-

- Market Research

- |

- CBD Near Me

- |

- Giveaways

- |

- Newsletter

- |

- Contact

- |

- Advertise

- |

As many of us stayed sequestered in our home offices throughout 2021, constantly reminded of the importance of health and hygiene, the CBD industry shifted to address these and the other concerns brought about by the pandemic.

We saw a large pop in high-THC products throughout 2021, for example, and an equally significant shift towards immunity-focused CBD products featuring new botanicals.

Large CBD research initiatives took aim at anxiety and sleep, which were fitting targets in 2021 for reasons we’re all tired of hearing; plus, our 2021 US CBD Consumer Report that surveyed over 3,500 people nationwide rolled out as well.

All the while, individual consumers and the organizations that represent them continue the seemingly endless effort to goad the FDA into stepping up the state of hemp regulation.

There was plenty of good, bad, and “what, why?” when all of the industry is taken into account; here’s a look at some of the most important trends we observed across the CBD industry in 2021.

The Delta-8 Can of Worms

Perhaps delta-9 THC is receiving less skepticism because of the favorable comparison to delta-8 THC, which has been a regulatory mess for everyone involved.

Delta-8 THC is a close “relative” of delta-9 THC in that its composition and effects (intoxicating, like delta-9) are very similar.

Earlier in 2021, several brands began offering delta-8 THC products as a “legal high” that worked around delta-9 THC restrictions.

The rift was clear early on; some brands opted to give delta-8 a very wide berth, while others embraced the cannabinoid.

Though there were other reasons, regulators were mostly riled up because, in order for a CBD product to contain more than a negligible amount of naturally scarce delta-8 THC, the manufacturer had to synthetically derive the cannabinoid from CBD.

Hence, the middle and latter half of 2021 saw vehement warnings from the FDA and CDC as well as plenty of legislative scrambling on the state level to ban or restrict delta-8 THC.

We’ve been closely monitoring the delta-8 THC situation, which isn’t quite over yet—we will continue to follow up as more developments surface.

Pressure on FDA Continues to Rise

Exactly three years after the 2018 Farm Bill—which effectively ended the federal ban on hemp by defining legal “industrial hemp”—was enacted, the US Hemp Roundtable released this statement entitled “It’s Been Three Years and FDA Still Refuses to Regulate CBD.”

The irony of the release date is not lost on this battle-worn pro-consumer group, which has stepped up to the plate repeatedly to enhance the state of CBD regulation so that consumers can stop playing Russian roulette with CBD products.

Though the House of Representatives has proposed multiple actions this year that would pressure the FDA to regulate CBD (HR 841 and the CBD Product Safety and Standardization Act) and several in the years prior, nothing comes to fruition.

Even with largely bipartisan support, each effort seems to fizzle out and loop back to no avail.

Though we’re all waiting, we’re not waiting idly—thanks to the U.S. Hemp Authority and other certifying bodies, customers at least have some assurances that the products they’re buying are tested and manufactured in compliance with high standards.

Supporting these pieces of legislation and the US Hemp Roundtable is a win-win for both hemp supporters and opponents because the industry is already here—it’s now about consumer safety.

A Shift Towards High-THC Products

Industry mainstays and smaller brands alike took a much more liberal approach to delta-9 THC in 2021 than we have seen in previous years.

Up until 2021, the vast majority of CBD brands were still pretty tentative, often disclaiming more than once on the labeling that their products were either THC-free or well below the legal limit.

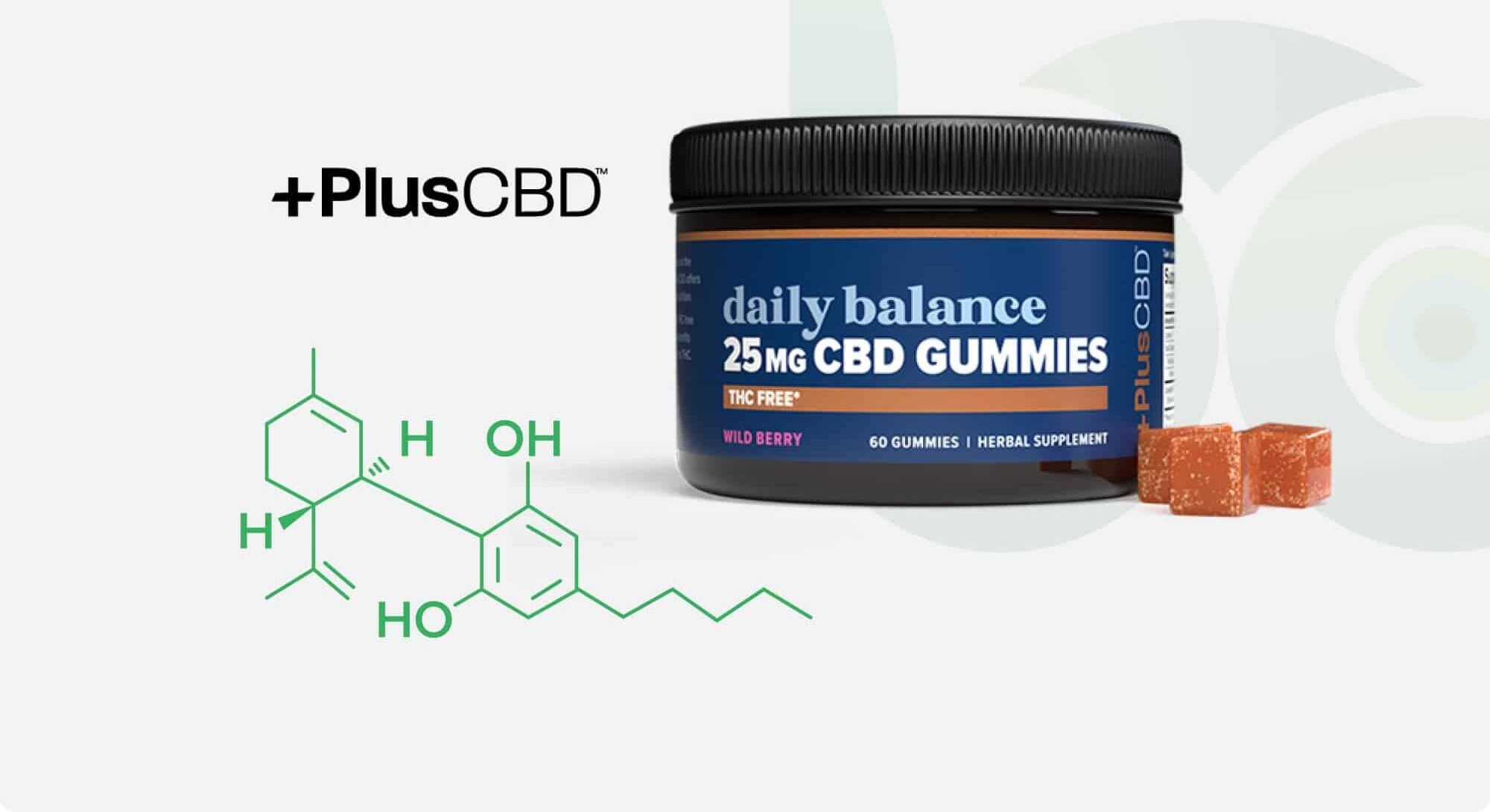

Now, brands like PlusCBD, Five, Cornbread, and others are more boldly advertising the (considerably higher) THC content, even advertising the milligrams per serving on the front of the label.

From Five’s Daily Buzz Gummies to a selection of tinctures from Cornbread, we see as much as 5 milligrams of THC advertised per serving.

To be clear, all of the cases mentioned are still compliant with the 2018 Farm Bill, as these brands have ratcheted up the overall hemp concentration so that 5mg/serving is still below the 0.3% line.

Interested in the best full-spectrum CBD oil? See our Best CBD Oil of 2021 award winner.

Gummies Gain Ground

On a much less contentious note, CBD gummies were by no means the new kid on the block at the beginning of 2021, but their steady climb seemed to accelerate into a run as brands read the writing on the wall.

According to our 2021 consumer report, gummies are the preferred product by nearly 1 in 5 current CBD consumers.

A huge swath of CBD industry frontrunners like CBDistillery, Lazarus Naturals, Cornbread Hemp, Five, Charlotte’s Web, Receptra, and PlusCBD launched new gummy lines and/or reworked their existing CBD gummies in 2021.

Beyond the sheer volume, we were also pleased to see ample attention to making improvements in ingredient and formulation quality, extract availability, taste and texture, variety, and more.

Suffice it to say, the bar has officially been raised; it is now much easier to find a potent, synergistically formulated CBD gummy filled with organic ingredients and far less sugar.

See our Best CBD Gummy award winner of 2021.

Synergistic Products Take Hold

Like the “gummy boom,” we were also privy to the synergistic formulation trend well before 2021 rolled around, but it certainly picked up throughout the year.

On both the cannabinoid front (expanding beyond the big three: CBN, CBG, and CBD) and the supporting botanicals front, the industry observed a sweeping effort to back up CBD with dozens of new ingredients.

Where before you may have seen “melatonin” or “valerian root” slapped onto a label as more of a marketing ploy, we are now seeing research-driven formulations that integrate L-theanine, elderberry, vitamin B, ashwagandha, Lion’s Mane, manuka honey, mushrooms, and dozens of other botanicals.

Most importantly, these formulations are actually aimed at immunity (relevant much?), focus, and other functional targets.

As always, we’ll maintain a critical approach when evaluating these products to weed out hacky marketing tactics from the real research-backed formulations, but in 2021, we saw more of the latter.

Check out the winners for the Best CBG of 2021 and Best CBN of 2021.

New Studies and Delivery Methods

Gone are the days of the 10-person qualitative CBD trial; CBD companies and partnering laboratories are seriously stepping up their research efforts as the FDA continues to ask for more data.

Once again, we have to applaud CBDistillery for their massive strides in this direction throughout 2021 and before.

Dubbed “pathfinder missions,” CBDistillery pledged earlier in the year to embark on 8 studies in partnership with the Releaf App, a cannabis use tracking app that allows people to log their dosage, experiences with products, and more.

These studies will assess the impact of (CBDistillery) CBD products on sleep, anxiety, and much more, while also illuminating general use habits among large pools of participants.

We’ve also seen bioscience developers like Lexaria ambitiously pitting their proprietary CBD formulations against FDA-approved Epidiolex, a CBD-based drug used for seizures.

Finally, we’re seeing CBD brands make actual consumer-facing changes in lieu of positive research results, like nanoemulsion or liposomal delivery systems, as modeled by Elixinol.

Want to be a part of furthering the science behind CBD? See if you qualify for a CBD study here.

2022 and Beyond

Based on our observations throughout 2021 as well as conversations with well-positioned advocates and brand representatives, here’s what we believe will happen (or not happen) within the CBD industry in 2022 and beyond:

As per our illuminating conversation with the US Hemp Authority President Dr. Marielle Weintraub, we agree that states will continue to reconcile differences in hemp labeling laws and other regulations to allow for smoother interstate commerce as the FDA continues to make everyone wait on federal regulation.

On that note, it’s highly unlikely that either side of the hemp consumer advocate/lobbyist coin (industry self-regulation and pressuring the FDA) will ease up in their pursuit for greater safety and transparency standards.

Another important interview we held this year—a look under the National Hemp Association’s hood with executive director Erica Stark—revealed that the hemp fiber industry is probably going to advance with less of a rocky takeoff than we’re seeing with consumer products.

“In 5-10 years we’re going to see industrial hemp become as traditional row crops like corn; we’ll see lots of processing centers pop up, paper products, and bioplastics,” Erica told us.

Finally, though high-THC products and the greater focus on gummies isn’t likely to go away anytime soon, we are curious as to whether or not the new delivery methods (like nanoemulsion and liposomal) and synergistic products prove to be trend-proof.

From the CBD Insider editorial team, we’d like to wish everyone a happy and safe holiday—we’ll see you next year!