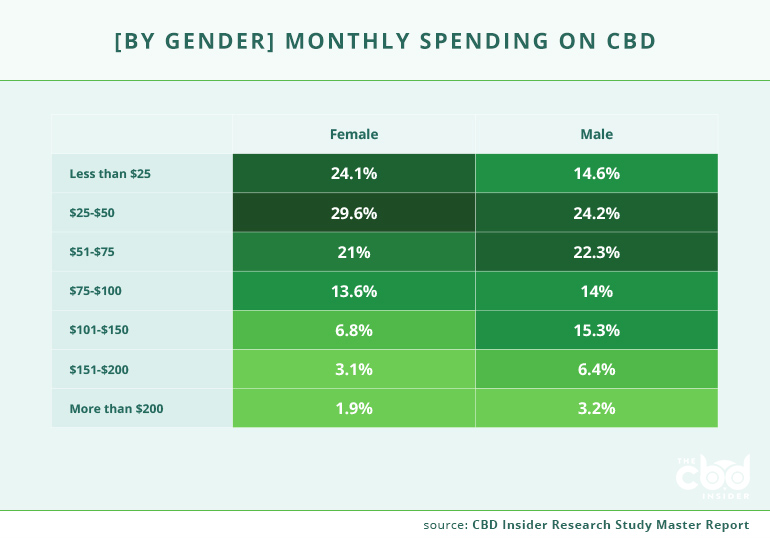

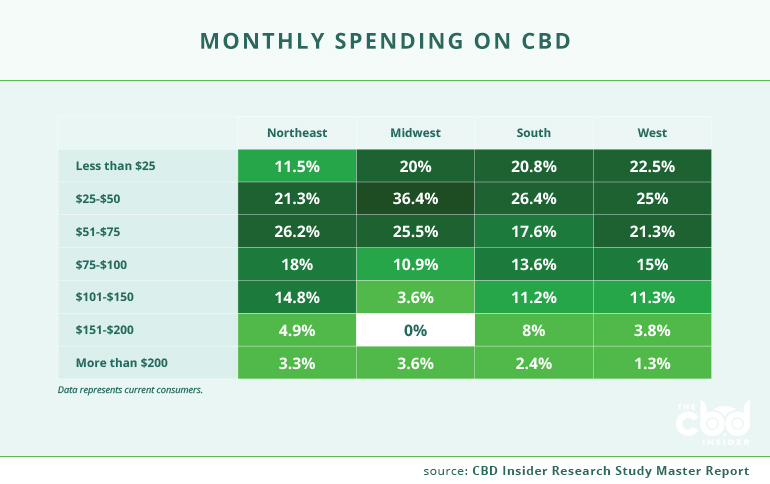

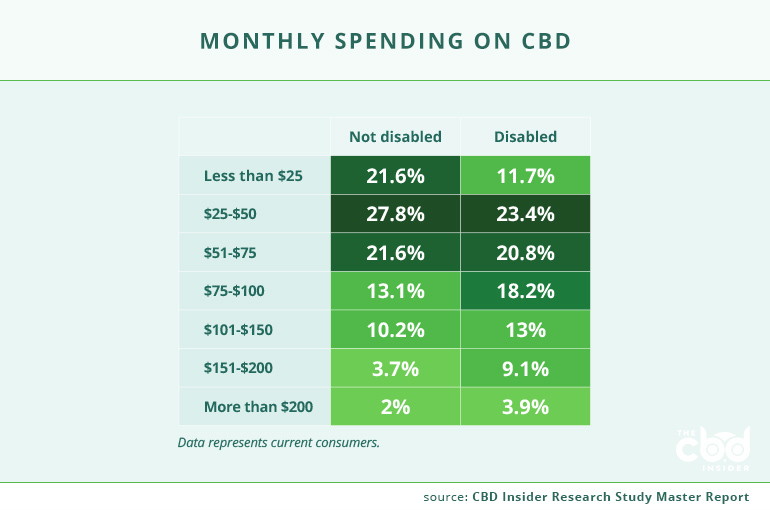

Regarding spending, over half of consumers (54.1%) said they spend more than $50 on CBD per month. When broken down by age, a majority of those 55 and older (57.3%) said they spend less than $50 monthly on CBD. The majority of all other age groups said they spend more than $50.

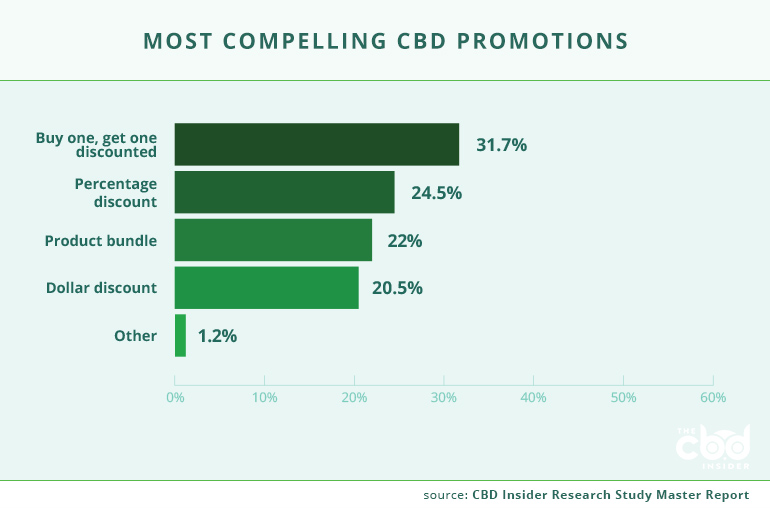

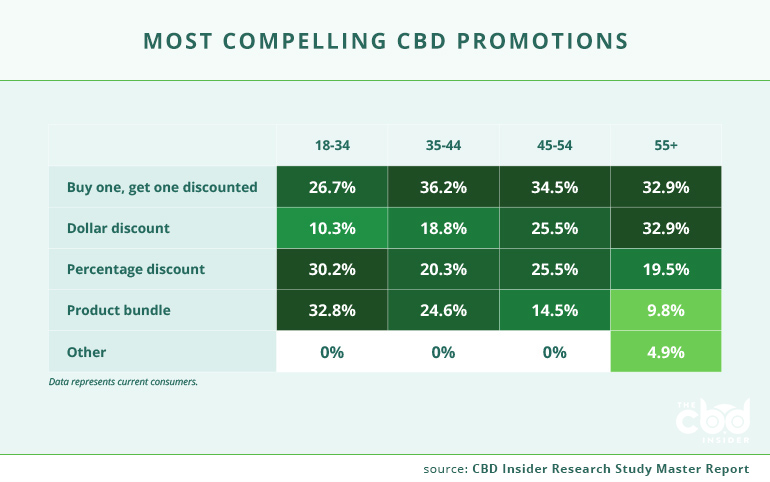

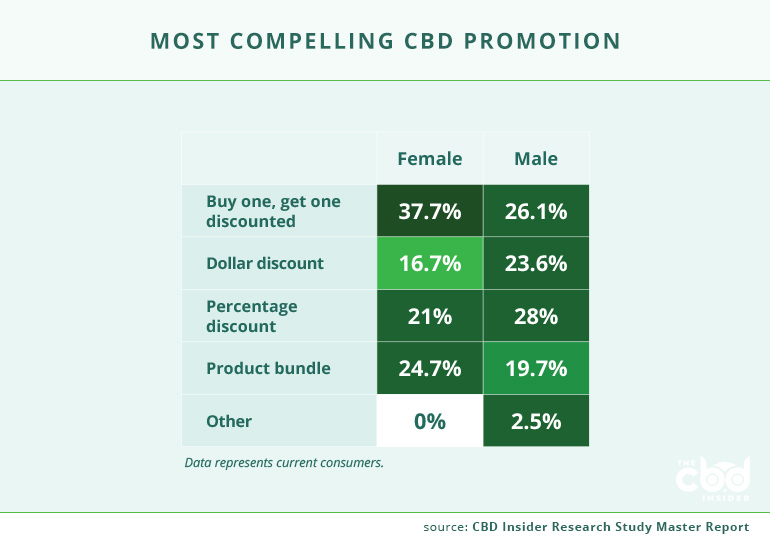

Almost one-third of consumers (31.7%) said buy one, get one discounted promotions make them most likely to make a purchase. Percentage

discounts (24.5%) came in second followed by product bundles (22%).

Past Consumers

Understanding Lost Consumers

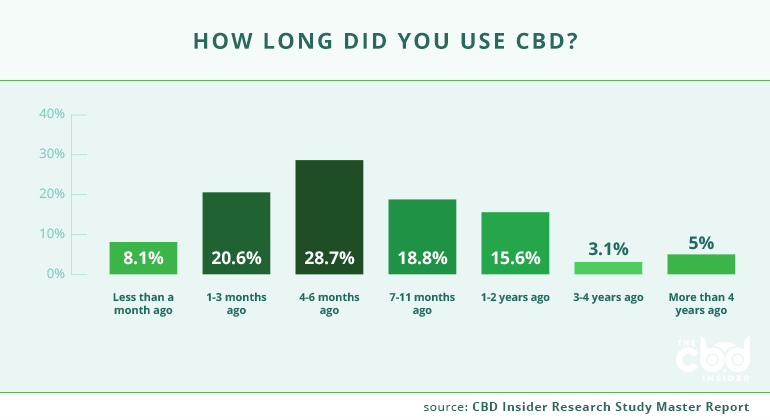

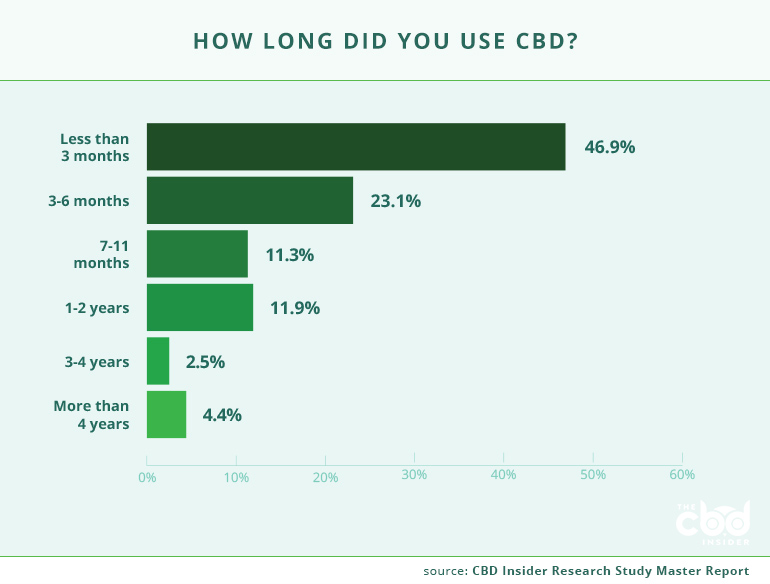

Three in four past consumers last used CBD sometime in 2019 (76.2%). A plurality of them said they only used it for less than three months before they stopped (46.9%).

Like current CBD consumers, almost four in five past consumers used CBD at least weekly (79.4%), but a plurality used it daily (44.4%).

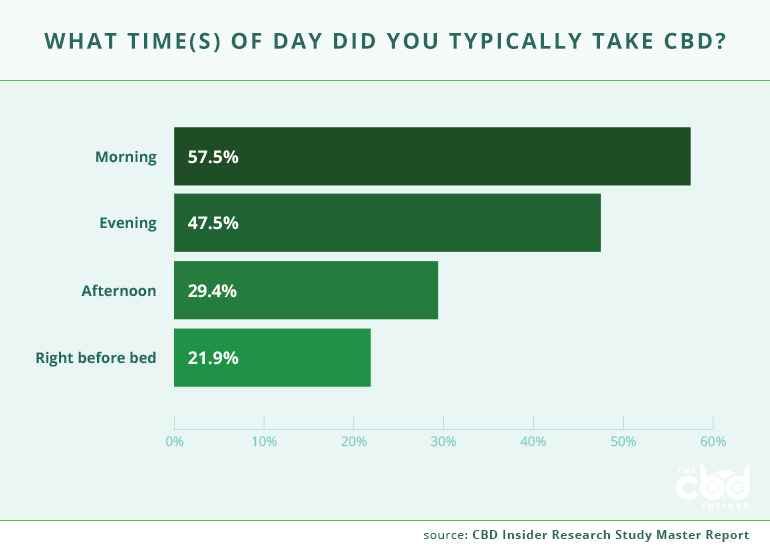

The most common time for past consumers to use CBD was in the morning (57.5%) followed by the evening (47.5%).

Past consumers were more likely to take CBD multiple times in a day (55.1%) rather than once, but at a lower rate than current consumers (62.7%).

Surprisingly, more than two in five past consumers (41.3%) do not know how much CBD they used. Of those who did know, more than one in three (37.6%) used less than 25mg of CBD per serving.

The most used products among past consumers were tinctures (40.6%), edibles (25.6%), and vape products (20%). Nearly a quarter of past

consumers preferred tinctures (22.5%) while edibles and vape products tied for second (16.3%).

Past consumers, like current consumers, most commonly reported using CBD for aches and discomfort (47.5%). The second most commonly reported use was relaxation (34.4%) and third was muscle soreness and recovery (23.1%).

Energy was the use with the highest perceived effectiveness rate with nearly three in five (58.9%) past consumers saying they found it to be

“extremely effective” or “very effective.” Mood (44.4%) and general health (38.9%) rounded out the top three.

Concerns About CBD

Past consumers were less likely to report developing a tolerance to CBD than current consumers. More than three in four past consumers (77.5%) said they did not develop a tolerance. Among those who said they did develop a tolerance, two in three (66.7%) said it happened within three months, which is similar to current consumers.

More than three in four past consumers (76.3%) also said that they did not notice any negative side effects. Interestingly, one in ten (10%) were not sure if they experienced negative side effects, leaving just over one in ten (13.8%) past consumers to say yes. Among those who said they noticed side effects, the most common was dry mouth (45.5%).

Almost half of past consumers said they would not use a CBD vape pen (48.1%). More than half of those who said they would not use a CBD vape pen cited safety concerns as a reason (57.1%).

Winning Back Lost Consumers

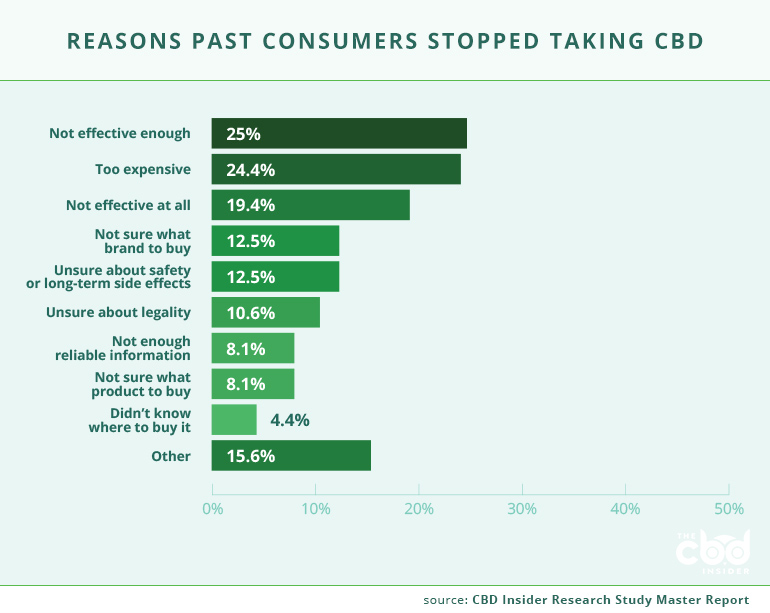

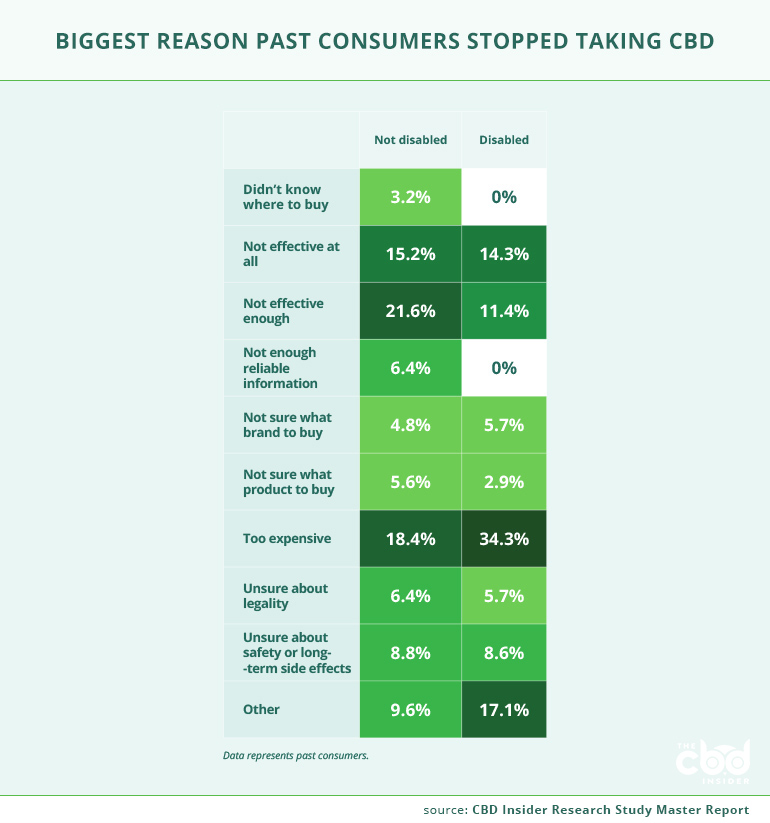

Most past consumers discontinued their use of CBD because it was not effective enough (25%), too expensive (24.4%), or not effective at all (19.4%).

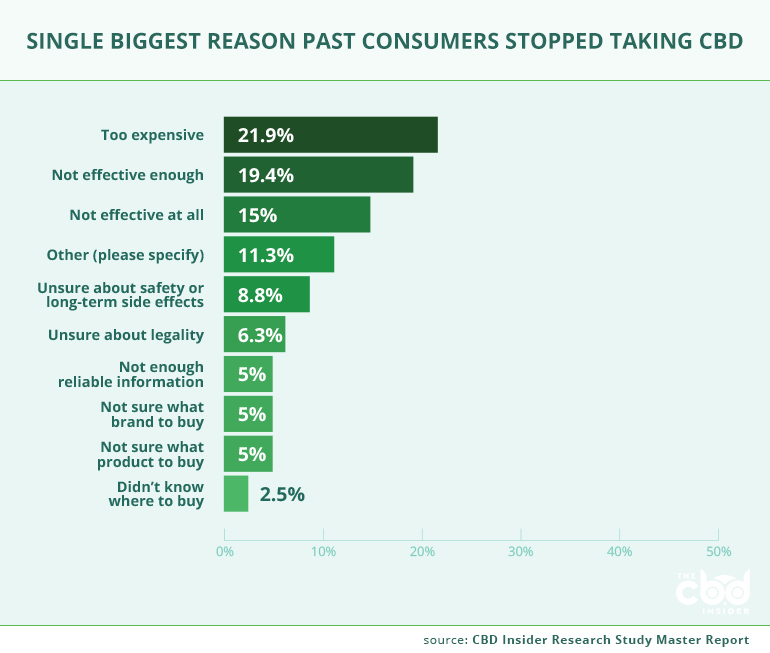

When asked what their single biggest reason was for no longer using CBD, a plurality of past consumers said it was too expensive (21.9%), but more than one in three consumers said it was either not effective enough (19.4%) or not effective at all (15%).

The fact that more than three in four past consumers were either unsure about how much CBD they were taking, or taking small servings, indicates they were probably not using enough CBD to be effective.

Despite several past consumers saying that CBD was not effective enough, seven in eight of them (87.5%) think CBD is definitely effective or might be effective for some people.

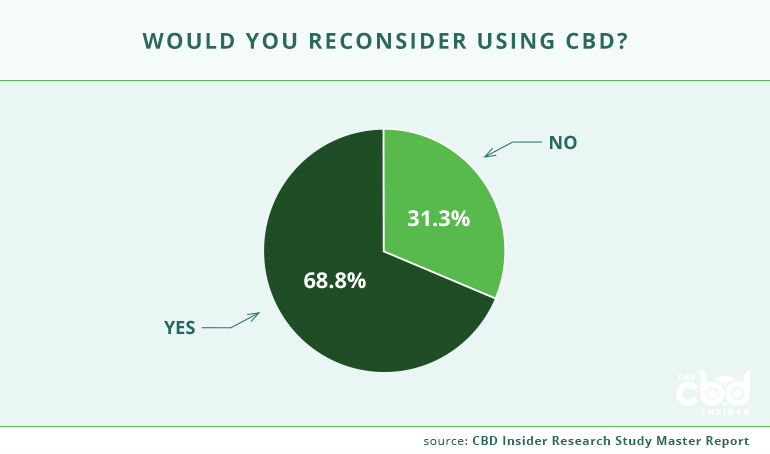

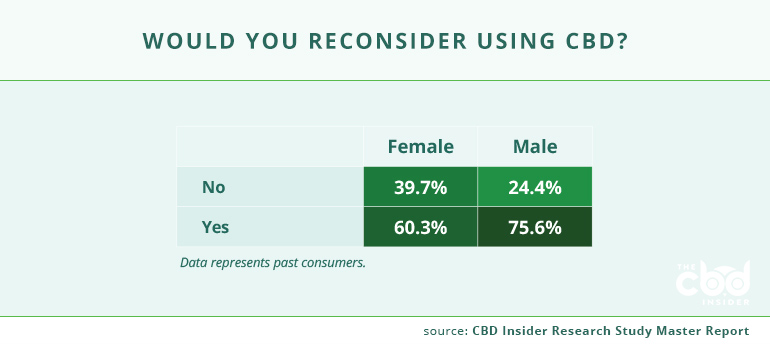

Perhaps as a result, more than two-thirds of past consumers (68.8%) said they would reconsider using CBD.

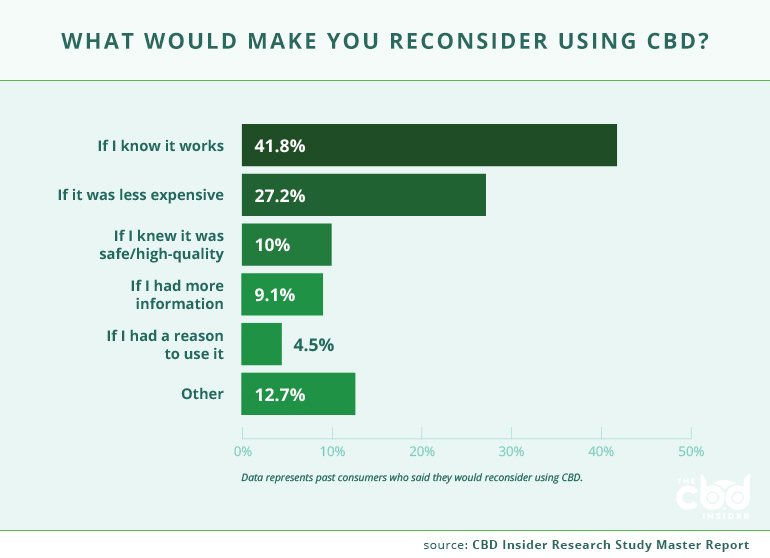

When asked what would make them reconsider, 31.8% of past consumers mentioned better efficacy as a reason they would reconsider CBD, while 29.1% mentioned lower costs.

Potential Consumers

Reasons They Haven’t Tried CBD

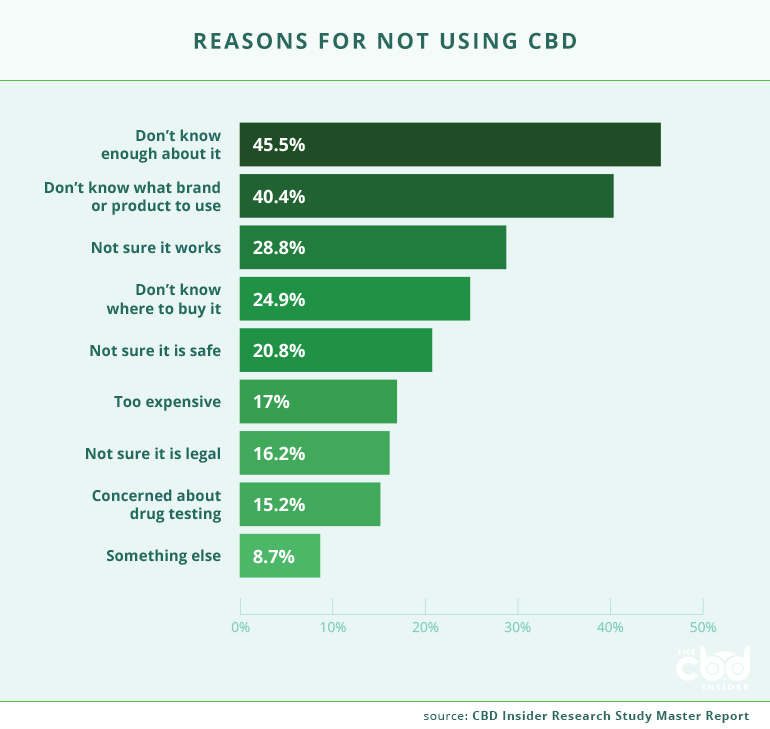

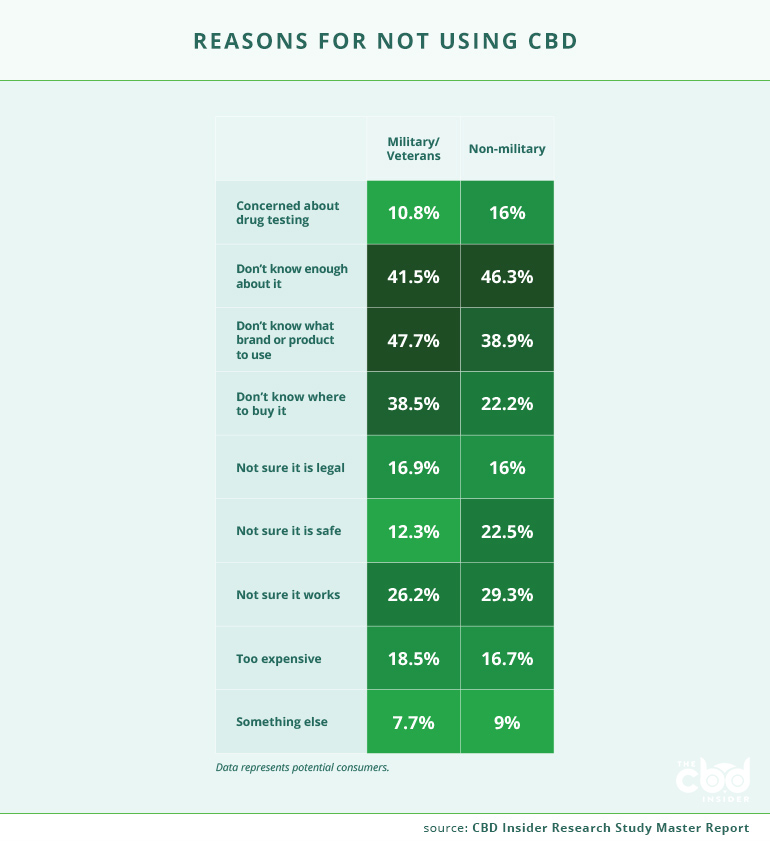

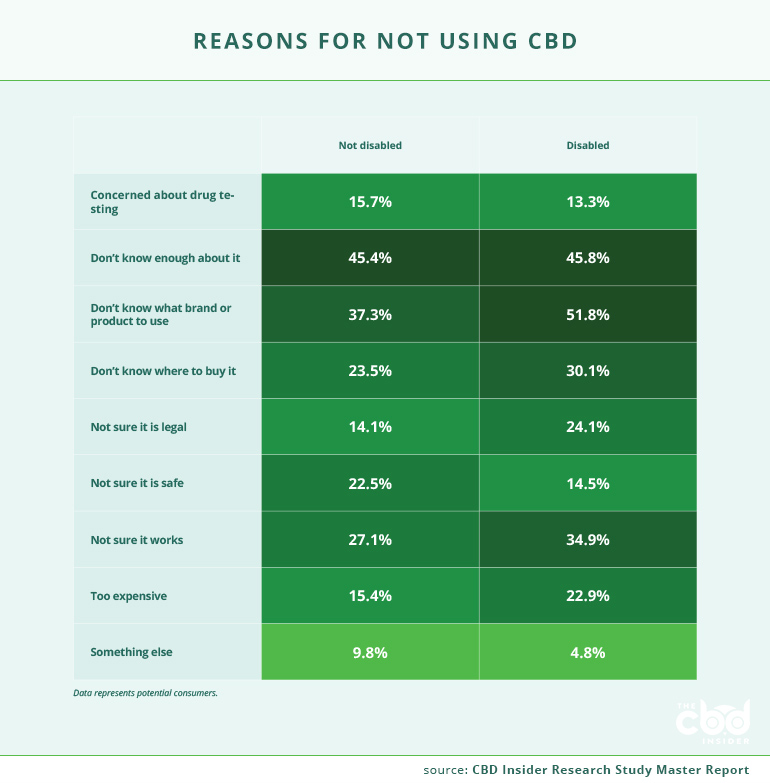

A lack of education is the main culprit preventing potential consumers from trying CBD.

Almost half (45.5%) of the potential consumers said they had not used CBD because they did not know enough about it. In the same vein, two in five (40.4%) said they did not know which brand or product to use.

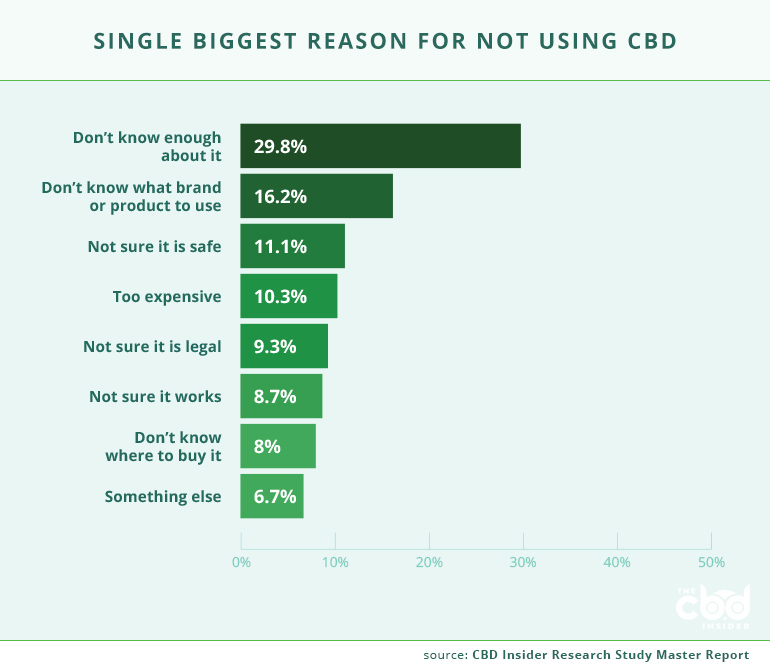

When asked what their single biggest reason was, these answers remained consistent.

Reasons They Would Try CBD

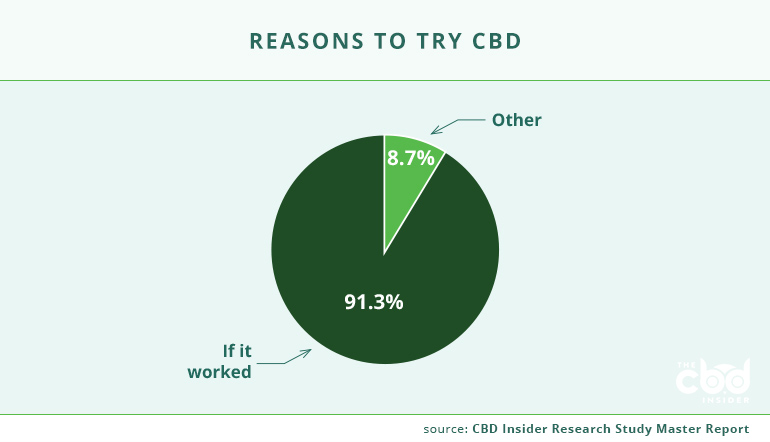

The overwhelming majority of potential consumers said they would try CBD if they knew it would work (91.3%), especially for certain ailments.

Other reasons included wanting to know if it was safe and affordable.

The most common ailments potential consumers mentioned were forms of pain (42.5%) such as from a condition like arthritis or pain in general. Anxiety (12.1%) and sleep (5.1%) were also mentioned.

Purchase Decision Factors

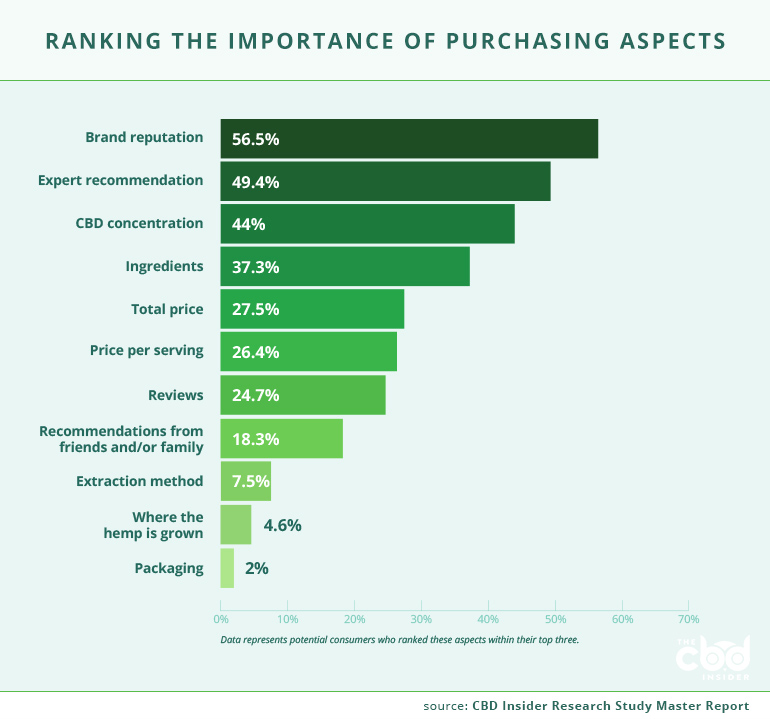

Like current consumers, potential consumers need to feel confident about the brands and the products they are purchasing.

Brand reputation (56.5%) is the most important consideration to potential consumers before purchasing CBD, followed by expert recommendation

(49.4%) and CBD concentration of a product (44%).

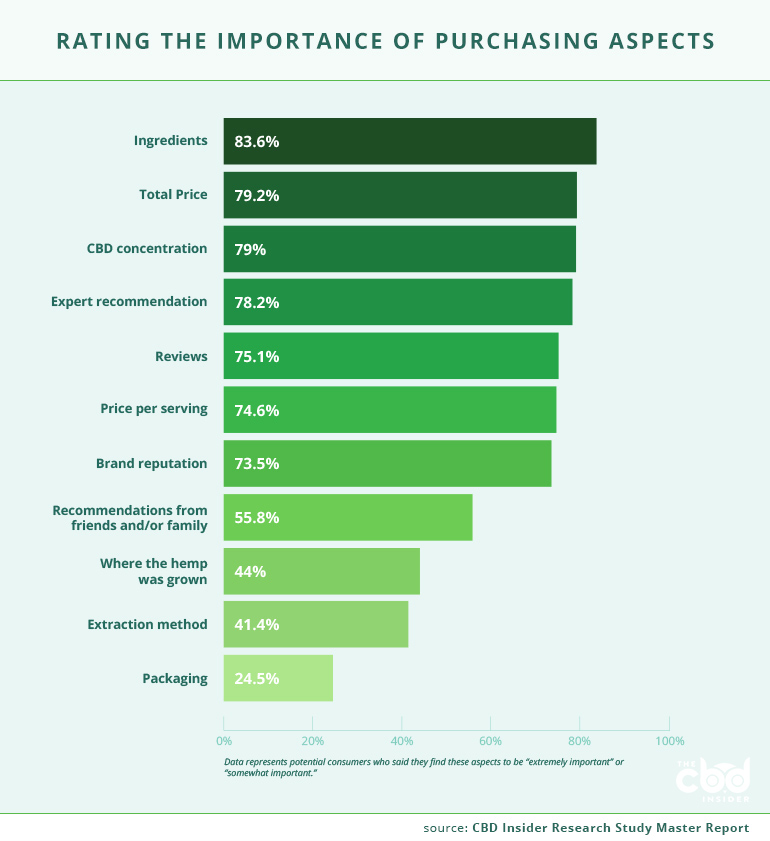

When asked to rate how important these aspects were, the answers changed. Ingredients were given the most importance as more than four in five potential consumers (83.6%) said ingredients were “extremely important” or “very important” to them. Total price (79.2%) and CBD concentration (79%) made up the rest of the top three.

Part Two: Crosstabs

Respondent Profiles

We conducted analyses on the subgroups in our sample, primarily from five categories: age, gender, region, military status, and people with disabilities.

Below is a breakdown of our survey respondents:

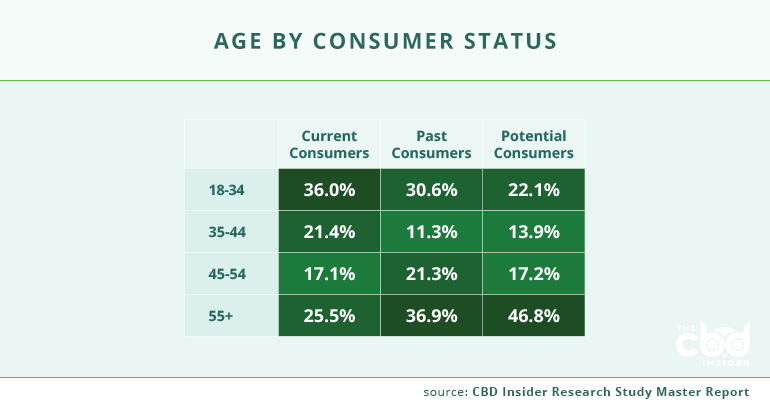

Age

- Current consumers: 36% were 18-34, 21.4% were 35-44, 17.1% were 45-54, and 25.5% were 55 and older.

- Past consumers: 30.6% were 18-34, 11.3% were 35-44, 21.3% were 45-54, and 36.9% were 55 and older.

- Potential consumers: 22.1% were 18-34, 13.9% were 35-44, 17.2% were 45-54, and 46.8% were 55 and older.

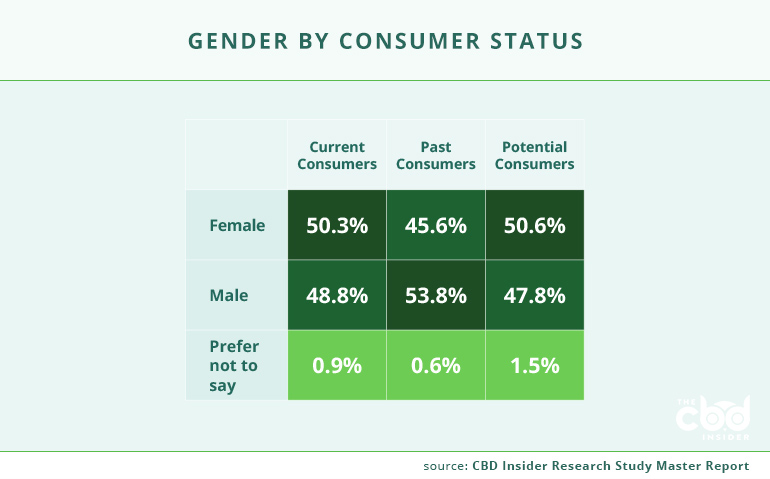

Gender

- Current consumers: 50.3% were female, 48.8% were male, and 0.9% preferred not to answer.

- Past consumers: 45.6% were female, 53.8% were male, and 0.6% preferred not to answer.

- Potential consumers: 50.6% were female, 47.8% were male, and 1.5% preferred not to answer.

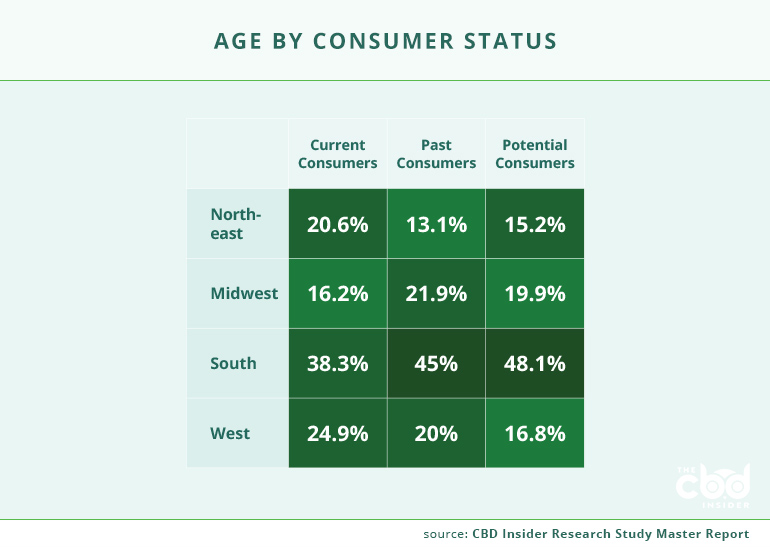

Region

- Current consumers: 20.6% were from the Northeast, 16.2% were from the Midwest, 38.3% were from the South, and 24.9% were from the West.

- Past consumers: 13.1% were from the Northeast, 21.9% were from the Midwest, 45% were from the South, and 20% were from the West.

- Potential consumers: 15.2% were from the Northeast, 19.9% were from the Midwest, 48.1% were from the South, and 16.8% were from the West.

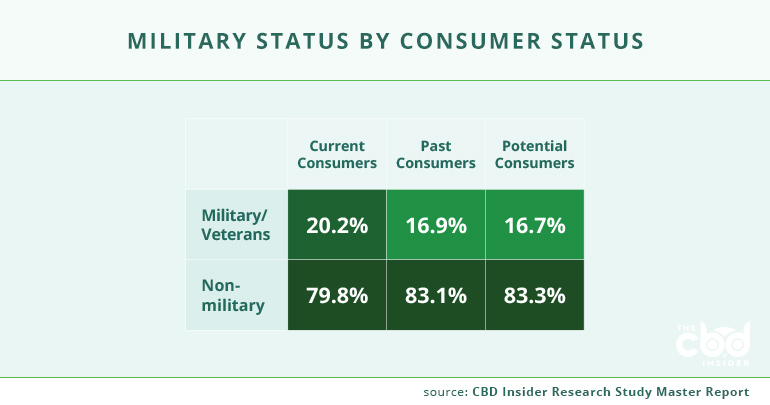

Military Status

- Current consumers: 20.2% were military and veterans.

- Past consumers: 16.9% were military and veterans.

- Potential consumers: 16.7% were military and veterans.

People with Disabilities

- Current consumers: 23.9% were disabled.

- Past consumers: 21.9% were disabled.

- Potential consumers: 21.4% were disabled.

Rather than provide a redundant, comprehensive analysis of each demographic, we decided to highlight interesting and valuable insights from these particular subgroups in the below sections.

Age

Here are the highlights from our respondents by age:

Younger consumers are more likely to use higher serving sizes of CBD than older consumers.

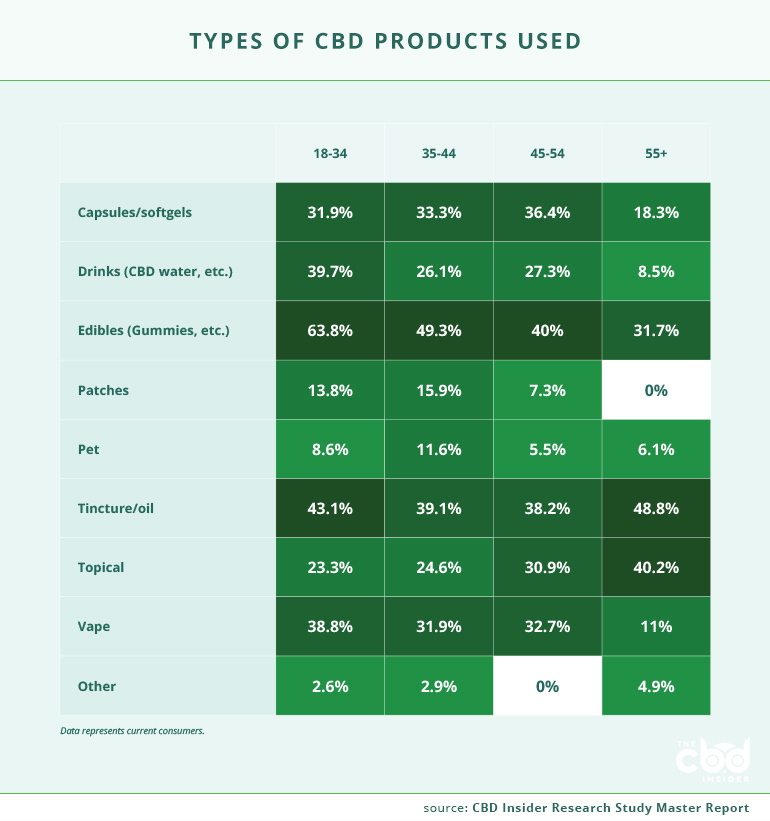

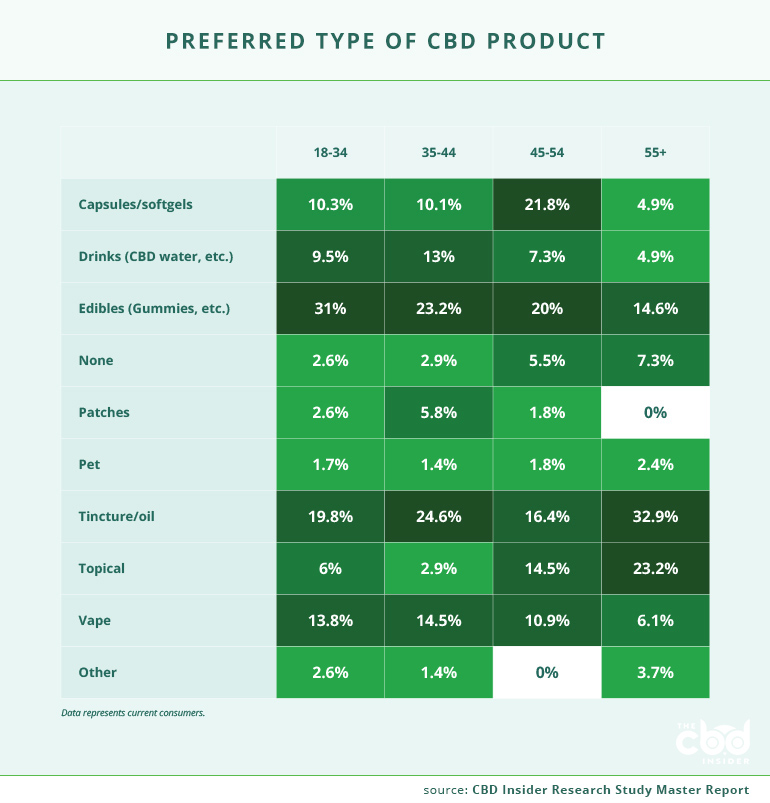

The 18-34, 35-44, and 45-54 age groups were far more likely to use edibles, vape products, and CBD drinks than those 55 and older. Tinctures were the most used only among the 55 and older group.

Consumers 55 and older prefer CBD tinctures and topicals more than any other age group while edibles were more preferred by the younger demographics.

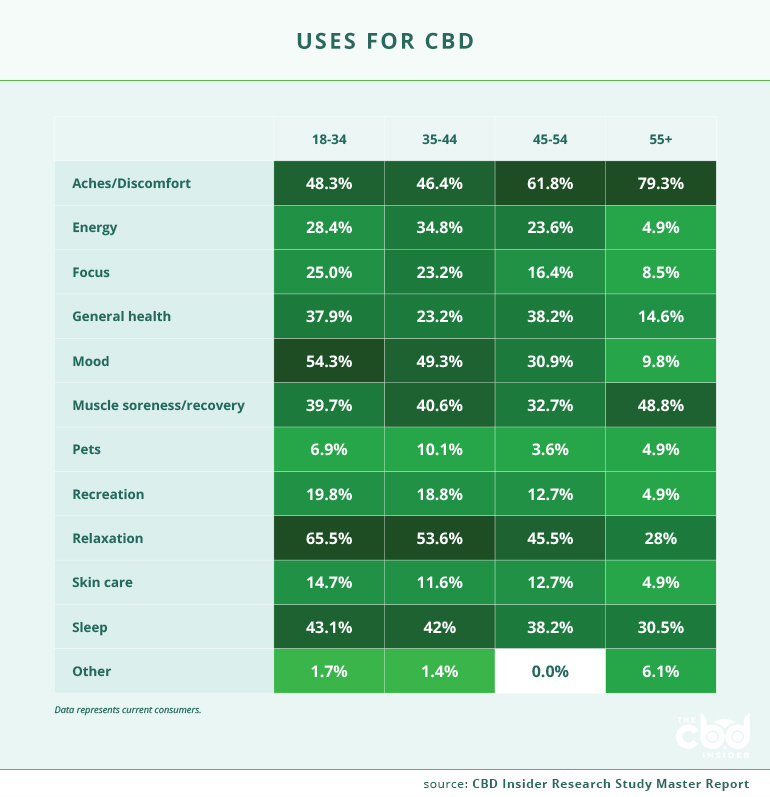

The consumers in the two older age groups were more likely to use CBD for aches and discomfort while younger consumers were more likely to use it for relaxation and mood.

The number of consumers who reported developing a tolerance to CBD significantly declined with age.

Consumers 55 and older were much less likely to report negative side effects than the other age groups.

Younger consumers prefer percentage discounts and product bundles while older consumers find BOGO deals and dollar discounts more compelling.

Current CBD consumers 18-44 were more than twice as likely to know the difference between hemp extracts than older consumers.

Consumers in the 55 and older group feel significantly more comfortable purchasing CBD products at brick and mortar stores than the other age groups. The 18-44 age group feels more comfortable purchasing CBD at marjiuana dispensaries than the 45 and older age group.

Gender

Here are the highlights from our respondents by gender:

Women are more likely to prefer edibles than men, while men are more likely to prefer capsules than women.

Women are significantly more likely to use CBD for mood and relaxation than men.

Men are more likely to supplement or replace their medication with CBD than women. Men are twice as likely to replace and supplement prescription sleep drugs than women, while women are twice as likely to replace a prescription anxiolytic (anti-anxiety) drug than men.

Female consumers are more likely to get their information about CBD from family and friends than male consumers.

Brand reputation is more important to women than men.

Women find BOGO deals more compelling than men do.

Male past consumers are more likely to reconsider using CBD than female past consumers.

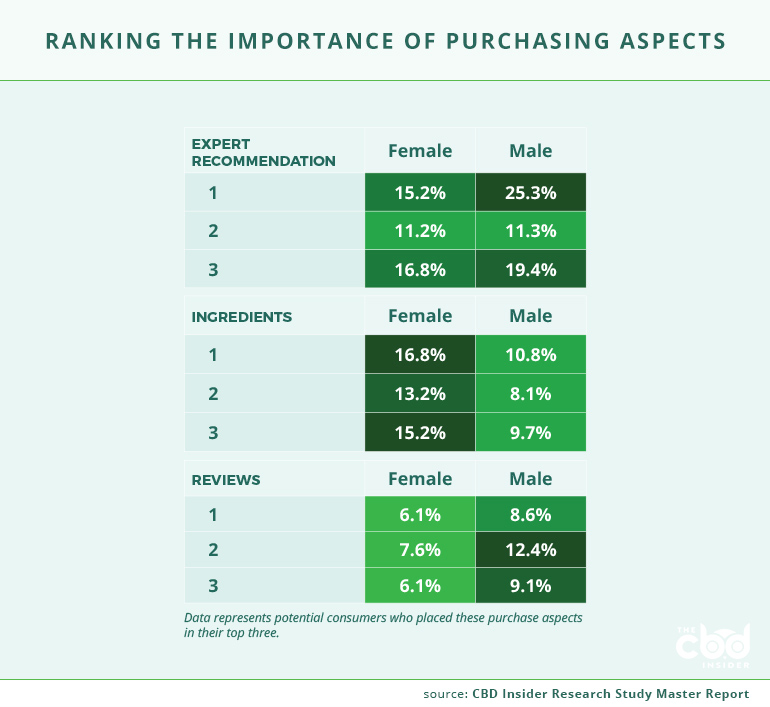

Male potential consumers ranked “expert recommendation” and “reviews” higher than potential female consumers in importance. Women ranked “ingredients” higher than men.

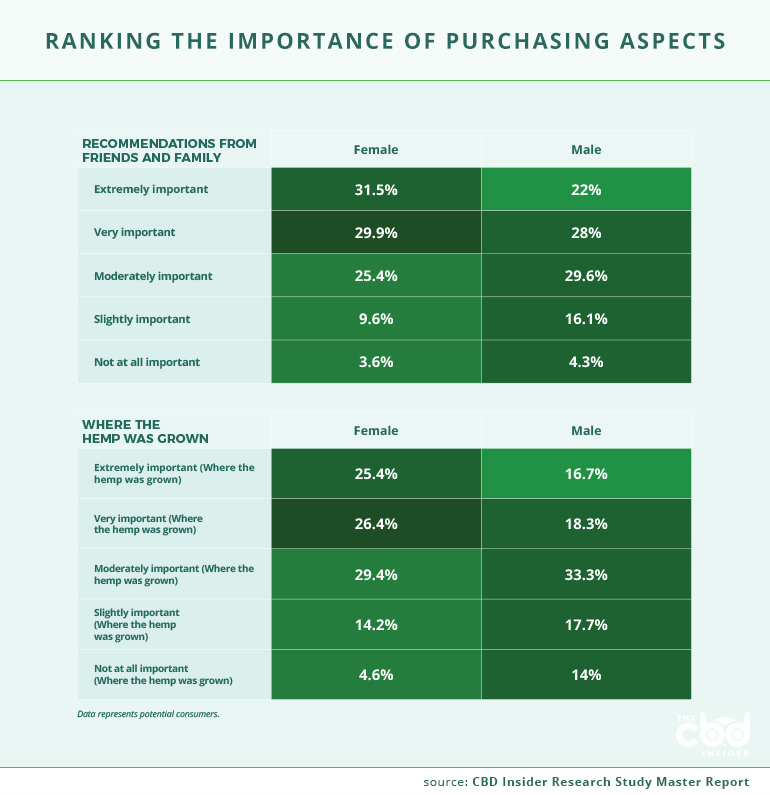

Female potential consumers placed more importance on “recommendations from friends and family” and “where the hemp was grown” than male potential consumers.

Region

Here are the highlights from our respondents by region:

Current and past CBD consumers in the West are more likely to have used edibles than any other region; however, consumers in all other regions were more likely to say they preferred edibles than consumers in the West.

Tinctures were the most preferred products among all regions except in the Northeast.

Consumers in the West see more CBD products for sale in marijuana dispensaries and on CBD brand websites than all other regions; consumers in the West were also more likely to say they would feel comfortable purchasing from marijuana dispensaries and directly from brand websites.

Current consumers in the West and Midwest are more likely to report using CBD for aches and discomfort. Consumers in the Midwest were much less likely to report using CBD for energy and skin care.

Consumers in the Northeast reported the highest number of individuals who replaced a medication or are supplementing a medication with CBD.

Midwest consumers spend the least amount of money on CBD monthly.

Among potential CBD consumers, those in the West are by far the most likely to see CBD being sold in a marijuana dispensary.

Military & Veterans

Here are the highlights from our respondents by military status:

Military and veterans are more likely to use less popular CBD products like CBD drinks and far less likely to use more traditional products like tinctures.

The most preferred CBD product among military and veterans is CBD drinks.

Military and veterans are much less likely to use CBD for aches and discomfort or relaxation than non-military consumers.

Military and veterans are more likely to know how much CBD they are taking and to take higher serving sizes.

More than half of military and veterans who identified as current consumers reported developing a tolerance to CBD.

Over half of military and veterans who are current consumers said they supplement a medication with CBD, while almost one in four of them said they replace a medication with it. More than one in ten have replaced a prescription opiate with CBD while nearly one in four supplement a prescription opiate with CBD.

Military and veterans who are current and potential consumers notice CBD advertisements on podcasts and radio more than non-military consumers.

Military and veterans who are current consumers are significantly less likely to get information about CBD from family and friends than non-military consumers. However, one in three military and veterans get information about CBD from their physician as compared to one in five non-military consumers.

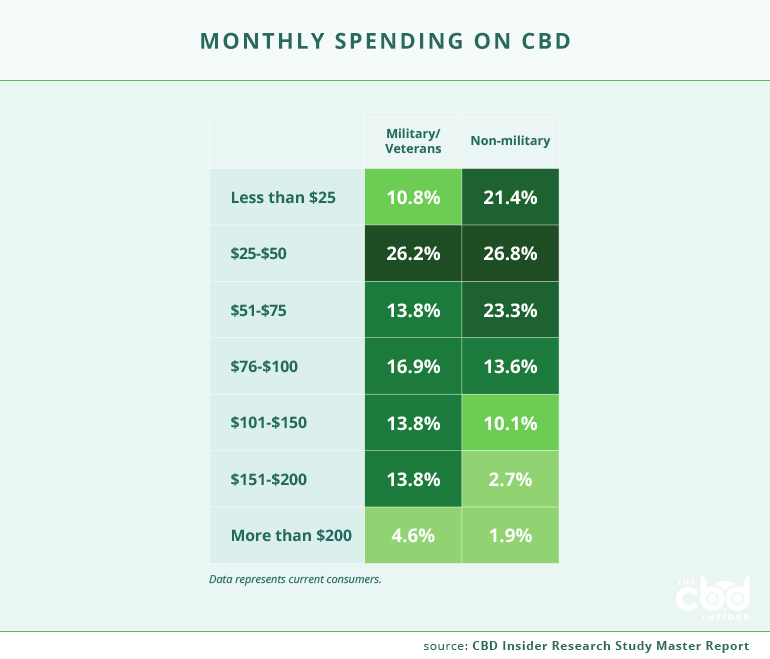

Military and veterans spend more monthly on CBD than non-military consumers.

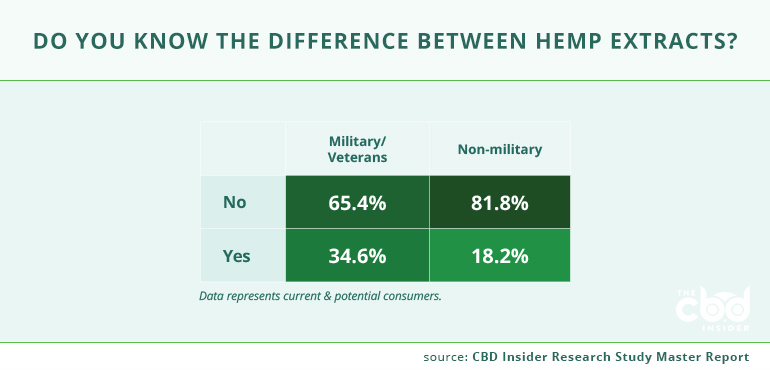

Military and veterans who are current and potential consumers are almost twice as likely to know the difference between hemp extracts than non-military consumers.

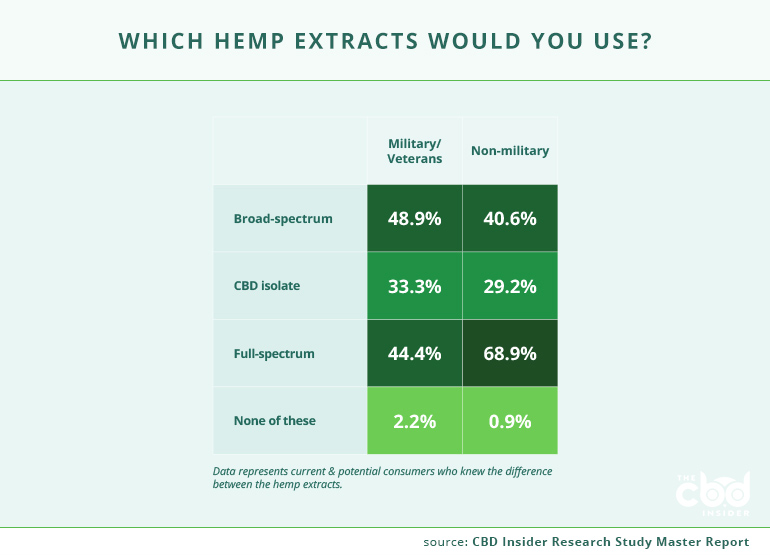

Military and veterans who are current and potential consumers are most likely to use products made with broad-spectrum hemp extract (due to the absence of THC) while non-military consumers are most likely to use full-spectrum hemp extract.

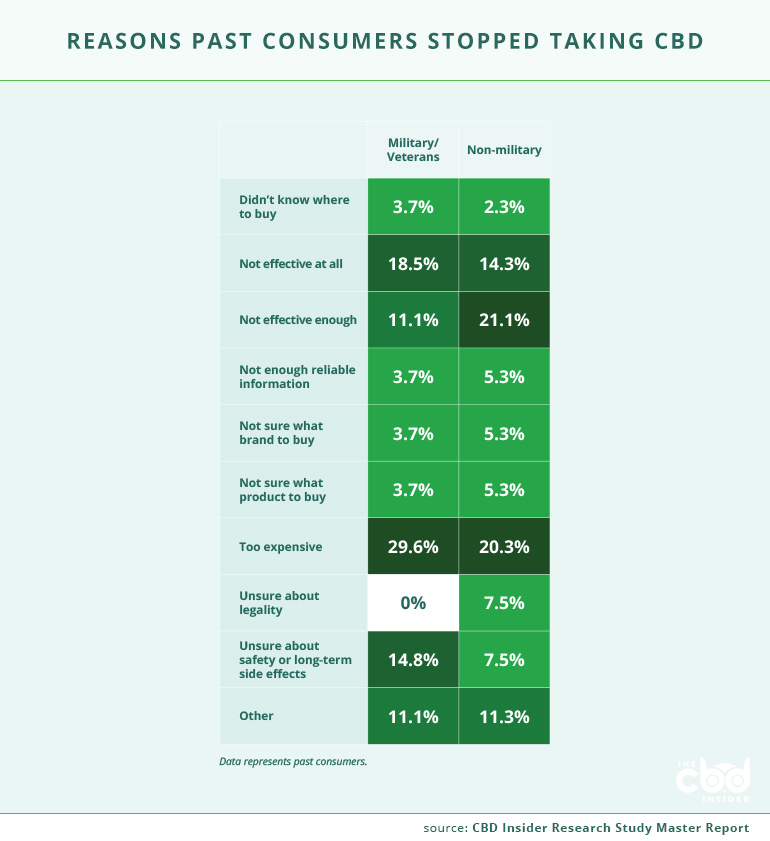

The single biggest reason military and veterans who are past consumers said they stopped using CBD was because it was too expensive.

The most cited reason military and veterans who are potential consumers have not used CBD is they don’t know what brand or product to use.

Disabled

Here are the highlights from our respondents by disability status:

Disabled consumers are more likely to know the difference between full-spectrum, broad-spectrum, and CBD isolate products than non-disabled consumers.

Almost one in three disabled current CBD consumers replaced a medication with CBD and more than half are supplementing a medication with CBD.

Disabled consumers were more likely to know how much CBD they were taking and take higher serving sizes than non-disabled consumers.

Disabled consumers replaced twice as many prescription opiates than non-disabled consumers and are almost three times as likely to supplement a prescription opiate with CBD.

Almost two in three disabled current CBD consumers spend more than $50 monthly compared to half of non-disabled consumers.

Disabled consumers are much more likely to use CBD isolate than non-disabled consumers, likely due to the absence of THC.

Disabled past CBD consumers were almost twice as likely to cite CBD being too expensive as the reason they stopped using it than non-disabled consumers.

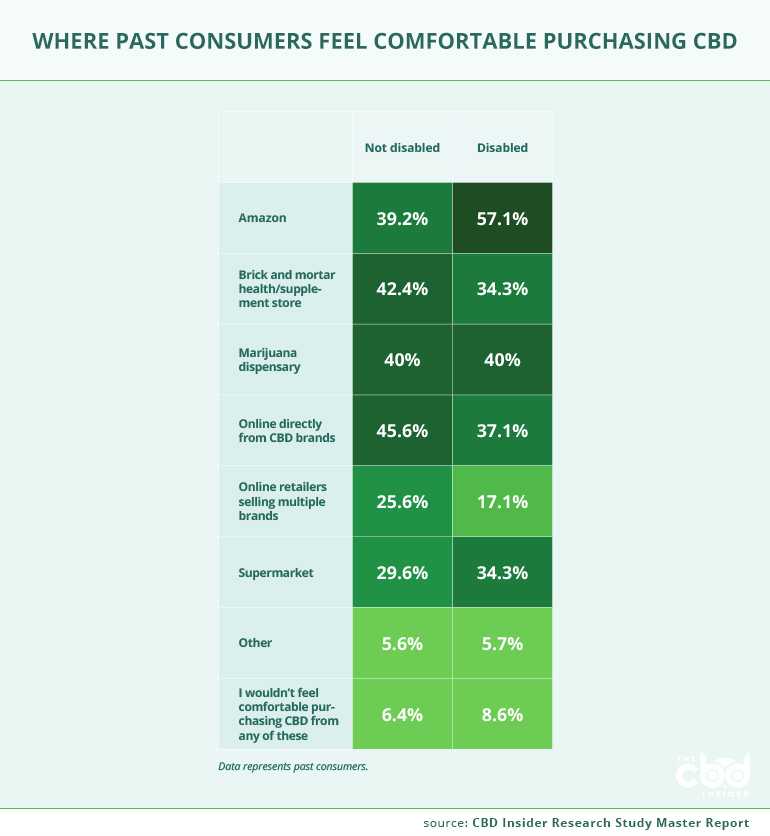

Well over half of disabled past CBD consumers said they feel comfortable purchasing CBD from Amazon compared to almost two in five non-disabled consumers.

Disabled potential CBD consumers are more likely to say they have not used CBD because they don’t know what brand or product to use than non-disabled consumers.

Key Takeaways

Consumers want to purchase CBD from Amazon, but Amazon’s policies make it tough.

More than one quarter of CBD consumers (26.7%) reported purchasing products from Amazon and almost half of all consumers (49.4%) said they would feel comfortable purchasing from Amazon.

The number of consumers purchasing from Amazon is surprising because the platform does not technically allow the sale of CBD. However, several brands can be found selling “hemp oil” to skirt the policy. Since it is not allowed to be mentioned, buying “CBD” products on Amazon is risky because consumers cannot be sure how much CBD is in them, or if there is any at all.

With the expectation that online purchasing will play a larger role in the future, especially in a post-COVID-19 era, consumers will likewise expect

Amazon to carry reputable CBD products.

Given the popularity of Amazon and the federal standing on CBD, we strongly encourage Amazon to reconsider their policy so that their customers can purchase CBD quickly and safely.

Some consumers report developing a tolerance to CBD despite the fact scientific research has not observed this phenomenon.

More than one in three CBD consumers (35.1%) said they developed a tolerance to CBD, requiring them to increase their serving size on multiple

occasions over time.

According to the 2018 Critical Review Report on CBD by the World Health Organization (WHO), “CBD exhibits no effects indicative of any abuse or dependence potential.”

Dependence is characterized by tolerance and withdrawal, meaning the WHO has not found any research to indicate that humans or animals build a tolerance to CBD. The WHO’s 2018 report only mentions one animal study that observed no tolerance to CBD at any dosage. No data from human research studying tolerance were available at the time.

In light of this information, we believe that as consumers increased their serving sizes in an attempt to achieve their desired results, they may have mistook this trial-and-error period as developing a “tolerance” to CBD. It seems to us that tolerance is one piece in the bigger puzzle of determining how much CBD consumers should be taking.

In most human studies, researchers test a few doses of CBD no less than 100mg—and much more in many cases—to determine which

dosage is most effective. Usually, the most effective dosage is more than 100mg.

As a result, we would like to see CBD brands

increase the potency of their products across the board to reflect the available science.

A lack of education is preventing many potential consumers from trying CBD.

The most common reason potential consumers cite for not having tried CBD is they do not know enough about it.

We did identify a couple of groups that displayed a more robust understanding of CBD within the potential consumer segment, including

consumers who are disabled or military personnel and veterans. However, the vast majority are still in the dark about the fundamentals of CBD, such as knowing the difference between full-spectrum, broad-spectrum, and CBD isolate products.

In private conversations with our editorial team, brand representatives frequently cite their frustration at their inability to educate customers due to the legal risk that doing so exposes them to. While brands are restricted in what they can say about CBD because of current regulations, we encourage them to find creative methods for informing their customers, and to aggressively push for federal regulators to provide clear guidance on acceptable ways to educate consumers.

CBD is beginning to displace some medications.

More than one in five current CBD consumers (22%) have replaced a medication and more than two in five (44.7%) are supplementing a medication with CBD. Almost one in ten consumers said they replaced a prescription opiate (8.1%), which provides some anecdotal evidence that CBD may play a role in the solution to the US opioid epidemic.

With natural and alternative therapies growing in popularity, it will be interesting to see if CBD displaces more medications over time.

Brand reputation is important to most consumers, but brand recognition still remains low.

Brand reputation is one of the top three considerations for current and potential CBD consumers when making a purchase decision. However, among all consumers, no brand received more than 20% brand recognition.

These data indicate that there is plenty of opportunity for brands to create loyal followings; however, because of current bans on advertisements featuring CBD, companies cannot always effectively promote their brands.

Once advertisements are allowed for CBD, we

expect brand recognition to increase dramatically.

The industry needs the FDA to create regulations for hemp-derived CBD products.

Consumers strongly believe that the FDA should play a role in regulating hemp-derived CBD products. Almost three in four of all consumers (73.9%) said they wanted either FDA regulation or a combination of FDA and industry self-regulation.

With this in mind, the current regulatory system leaves both brands and consumers in the dark when it comes to how products can be marketed.

Some brands have received warning letters from the FDA due to making egregious medical claims. These brands and others would benefit from clear guidance about how to market CBD.

The prohibitive cost of some CBD products is a barrier to entry for many.

While healthy profit margins are certainly acceptable and expected, we are concerned with the current “price per serving” of many CBD products. We believe that the current cost of CBD is preventing many people from experiencing the benefits of it. When past consumers were asked for the single biggest reason they stopped using CBD, the most common answer was that CBD was too expensive (21.9%). The second most common answer was that CBD was “not effective enough” (19.4%), which we posit is at least partially a function of past consumers failing to use a sufficient dosage of CBD due to concerns about cost per milligram.

In addition, when potential consumers were asked how much they would be willing to spend per month on CBD, 70.4% of them indicated that they would be willing to spend $50 or less per month; a budget that—at typical current prices—would prevent them from using CBD at the dosages and frequencies typically used by current consumers who find CBD to be effective.

Given the oversupply of hemp biomass and the corresponding sharp decline in biomass pricing, there should be plenty of margin for companies to make healthy profits while also offering some of their products at a price point that is attainable for all income levels.

One option is to offer a line of basic, utility-focused products, while also offering a more premium line of products. We applaud the brands that are

already taking this (or a similar) approach.

Regardless of how brands address the issue, we believe that offering some products at a more approachable price point will bring past consumers back to CBD, encourage potential customers to give CBD a shot, and will lead to current consumers experimenting with higher, potentially more effective dosages.

The anecdotal evidence surrounding CBD warrants increased scientific research.

Most current consumers reported finding CBD extremely or very effective for the reasons they were using it. Add to this the fact that more than one in five consumers (22%) replaced a medication with CBD and there is plenty of anecdotal evidence that CBD is beneficial.

While some studies have been and are being conducted, the data indicate much more research is necessary to prove what CBD is most useful for.

Content advertised on or by The CBD Insider, on its website, in any reports, or any social media platform affiliated with The CBD Insider, is for informational purposes only. The CBD Insider doesn’t offer medical advice and the content within this report is not intended for medical advice, diagnosis, or treatments, and has not been evaluated by the FDA. We recommend consulting with your healthcare professional before using any products discussed in this report.

9 Comments

Great report and I’d recommend it to others in the industry. Succinct, insightful and very well presented. Love the infographics.

Thank you for that feedback! It means a lot to us 🙂

Great report and I’d recommend it to others in the industry. Succinct, insightful and very well presented. Love the infographics.

Thank you for that feedback! It means a lot to us 🙂

Great report and I’d recommend it to others in the industry. Succinct, insightful and very well presented. Love the infographics.

Thank you for that feedback! It means a lot to us 🙂

This is a must-read document if you are in the Hemp/CBD or Cannabinoid market. This researched based statistical analysis reveals truths that every entrepreneur, business owner, dispensary sales person and investor should know. It not only reveals the fallacies about the entire industry’s belief system in many areas but also points to the facts of what customers really want and what they actually are willing to pay. This foundational resource will assist each company that is looking to increase their marketing effectiveness, what areas to focus on regarding growing their sales and eliminating time wasting exercises in seeking new customers in this new space. As this report reveals, we have not even begun to scratch the surface in the US regarding education and recruiting new consumers of this amazing cannabinoid we call CBD. ~David Wilkinson, Co-Founder of The Hemp Business Advisors

This is a must-read document if you are in the Hemp/CBD or Cannabinoid market. This researched based statistical analysis reveals truths that every entrepreneur, business owner, dispensary sales person and investor should know. It not only reveals the fallacies about the entire industry’s belief system in many areas but also points to the facts of what customers really want and what they actually are willing to pay. This foundational resource will assist each company that is looking to increase their marketing effectiveness, what areas to focus on regarding growing their sales and eliminating time wasting exercises in seeking new customers in this new space. As this report reveals, we have not even begun to scratch the surface in the US regarding education and recruiting new consumers of this amazing cannabinoid we call CBD. ~David Wilkinson, Co-Founder of The Hemp Business Advisors

This is a must-read document if you are in the Hemp/CBD or Cannabinoid market. This researched based statistical analysis reveals truths that every entrepreneur, business owner, dispensary sales person and investor should know. It not only reveals the fallacies about the entire industry’s belief system in many areas but also points to the facts of what customers really want and what they actually are willing to pay. This foundational resource will assist each company that is looking to increase their marketing effectiveness, what areas to focus on regarding growing their sales and eliminating time wasting exercises in seeking new customers in this new space. As this report reveals, we have not even begun to scratch the surface in the US regarding education and recruiting new consumers of this amazing cannabinoid we call CBD. ~David Wilkinson, Co-Founder of The Hemp Business Advisors