-

- Market Research

- |

- CBD Near Me

- |

- Giveaways

- |

- Newsletter

- |

- Contact

- |

- Advertise

- |

It is fair to say that 2019 was the year that CBD finally entered mainstream culture. The CBD industry in the United States exceeded $4 billion in sales last year, which represents 562% growth from the previous year.

As the market for hemp-derived CBD matures, it is important that consumers, manufacturers, retailers, and regulators make informed decisions with regard to CBD.

With that in mind, we surveyed more than 1000 individuals from across the US to learn what consumers think of CBD, which forms of CBD they prefer (if any), how effective CBD has been to manage health conditions, and more than 70 other questions.

Our findings ranged from the expected—such as tinctures being one of the most popular CBD products—to the surprising—such as consumers having no idea how much CBD they should take.

Our study consisted of 15-minute surveys conducted online through trusted audience panels and focus groups throughout the United States from December 11, 2019, to January 17, 2020, and we segmented each consumer into four categories:

- Current consumers of CBD products

- Past consumers of CBD products

- Potential consumers of CBD products (i.e. familiar with and open to trying CBD)

- Non-consumers of CBD products (i.e. either unaware of CBD or not at all interested in it)

Our raw report consists of more than 200,000 rows of data, crosstabs, and other insights, but we’ve summarized 15 of the most compelling findings below.

If you’re interested in our final report, which will go into much greater detail than this report, you can sign up below to have a free copy delivered directly to your inbox.

Study Findings

- Finding #1: More Than Half of Current Consumers Started Using CBD in 2019

- Finding #2: A Majority of People Are Using CBD for Physical Relief

- Finding #3: The Most Effective Reported Use for CBD is ‘Energy’

- Finding #4: Edibles and Tinctures are the Most Popular CBD Products

- Finding #5: Consumers Need Direction On How Much CBD to Take

- Finding #6: Consumers Are More Likely to Buy CBD Online

- Finding #7: Most Consumers Say They Did Not Develop a Tolerance to CBD

- Finding #8: Overwhelming Majority of Consumers Say They Did Not Experience Side Effects

- Finding #9: Most Consumers Spend More Than $50 on CBD Monthly

- Finding #10: A Vast Number of Consumers Lack Fundamental Knowledge About CBD and Hemp

- Finding #11: Consumers Want Reliable Products from Trustworthy Brands

- Finding #12: Consumers are Split on What They Think of CBD Regulations

- Finding #13: Past Consumers Stopped Using CBD Because It Was Ineffective and Too Expensive

- Finding #14: Most Past Consumers Would Reconsider Using CBD

- Finding #15: Potential Consumers Don’t Know Enough About CBD to Try It

Finding #1: More Than Half of Current Consumers Started Using CBD in 2019

The full legalization of hemp in the 2018 Farm Bill and retailers such as CVS Pharmacy, Walgreens, and Kroger introducing CBD products to their customers has likely contributed to the number of people who are new consumers.

CBD products first started appearing on the shelves of major retailers in January 2019 at Neiman Marcus. CVS began selling CBD topicals in March and Walgreens announced their plans to sell CBD a week later.

Finding #2: A Majority of People Are Using CBD for Physical Relief

Consumers are motivated to use CBD most by physical discomfort.

The most popular reasons for using CBD among current consumers were for aches and discomfort (58.1%), relaxation (50.0%), and muscle soreness/recovery (41.0%).

Finding #3: The Most Effective Reported Use for CBD is ‘Energy’

Surprisingly, the use with the highest reported effectiveness rate was energy. More than four in five current consumers using CBD for this purpose said that CBD was “extremely effective” or “very effective.”

In future research, we plan to dig deeper into what consumers mean by “energy.”

The most popular uses for CBD—aches and discomfort, relaxation, and muscle soreness and recovery—also had high efficacy rates.

Two in three consumers said CBD was extremely or very effective for aches and discomfort, seven in ten said the same for muscle soreness and recovery, and nearly four in five agreed for relaxation.

Interestingly, current consumers with physically strenuous jobs were far more likely than those without such occupations to say CBD was extremely or very effective.

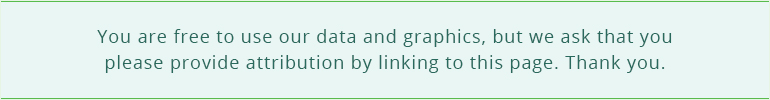

Finding #4: Edibles and Tinctures are the Most Popular CBD Products

Convenient and simple products like edibles have become the most widely used CBD products.

Tinctures, which have been the most common product type in the past, follow as the second most popular.

Third place went to capsules and softgels, while fourth place was tied between topicals and vapes.

Notably, more consumers have used topicals in the Western U.S. (45%) than any other region.

However, despite the lower usage rate, tinctures ranked as the preferred CBD product, narrowly edging out edibles.

Those making less than $30,000 prefer edibles (37.7%) more than any other income group.

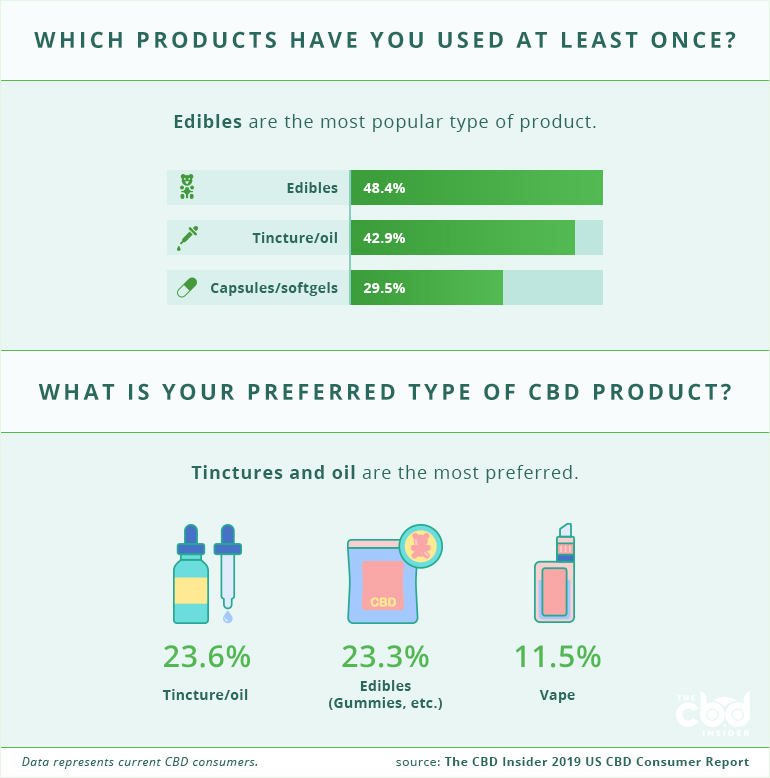

Finding #5: Consumers Need Direction On How Much CBD to Take

Consumers aren’t sure how much CBD they should be taking.

A surprising number are either using an especially small amount of CBD or have no idea how much they are taking.

Nearly two-in-five current consumers are taking 25mg or less, while another one-in-five is not sure how much CBD they are taking.

Past users were twice as likely to be unsure about how much CBD they were taking.

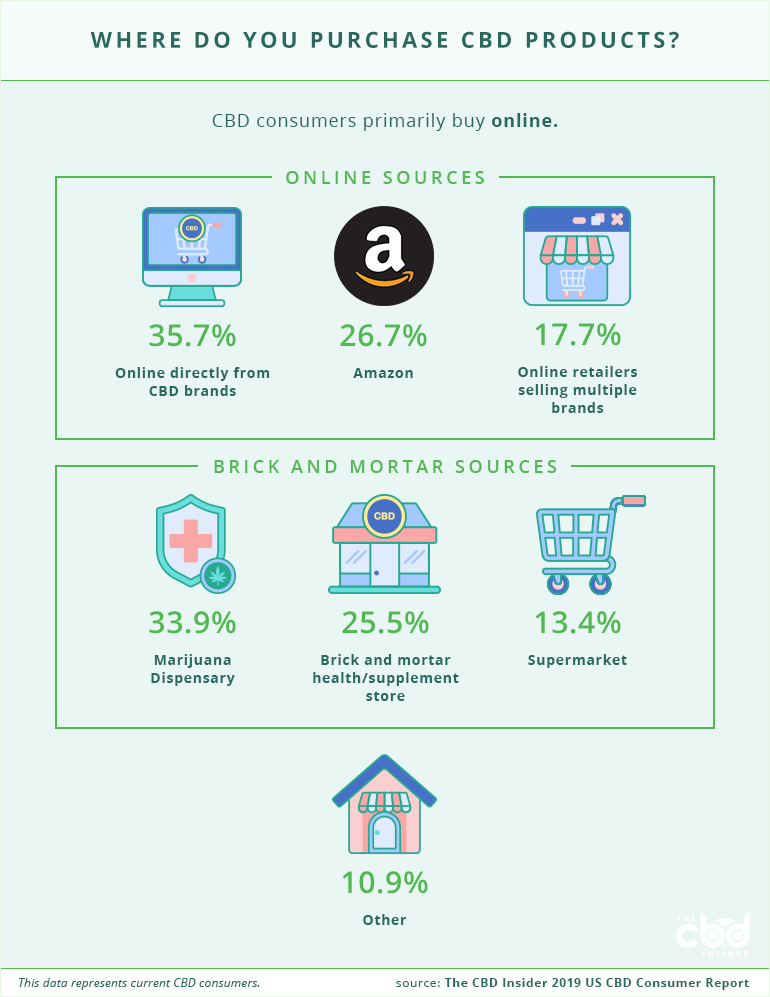

Finding #6: Consumers Are More Likely to Buy CBD Online

The most common places consumers purchase CBD products are directly from brand websites, marijuana dispensaries, and Amazon.

Technically, Amazon does not allow CBD to be sold on its platform; however, several brands can be found selling “hemp oil” to skirt the policy.

As a result, buying these products on the Amazon marketplace can be risky and confusing. Since Amazon does not allow CBD to be mentioned, consumers do not know how much CBD is in the products they are buying, or if there is any at all.

Given the popularity of Amazon and the federal standing of CBD, we strongly encourage Amazon to reconsider their policy so that their customers can purchase CBD quickly and safely.

Finding #7: Most Consumers Say They Did Not Develop a Tolerance to CBD

Nearly seven in ten consumers said they did not develop a tolerance to CBD.

Of those who said they did develop a tolerance, a majority said it took less than three months.

Interestingly, the World Health Organization (WHO) noted in its 2018 critical review report on CBD that research has not found humans to develop a tolerance to CBD.

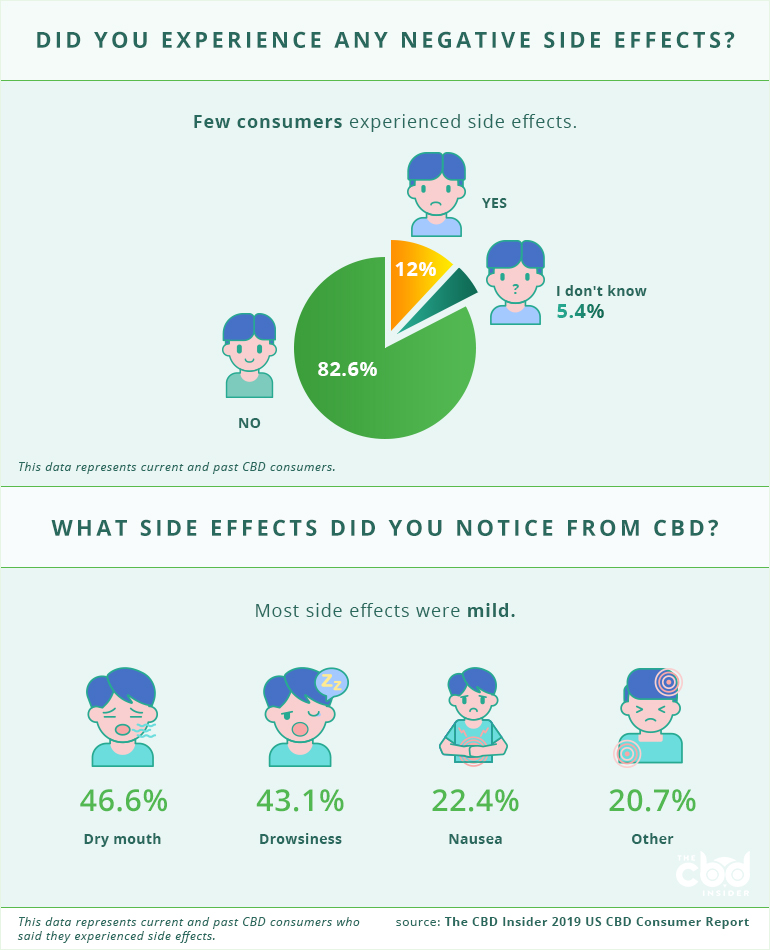

Finding #8: Overwhelming Majority of Consumers Say They Did Not Experience Side Effects

CBD consumers overwhelmingly reported they did not notice side effects with CBD.

Of those who answered yes, the most common side effects were dry mouth and drowsiness.

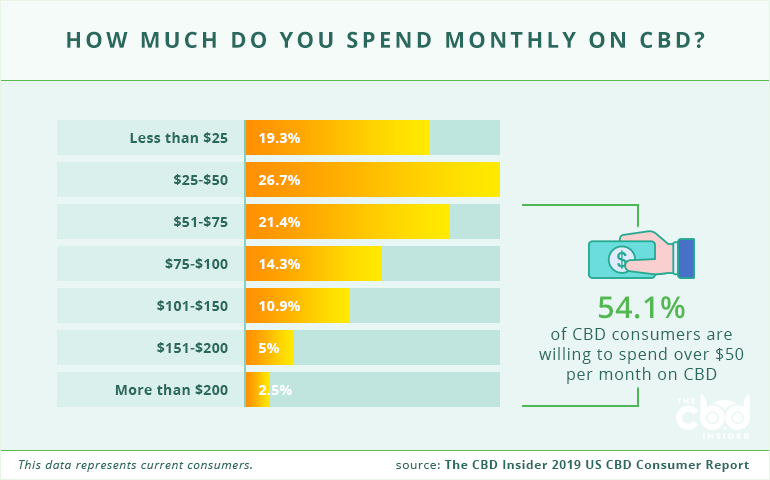

Finding #9: Most Consumers Spend More Than $50 on CBD Monthly

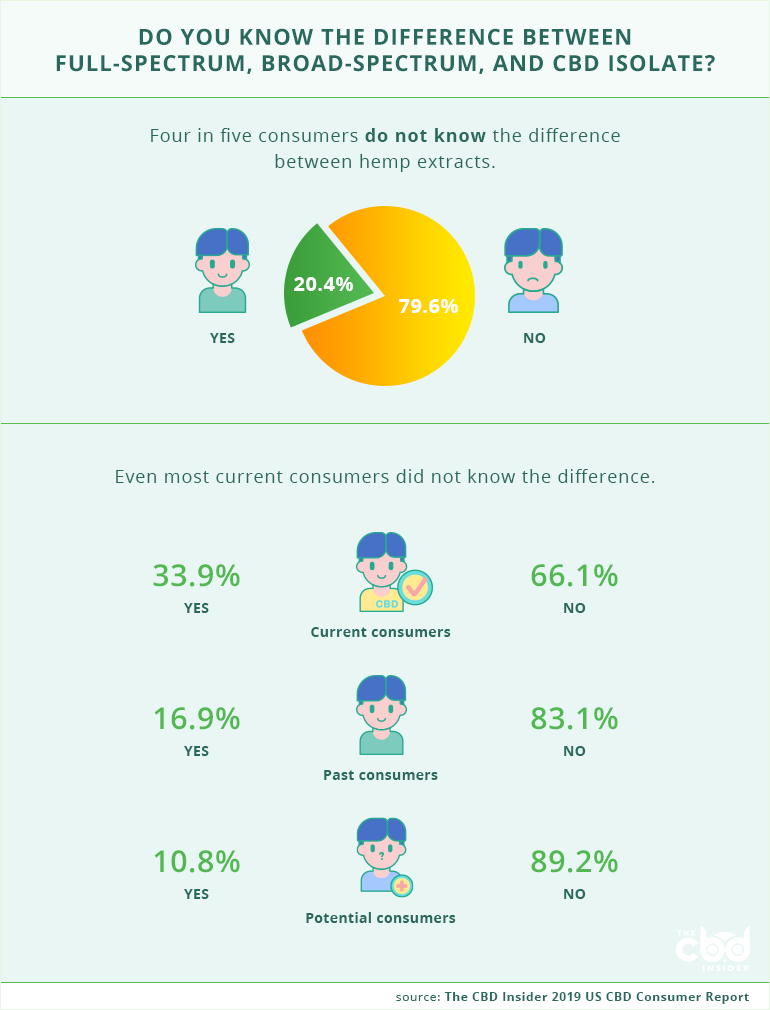

Finding #10: A Vast Number of Consumers Lack Fundamental Knowledge About CBD and Hemp

As expected with a relatively new industry, consumers need reliable sources of basic CBD information.

Nearly four-fifths of all respondents—current, past, and potential consumers—said they did not know the difference between full-spectrum, broad-spectrum, and CBD isolate.

While current consumers were more likely to know the difference, the vast majority was still unaware.

The fact that most current consumers lacked knowledge about an essential aspect of CBD products underscores how important it is that brands provide consumers with education.

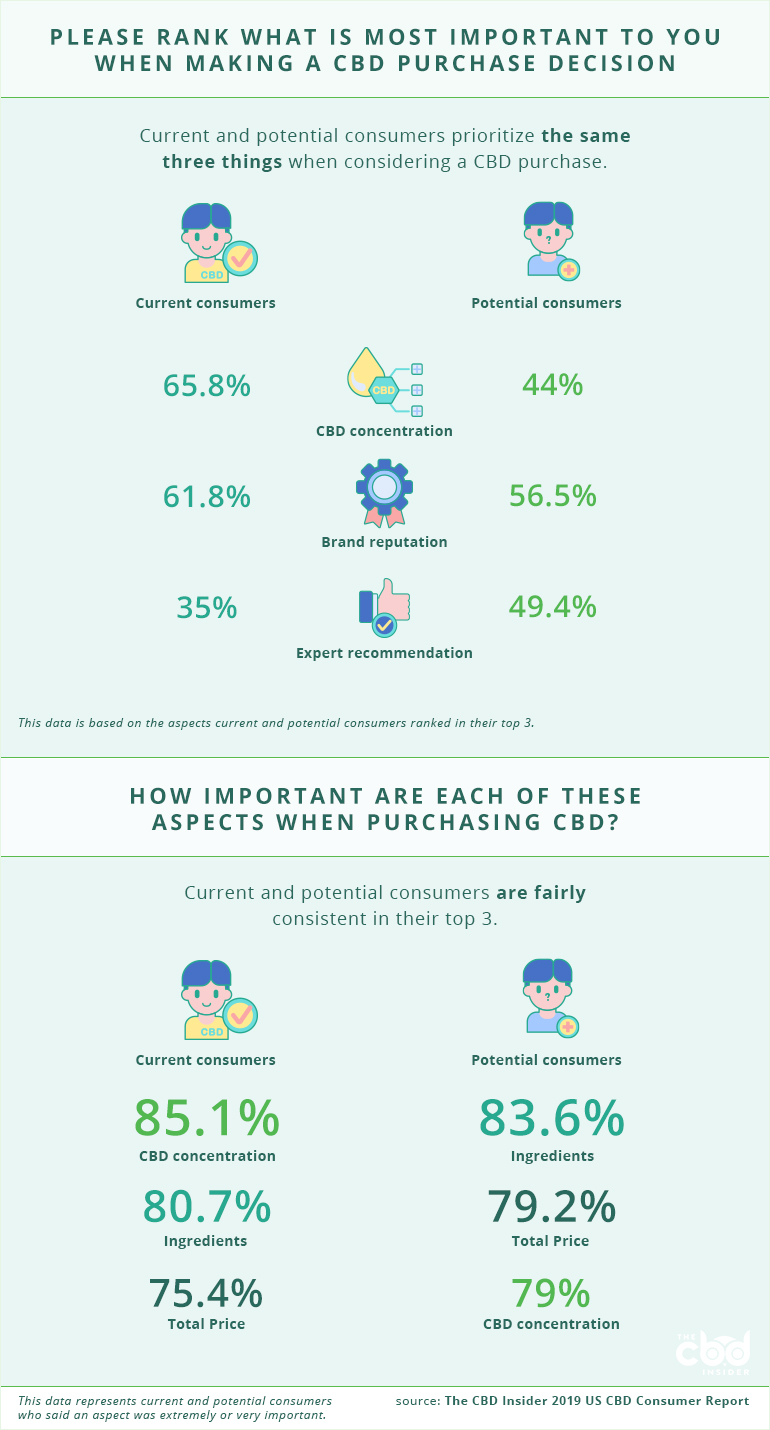

Finding #11: Consumers Want Reliable Products from Trustworthy Brands

Consumers want to be confident in the quality of their CBD products as well as the brands they come from.

Brand reputation (56.5%) is the most important consideration to potential consumers before purchasing CBD, followed by expert recommendation (49.4%) and CBD concentration of a product (44%).

CBD concentration (65.8%) and brand reputation (61.8%) were most important to current consumers, while expert recommendation (35%) was a distant third place.

When asked how important an aspect was, 85.1% of current consumers said CBD concentration was “extremely important” or “very important”, 80.7% said the same of ingredients, and 75.4% said the same of total price.

The top three among potential consumers were the same as current consumers but in a different order: ingredients, total price, and CBD concentration.

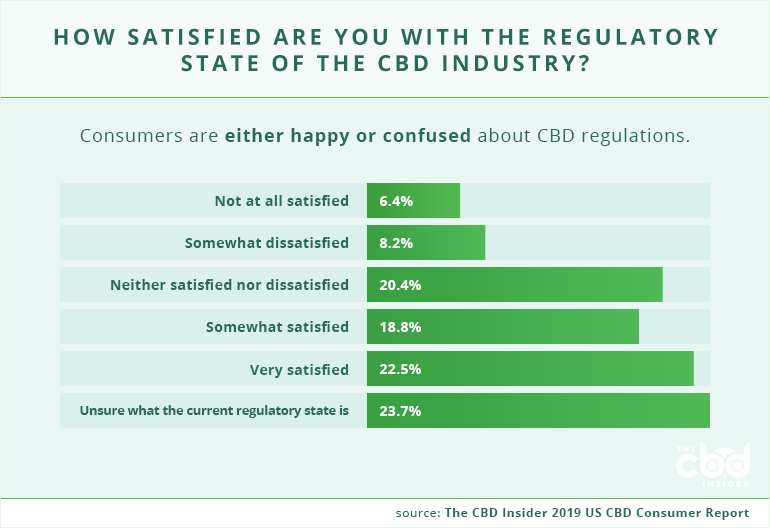

Finding #12: Consumers are Split on What They Think of CBD Regulations

Regulations surrounding the CBD industry remain confusing for consumers.

When asked how satisfied they were with the regulatory state of the industry, a plurality of consumers said they were either unsure about it or were neither satisfied nor dissatisfied.

However, more than two in five consumers said they were extremely or somewhat satisfied.

We think this is likely because it is fairly easy to purchase CBD online or at brick and mortar stores that stock CBD—despite the fact that legislators, regulators at the FDA and USDA, and technology platforms like Amazon are still unsure what to do with CBD.

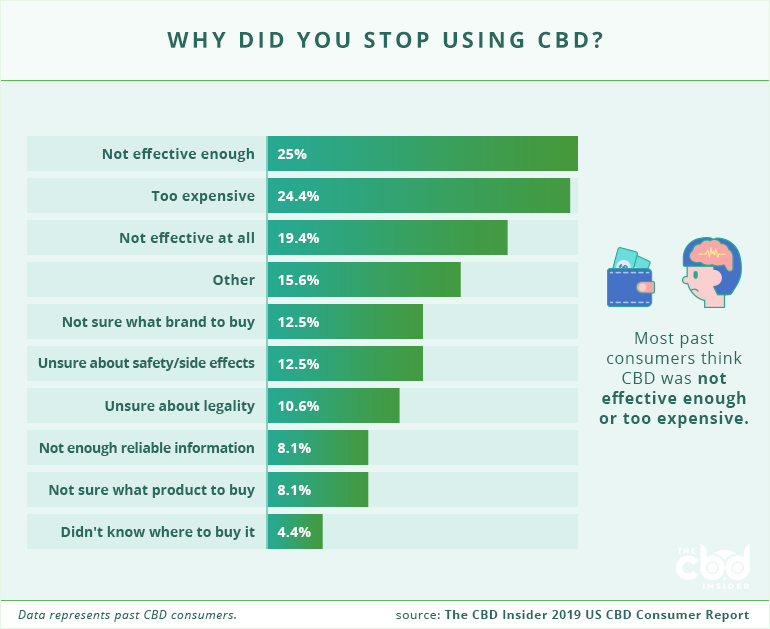

Finding #13: Past Consumers Stopped Using CBD Because It Was Ineffective and Too Expensive

Most past consumers discontinued their use of CBD because it was not effective enough or too expensive.

The fact that more than three in four past consumers were either unsure about how much CBD they were taking or taking small servings indicates they were probably not using enough CBD to be effective.

It is up to CBD brands, as well as education sources like The CBD Insider, to help consumers better understand serving sizes.

Unfortunately, CBD brands are hindered when it comes to recommending serving sizes so consumers are left with little guidance.

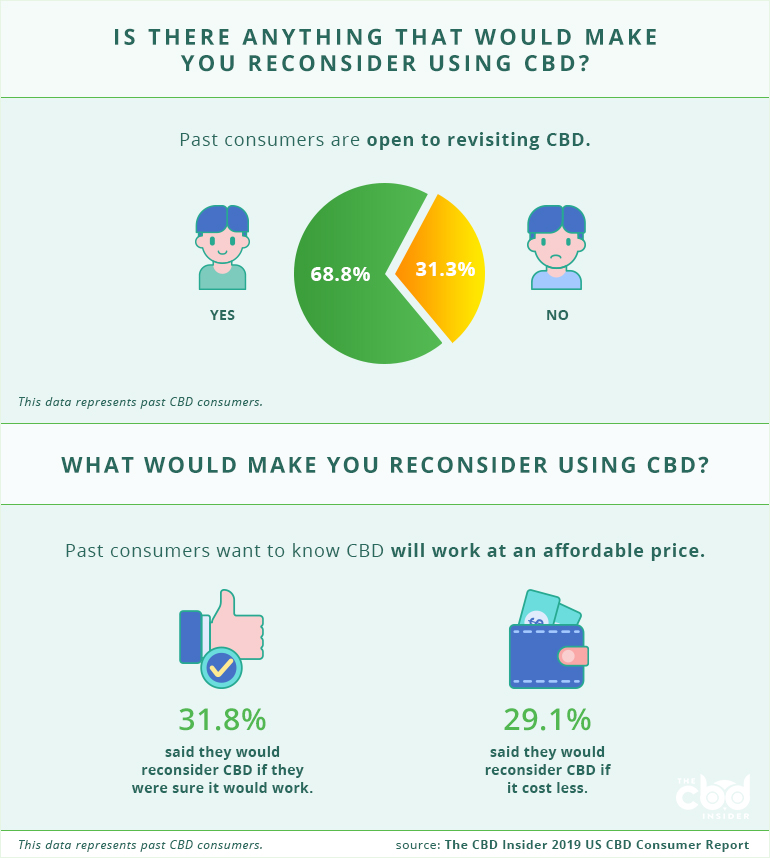

Finding #14: Most Past Consumers Would Reconsider Using CBD

More than two-thirds of past consumers said they would reconsider using CBD.

When asked what would make them reconsider, almost one in three past consumers mentioned better efficacy as a reason they would reconsider CBD, while 29.1% mentioned lower costs.

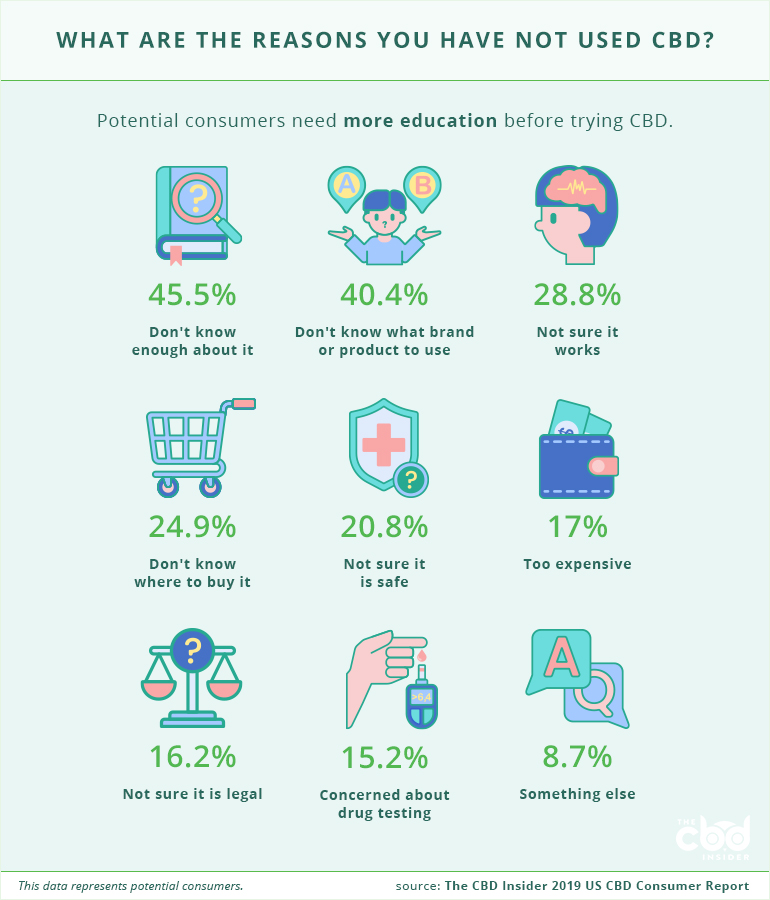

Finding #15: Potential Consumers Don’t Know Enough About CBD to Try It

A lack of education is the main culprit preventing potential consumers from trying CBD.

Almost half of the potential consumers said they had not used CBD because they did not know enough about it. About two in five said they did not know which brand or product to use.

When asked what their single biggest reason was, these answers remained constant.